Introduction to Forex Trading Taxes

Forex trading tax refers to the portion of your earnings that must be paid to the government for participating in currency trading. Just like other income sources—be it a job, business, or selling goods—trading profits are also taxable.

Taxes apply across financial markets, whether you’re dealing in stocks, commodities, cryptocurrencies, or currencies. The forex market is international, and each country has its own set of tax laws.

In regions where forex trading is legal, clear rules are in place to govern how earnings are taxed. However, in countries where it’s restricted, tax regulations may not apply at all.

If you are a forex trader, then proper knowledge of currency trading is required. It is a must-know, especially for professional traders who are making a good amount of money in the market.

Forex Trading Taxes in Different Countries

As we have discussed above, every country has different forex and tax laws. In order to help you out, here are currency trading tax policies for major economies:

United States Forex Taxes

A quick glance

Forex trading tax can be defined as the deduction or charges that the government charges for carrying out trading activities in currencies.

Yes, you need to pay taxes if you trade in cryptocurrencies, stocks, indices, commodities, currencies, or any other financial market. However, the tax rate or exemption differs from country to country.

UAE, Hongkong, Singapore, Switzerland, New Zealand, Cyprus, Bahamas, and Malta are some forex trading tax-free countries

- Keep the Record

- Record the time and type of income

- Avoiding Recording Expenses

- Keep yourself update

- File Forex Tax on Time

- Software Integration

A forex trader may suffer unfavourable outcomes, penalties or additional charges for not paying tax.

United Kingdom Forex Taxes

United Kindom is amongst the most favourable places for forex traders. The HM Revenue and Customs Department is responsible for determining citizens’ tax liability. UK citizens don’t have to pay any tax for spread betting in forex. However, no tax means no claims in the cases of losses.

Self-employed or full-time forex traders engaged in CFD trading are liable to pay capital gains in the UK. They are also eligible for claims in case of losses. Coming to the tax slabs, the government offers an allowance for the profit of the first 12000 EURO. The tax rate is around 10% for the annual profit below 50,000 EURO and 20% above 50,000 EURO.

Canada’s Forex Trading Taxes

The Canada Revenue Agency (CRA) administers and manages currency trading tax in Canada. The tax and policy of Forex trading are quite simple. Forex traders come in two categories: First investor and second businessman.

The traders in the investor category are liable to a capital gain tax of 50% of their marginal tax rate. However, most traders fall under the category of businessmen. 100% of their profit is liable for tax deduction at the current rate, while, like businesses, 100% of losses are eligible for deductions.

In addition, you can claim a deduction on expenses like the purchase of educational or market analysis resources, withdrawal or deposit fees, automated tools fees, internet charges and other fees.

Australian Forex Taxes

The Australian Taxation Office administer forex trading taxes in the country. Forex traders fall into two categories: Investors and traders. Investors are those who hold an asset for more than one year. Such citizens are liable for capital gain tax. Investors also get a 50% discount. However, losses are not deductible.

The other one is traders who hold assets for less than 12 months and make a profit from short-term price fluctuation. Traders are liable to pay personal taxes on their trading income. The trading income is an overall profit after deducting losses and expenses.

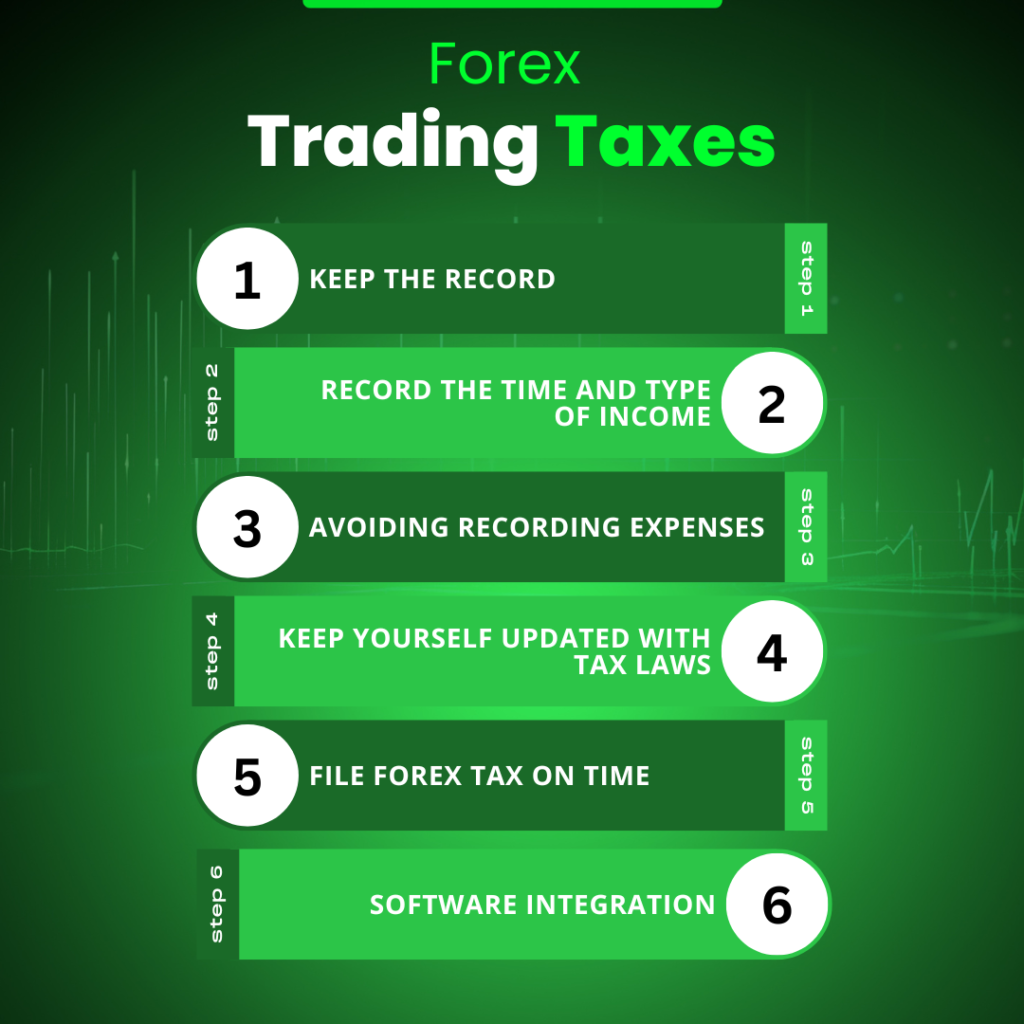

Tips for Managing Forex Trading and Taxes

Managing forex tax is not a simple task; many traders struggle during this process. So, to help you out, here are some amazing tips that help you manage your currency trading taxes efficiently:

Keep the Record

One of the biggest mistakes a forex trader makes while dealing with taxes is avoiding record keeping. A trader should keep proper records with documents of all their trading activities and expenses.

Keep track of the transaction record, profit and loss statements, monthly or year statements for the forex broker, trading expense receipts, and other documents. So that you can avoid errors during tax calculations and filing.

Record the time and type of income

One can trade in the forex market in the over-the-counter market or through future or options contracts. In addition, trading can be short-term or long-term.

In many countries, tax regulations and policies differ based on these two factors. So, a trader should have a clear idea of the nature and time period of currency trading.

Avoiding Recording Expenses

Traders can save a good amount of tax by keeping a record of expenses. In most countries, traders are eligible for expenses deductions.

A trader should record trading platform fees, learning charges, purchase of trading resources or tools, and other expenses. So that they can claim the necessary deductions during the tax filing process.

Keep yourself updated

A professional or full-time trader should stay aware of the tax rules and regulations. Every country has different forex tax laws. In addition, the institution regularly amends changes to these policies. So, a trader should know about these updates and amendments to make sure they comply with the standards.

Consult a Professional

Many traders avoid consulting a professional for a forex tax calculation. However, that’s not a good idea; tax calculation is quite complex, especially in forex trading.

One little mistake, misunderstanding or error may result in unfavourable outcomes. Professional consultants are well aware of all the laws and guidelines related to forex tax. They may charge some fees but can help you save significantly by suggesting deductions.

File Forex Tax on Time

A crucial aspect to consider when filing a forex tax is timing. Timely tax filing is necessary; otherwise, a trader may suffer penalties or additional charges. It will ultimately affect your overall profit, so be mindful of timely tax filing.

Software Integration:

If you have trouble calculating the tax and cannot hire a consultant, you can use tools. A range of forex trading tax calculators and software is available in the market. Integrate your trading platform with the software and accurately calculate your currency tax.

Wrapping Up

Forex Trading Taxes Calculation may be difficult but not as difficult as currency trading. If you can do currency trading and stay profitable, then tax calculation will not be difficult for you.

There are traders in the market who avoid paying taxes. However, it may result in unfavourable outcomes or penalties. Also, in most countries, the tax rules and regulations favour traders. So, instead of avoiding them, start playing them.