Your profit in the foreign exchange world is affected by numerous factors. And, the currency pair in which you are trading is the most important one. In order to help you out in choosing the right one, we have prepared a list of the best currency pairs to trade for beginners.

Understanding the concept of Forex Pairs

Currency is a form of centralized money issued by the central banks or the government. It is a common medium for people to exchange goods and services within the nation.

You can buy anything in your country with your nation’s currency. However, you cannot buy foreign products or services with the local currency. In such cases, you will exchange one currency for another.

Suppose you want to import a Mercedes from Japan to the USA. In this case, you can exchange your national currency with Japanese Yen. And then, you can make a payment to the Japanese company.

In the above case, you exchanged Japanese Yen with US Dollars to purchase a Mercedes. So, JPY/USD is a currency pair you are dealing with.

The value of each currency differs based on their economic status and financial health. Like gold and the stock market, people also trade in the currency market to take advantage of currency price fluctuations.

A quick glance

A currency pair is a group of two currencies that represent the value of one currency with respect to another currency.

USD/JPY, CAD/EUR, and GBP/CNY are examples of currency pairs. The first two letters of the currency code represent the country, and the last letter represents the currency.

USD/JPY, CAD/USD, GBP/USD, and USD/EUR are the example of major pairs.

GBP/AUD, EUR/JPY, CAD/NZD, etc., are examples of minor pairs. USD/INR, CAD/RUB, TRY/GBP, etc., are exotic pairs.

EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, NZD/USD, USD/CAD, EUR/JPY, EUR/GBP, and AUD/JPY are top traded currency pairs with the best market conditions.

What is a currency pair?

The currency exchange always takes place in pairs. In simple words, to buy one currency, you have to sell another. The currencies which you are exchanging make a currency pair.

A currency pair can be defined as a combination of two forex currencies that represent the value of one relative to the other.

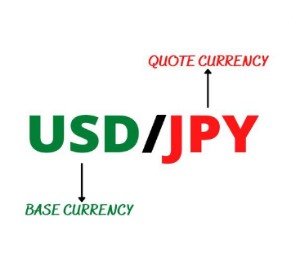

Currencies are always traded in pairs in the FX market. A pair consists of two currencies: the first one is the base, and the second one is the quote currency.

Currency pairs Examples

USD/JPY, CAD/EUR, and GBP/CNY are some examples of currency pairs. The first two letters of the code represent the respective country, and the last letter represents the currency of that nation.

In the pair USD/JPY, the base currency is USD representing United States Dollars. Meanwhile, JPY is the quote currency representing the Japanese Yen.

Suppose there is a trader trading in a USD/JPY pair; if the trader believes the value of USD will rise against JPY, the person will buy the pair and sell it in the opposite scenario.

In the above case, the trader will make money if the prediction goes right and lose money if it goes wrong. That’s how currency trading takes place in the foreign exchange market.

Types of Currency Pairs in the FX Market

Major currency pairs

Forex Major Pairs are the most popular pairs for trading. It consists of US Dollars and one another currency from 7 major currencies such as Japanese Yen, Britain’s Pound, etc.

These are considered the best currency pairs to trade for beginners, globally because they offer great market conditions. USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD, GBP/USD, and EUR/USD are examples of major FX pairs. You can get access to these pairs at almost every currency exchange platform.

Minor currency pairs

Forex Minors include any of the two major currencies, excluding USD. GBP/AUD, EUR/JPY, CAD/NZD, etc., are popular minor pairs.

Exotic currency pairs

These pairs include one major currency and one currency of emerging and developing nations. Such as USD/INR, CAD/RUB, TRY/GBP, etc.

Importance of choosing the Best Currency Pair

The type of currency pair plays a crucial role in forex trading. There are more than 170 legal currencies to trade in.

In the forex trading world, the more the competition more the chances of profit. So investing in strong currencies such as USD and EUR results in high profit.

The countries are economically sound, with the best infrastructure technologies, and great resources. So obviously, investing in these currencies is more profitable.

Meanwhile, investing in weaker and emerging currencies, such as currencies of Asian, and African nations, involves a huge risk.

Economic uncertainties, poverty, and unemployment negatively affect the currency value of emerging nations.

In addition, currency trading is affected by many factors, such as liquidity, leverage, spreads, and trading volume. These factors differ from pair to pair. Choosing the right currency pair is necessary to succeed as a forex trader and develop the best forex strategy.

But not to worry, we have prepared a list of the most traded forex pairs by studying them in different parameters. It will help you select the most ideal currency pair accordingly.

9 best currency pairs to trade for Beginners

EUR/USD (Euro/US Dollar): Best for Novice Traders

EUR/USD is amongst the most traded forex pairs by volume globally. It kind of dominates the currency market. The European Union and the United States are the strongest economies in the world.

So they enjoy power or influence over other countries that directly contribute to these currency strengths. Also, the strength of these currencies is usually measured against each other. Thus you can spot frequent price swings in this pair, giving birth to different opportunities in the market.

Further, The pair offers tight spreads, high liquidity, and volume to traders. As per the report, 30% of the forex transactions occur in EUR/USD. That makes it the best currency pair for beginners to start trading.

USD/JPY (US Dollar/Japanese Yen): Best pairs for tight spreads lovers

This pair is popularly known as Gopher. It is amongst the lowest spread forex pairs to trade in. Japan has the strongest economy in Asia, which is the reason why Yen is heavily traded in Asian countries.

The combination of Yen and USD is quite popular as the US dominates the world and Japan dominates Asia. The combination of Asia and the world’s strongest currency market JPY/USD the second most traded currency pair. The interest rate of the Bank of Japan and ECB.

GBP/USD (British Pound/US Dollar): Best for Day traders and Scalpers

This pair is popularly known as the cable. It is amongst the most profitable forex pairs for trading. The pair observes significant price swings throughout the day, resulting in fluctuations in exchange rates.

The pair is best for advanced day traders and scalpers. As it generates high profit, the chances of losing money are also high while trading in this pair.

USD/CHF (US Dollar/Swiss Franc): Safest Currency to trade

The pair is popularly known as Swiss. Switzerland’s financial system is already very famous amongst investors globally. Like gold trading, trading in the Swiss franc is also regarded as a safe-haven trading.

While the US Dollar dominates the currency market. This combination of safe haven and the strongest currency is quite popular. It attracts traders from all over the world to invest.

AUD/USD (Australian Dollar/US Dollar): Highly correlated to the commodity market

The combination of Australian and US dollars is popularly known as Aussie. The Australian Dollar is highly dependent on the commodity market. It earns a lot from exporting commodities such as metals and minerals globally. AUD’s value is affected by its import and export conditions.

So, whenever the prices and exports of these commodities increase, the Australian Dollar appreciates, and traders buy the pair during such scenarios and vice versa. Due to the strong correlation with commodity trading, it is amongst the best currency pairs to trade.

NZD/USD (Newzealand Dollar/US Dollar): Strong correlation with the Dairy market

New Zealand is amongst the leading economies due to its agriculture sector. New Zealand is the largest producer of milk and many other commodities. The strong influence in the agriculture sectors makes NZD/USD amongst the best forex pairs to trade.

The fluctuation in the demand and supply of the commodities keeps NZD fluctuating. As a result, traders frequently trade this pair.

USD/CAD (US Dollars/ Canadian Dollars): Correlation with oil prices

Canada is the largest exporter of oil. So its currency has a positive relationship with oil prices. That makes USD/CAD a popular pair in the forex market.

Oil export has a major role in the strength of Canadian Dollars. So whenever the oil price rises, traders sell the pair and buy the pair when the price declines.

EUR/JPY (Euro/Japanese Pounds): Correlation with Stock Market

The pair is popularly known as Euppy or Yuppy. Euro and Pounds influence the forex market. It is the seventh most traded forex pair. The pair offers low spreads and decent volatility in the market.

The best part about this pair is that it positively correlates with the stock market. When the stock market is bullish, the trades buy the pairs and sell it in the opposite case.

EUR/GBP (Euro/British Pounds): The most difficult currency pair

European Union and Great Britain are amongst the strongest economic pairs in the world. However, trading in EUR/GBP is quite difficult for traders. Their market changes very frequently due to changes in exports and imports. Thus it is difficult for traders to make accurate predictions.

One Bonus Pair

AUD/JPY (Australian Dollar/Japanese Yen): Proxy for Risk appetite

As we have studied above, the commodity market greatly affects the price of Australian dollars, and Japan is one of the strongest economies.

So AUD/JPY is amongst the most volatile forex pairs for traders who love high-volatility trading.

Final Words

Forex trading is highly affected by currency pairs. In order to select the right currency pair, the knowledge of that particular country and the market conditions is essential.

We have studied a brief introduction of the best currency pairs to trade, their features, and factors that cause a change in their trading. You can select any of these pairs for trading. However, it is better to diversify your capital in two to three pairs to develop the best forex strategy.

In addition, Consider their market correlations, analysis method, time frame, interest, and knowledge for selecting currency pairs. Like, Suppose, you are interested in oil trading, then USD/CAD will be ideal for you; if you also trade in the stock market, trade in EUR/JPY. Besides these, consider market volatility, liquidity, and risk to selecting top currency pairs in Forex.

Also, If you noticed, USD got a place in almost every most-traded currency pair. The reason is simple it is the strongest currency, and the change in its value affects all financial markets.

It kind of dominates the forex market. So starting trading with a major currency pair. In addition with the right pair select the best forex trading app for beginners.

Further, if you are still confused about currency pairs or how to choose the right pair, then Marketinvestopedia is there for you. We provide a number of training and educational resources. So if you want to expand your market knowledge, reach out.

0 Comments