Date: 27 June, Friday, 2025

01 Key News Insights

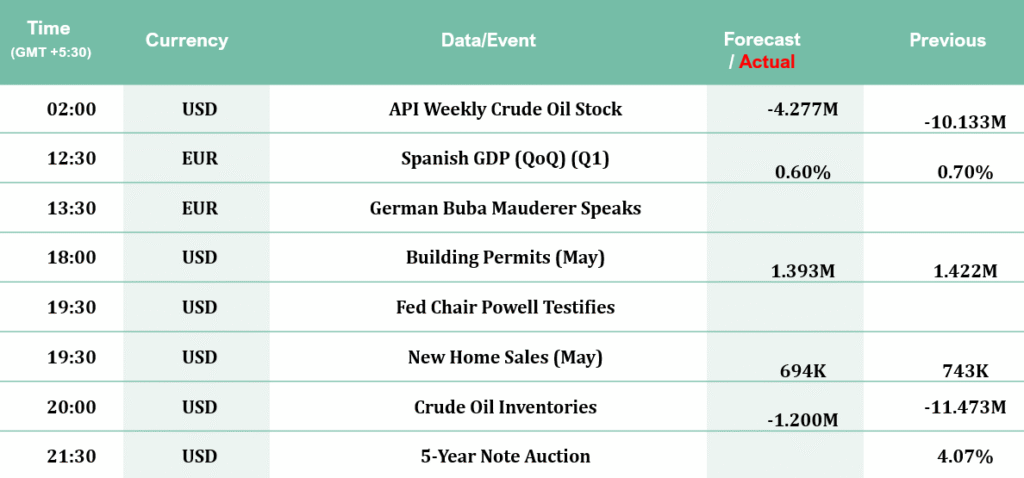

Important Data Events

- Consumer Confidence in USA declined sharply to 93.0, against an expected rise to 99.4.

FED BOSS POWELL TESTIFIES BEFORE CONGRESS (24 June, 2025):

- The Fed is well-positioned for a wait-and-see approach on rate cuts

- No immediate signal of interest rate cuts provided

Traders are awaiting:

- 1.Crucial Housing Data including Building Permits data & Sales of New Houses for the month of May.

- 2.Fed Chair Powell Testimony against Congress

- 3.Crude Oil Inventories

Israel-Iran War:

- Israel confirms ceasefire with Iran

- De-escalation between Iran and Israel has reduced geopolitical stress

- US reportedly failed to destroy Iran’s nuclear sites; Trump says “fake news“

Stock Market

- Tesla Europe sales slide 28% in May even as broader EV registrations rise

- European oil and defense stocks slip amid Israel-Iran ceasefire.

The Dollar Index (DXY)

- The index seems to be paralyzed today, providing no clear direction of the trend.

- While writing the report, DXY is flat near 97.45.

- Based on the fundamental and geopolitical scenario, prices are expected to rise with immediate hurdle at 97.56.

- If prices breach the mentioned level and sustain higher, then further bullishness can be expected in US Dollar.

USD/JPY

- JPY remains on the back foot against USD, with the pair climbing back closer to mid-145.00s during the early European session on Wednesday.

- The optimism over the Israel-Iran ceasefire remains supportive of a positive risk tone.

GBP/USD

- GBP/USD extends its winning streak for the third successive session, trading around 1.3620 during the Asian hours on Wednesday.

- The pair is hovering around 1.3648, the highest since February 2022, which was recorded on Tuesday.

- The risk-sensitive GBP/USD pair receives support from the improved risk appetite amid easing tensions in the Middle East.

02 - Economic Calender

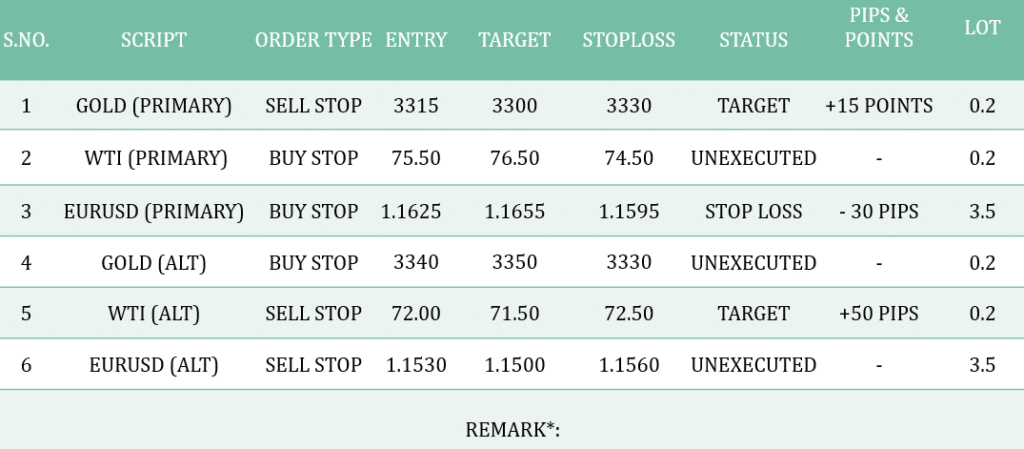

03 - Previous Day Performance

04 - Instructions/Guidelines for executing suggested trade

1.Close your trades within 8-10 hours or before 6:30 PM UTC (midnight IST), regardless of profit/ loss.

2.By chance, if you face losses in your “Primary Trade”, the “Alternative Call” is designed to recover those losses.

3.That’s why, always place the “Alternative call” alongside the “Primary Call”.

4.In case the “Alternative or Recovery Call” doesn’t get triggered the same day, a new call (or signal) will be provided the following day.

5.Generally, the Global Market Outlook Report includes signals with a higher reward-to-risk ratio (from 2:1 and higher). Therefore, consider booking partial profits in steps as follows:

a.For example, if the reward is two times the risk (or 2:1), consider booking half (or 50%) of the profit when levels reach a 1:1 ratio, and maintain the remaining position.

b.Then, when prices reach twice the risk (2:1), book the remaining 50% position.

c.To make this process seamless and smooth, consider placing two calls simultaneously with the same Stop-Loss (SL) and Entry-Level but different Target-Levels.

Note: These guidelines aim to optimize your trading strategy while managing risks effectively.

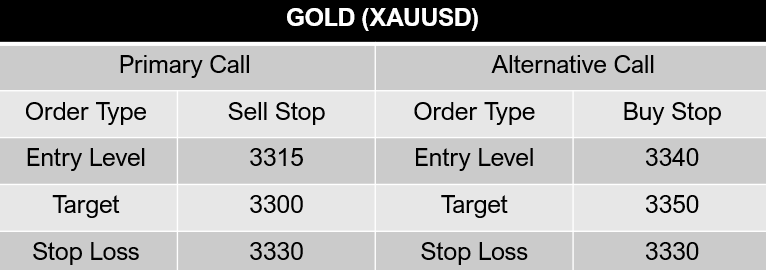

05 - Gold Analysis

Overview: The primary trend of gold is bullish, however, the precious metal is also consolidating sideways in the Asian-Euro session on Wednesday near fib level 0.786 (3327.65). The prices are struggling to rise higher, and failed to test the immediate hurdle of 3340, hence bearishness is expected to continue with crucial support at 3300.

Biasness: – The complete ceasefire announcement by Trump and confirmations by Israel should weigh on Gold rates quoted against the US Dollar. Also, Fed Chair Powell’s hawkish commentary is likely to support bears in the gold market.

Key Levels: R1- 3340 R2- 3355

S1- 3315 S2- 3300

Technical Analysis: Prices are trending in the lower selling zone of the indicators, below the middle Bollinger band and below the mid-50 level of RSI, both signaling bearishness.

Data Releases: Traders await the US New Home Sales report due later today along with the Fed Chair Powell’s testimony today, If Powell signals a hawkish stance or rate pause possibility, gold may fall as yields and the USD strengthens.

Alternative Scenario: If Gold fails to breach or/ and sustains below the crucial support level of 3315, then it could begin to rise higher with immediate resistance at 3340.

While writing the report, gold is trending at 3330

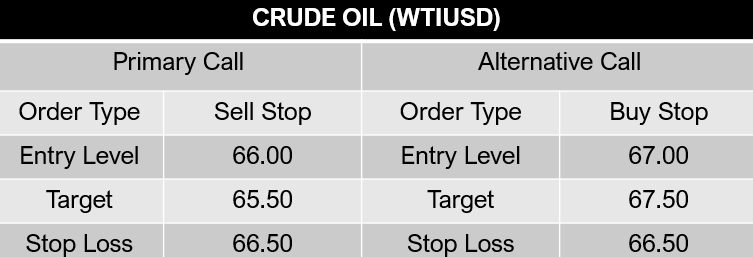

06 - Crude Oil

Overview: After breaking down from a rising wedge near $77.50 (R2), WTI crude saw a steep selloff, breaching $71.50 (R1). It’s currently stabilizing around $66.50. The structure suggests a possible short-term bounce toward $68–$69 before continuing the move lower toward $60.50 (S2), as indicated by the projected path.

Biasness: WTI crude oil plunged down. The decline followed news that Israel had agreed to a ceasefire with Iran after nearly two weeks of conflict. Easing geopolitical tensions reduced concerns over oil supply disruptions, leading to a drop in prices.

Key Levels: R1: 71.50 R2: 77.50

S1: 66.00 S2: 60.50

Indicator: The MACD histogram is deeply negative but showing signs of contraction, suggesting the current bearish momentum is weakening. However, the MACD line remains below the signal line and zero, indicating the trend is still bearish until a crossover or divergence confirms otherwise.

Data Release: Crude Oil holds steady as traders await today’s US inventory report. Stockpiles are expected to fall by 1.2M barrels, compared to a larger 11.5M barrel draw last week. A smaller decline may limit upside momentum in oil prices.

Alternative Scenario: If crude oil breaks the crucial resistance level of 71.5, it could signal bullishness.

While writing the report, the pair is trending at 66.50

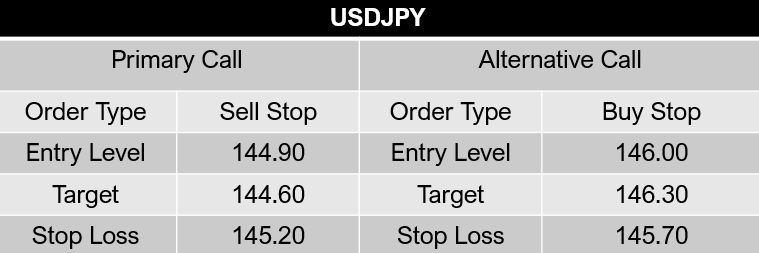

07 - USD JPY

Overview: USD/JPY is currently trading below the key $146.00 resistance level after a sharp drop from the recent highs near $148.00. The pair is attempting to hold above the $144.00 support, but price action remains corrective, hovering just under the 34-period EMA. Failure to reclaim $146.00 would keep the short-term bias tilted to the downside.

Biasness: USD/JPY weakens as differing policy paths between the BoJ and Fed favor the Japanese Yen. A broadly softer US Dollar adds to the pair’s decline, pressured by growing Fed rate cut expectations. The market anticipates lower US rates, making the Dollar less attractive.

Key Levels: R1: 146.00 R2: 148.00

S1: 144.00 S2: 142.00

Indicator: The MACD is positioned below the zero line with histogram bars still contracting, indicating waning downside momentum—the pressure remains on the downside.

Data Release: USD/JPY trades cautiously as traders await the US home sales report due later today. A weaker-than-expected figure may pressure the US Dollar on rising rate cut hopes. This could strengthen the Japanese Yen, pushing USD/JPY lower.

Alternative Scenario: If prices breach the Resistance of 146.00 along with the EMA, then bullish move is expected.

While writing the report, the pair is trending at 145.12

08 - Disclaimer

- CFD trading involves substantial risk, and potential losses may exceed the initial investment.

- Signals and analysis are based on historical data, technical analysis, and market trends.

- Past performance does not guarantee future results; market conditions can change rapidly.

- Consider your risk tolerance and financial situation before engaging in CFD trading.

- Signals are for informational purposes only and not financial advice.

- Each trader is responsible for their decisions; trade at your own risk.

- The report does not consider individual financial situations or risk tolerances.

- Consult with financial professionals if uncertain about the risks involved.

- By accessing this report, you acknowledge and accept the terms of this disclaimer.

Safe trading,

Market Investopedia Ltd