Forex Exchange History

In the present time, the Foreign exchange market is the largest and most liquid financial market. Many businesses, institutions, and profitable and non-profitable organizations engage in foreign exchange activities for different reasons. The Forex market has become a popular destination for investors and traders. However, for beginners, it is important to know how foreign exchange came into existence and became a popular choice for traders. In this article, we will discuss the forex exchange history with different periods.

What is the Foreign Exchange Market?

The Forex Market is a place where one currency is exchanged for another for different reasons, including import, export, traveling, and trading.

Foreign exchange is an over-the-counter decentralized market where all the transactions take place electronically. The market remains open for 24 hours and 5 days.

A quick glance

The Forex Market is a place where one currency is exchanged for another for different reasons, including import, export, traveling, and trading.

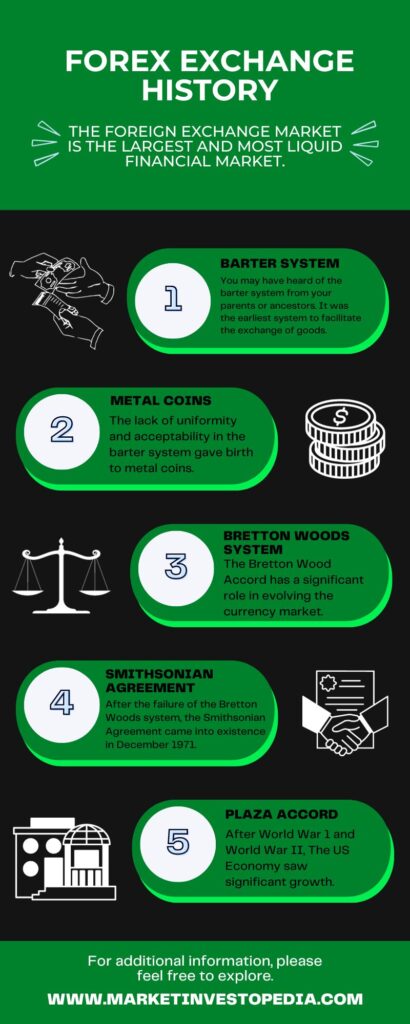

Barter System was the earliest system to facilitate the exchange of goods. During this time, there was no currency or centralized system of exchange. So, people used to exchange one commodity for another.

- Bretton Woods System aimed to create an adjustable pegged rate for one currency against another by three superpowers, including Great Britain, the United States, and France. Under this system, USD was pegged against the gold while the other currencies were pegged against the US Dollars.

- Plaza Accord is famous for a secret meeting between representatives of five major economies, including Britain, the US, France, Japan, and Germany in the Plaza Hotel of New York in September 1985. The main objective of this meeting is to depreciate the value of US Dollars against the other major currencies.

Foreign Exchange History

Forex is amongst the most popular and liquid financial markets, with a trading volume of over 7 trillion dollars and many participants from all over the world.

However, how foreign exchange started is an interesting story. It is a must for a trader to get well-versed in the forex exchange history for a better understanding of the currency market and its workings.

Barter System:

You may have heard of the barter system from your parents or ancestors. It was the earliest system to facilitate the exchange of goods. At the time of the barter system, there was no currency or centralized system of exchange.

So, people used to exchange one commodity for another. Suppose a person A has wheat and wants rice. So, he will find a person who has rice and is ready to take wheat from him in exchange.

The barter system prevailed and evolved for years. People used to travel to other towns and cities to exchange goods. However, the system was not as effective because mutual agreement is necessary. In addition, determining the value of the relative good was quite complex.

Metal Coins:

The lack of uniformity and acceptability in the barter system gave birth to metal coins. Metal coins have a significant place in the history of foreign exchange. The earliest coins were made of silver mined during the Mesopotamian period around 2500 BCE.

The first gold coin was produced somewhere around the 6th century. Throughout history, gold has maintained its value and is widely accepted. That is the reason why gold became a popular mode of foreign exchange at one point in time.

In the 19th century, many countries adopted the gold standard for exchange, as converting gold was easy. However, some limitations were also there with the gold standard due to which it was not sustained during the world wars.

During the First World War, European countries suspended the gold standard due to difficulty in printing more paper money. As a result, other countries were bound to print fiat and centralized currencies to facilitate exchange.

Bretton Woods System:

In the history of Forex trading, the Bretton Wood Accord has a significant role in evolving the currency market. The system aimed to create an adjustable pegged rate for one currency against another by three superpowers, including Great Britain, the United States, and France.

The main aim of this system is to create a new and efficient global monetary system. The US holds the most gold reserve at that time and even now. So, it is pegged against the gold while the other currencies were pegged against the US Dollars.

However, the Bretton Woods failed as there was not enough amount of gold in comparison to the dollar circulation. In 1971, the Bretton Wood system was finally ended.

Smithsonian Agreement:

After the failure of the Bretton Woods system, the Smithsonian Agreement came into existence in December 1971. The agreement was between the 10 leading economies of the world.

The main aim behind the accord is to adjust the exchange rates of the Bretton Wood Agreement and create an effective foreign exchange system with a greater band of fluctuation. However, the agreement also failed eventually.

Plaza Accord:

After World War 1 and World War II, The US Economy saw significant growth. Any change in its political, social, and other factors started impacting other countries. The demand for American goods and services was all over the world, and as a result, US Dollar saw a major increase. The weight of the US Dollar was crumbling the other major European economies during the 1980s.

Plaza Accord is famous for a secret meeting between representatives of five major economies, including Britain, the US, France, Japan, and Germany in the Plaza Hotel of New York in September 1985. The main objective of this meeting is to depreciate the value of US Dollars against the other major currencies. The Plazo Accord caused a significant fall in the value of USD. It was the time when traders started seeing currency trading as a way of making money and putting their money in the market.

Emergence of Internet Trading in Forex Exchange History

The failure of Bretton Wood, the Smithsonian agreement, and other accords gave birth to the free-floating system in Foreign exchange history. The system works on the principle of flexibility in exchange rates according to market forces without any interventions of government authorities or central banks. The period from 1980 to 2000 is a revolutionary period.

The emergence of the internet has evolved foreign exchange. The first Electronic Communication Network, or ECN, was developed somewhere around 1969. During the 1990s, the computerized system to buy and sell currencies was established and evolved. The development of communication and technology resulted in the development of forex trading. It became accessible to forex traders, replacing the traditional complex trading systems.

Forex Trading in Present Time

From the barter system, gold standard, and Bretton Wood agreement to the Gold Standard, the different stages of FX exchange history evolved the currency market. In the present time, the daily market cap of foreign exchange is around 7 trillion dollars. People from all over the world participate and make money in the currency market.

There are more than 180 legal currencies and over 10 million forex traders in the world. However, USD still holds the top position and dominates currency trading. Besides USD, EURO and Japanese Yen are the most traded currencies.

Like the stock market, forex has also become a popular means for investing money. Many institutions, big banks, governments, and retail traders participate in the forex market. In addition to this, the advent of forex trading gave birth to widely known trading platforms like Meta Trader 4 and 5.

There are many signal providers and forex broker platforms to start your trading journey at present. With all the positive aspects, foreign markets also became a destination for scammers and fraudsters. However, these scams are quite common in the other market.

Overall, the forex market has significantly developed over the years. It is the biggest and most liquid market. Many part-time and full-time traders all over the world are making a good amount of money in the market. The Forex market is expected to reach new heights in the future due to many trading opportunities and strategies.

Bottom Line

The Forex exchange history is full of ups and downs; nevertheless, that’s how evolution takes place. Many traders don’t know how forex trading started, and they did not find the need to get themselves well-versed in the history.

However, a trader needs to understand that history reflects the triumphs and tragedies. Understanding the origin of currency trading will help you to clear the basics and enable you to learn the mechanism of the FX market.

Also, it will help you to identify how economic, social, and political factors affect foreign exchange. Fundamental analysis is crucial for forex trading, and history enables you to master the art of this analysis. In addition to this, knowledge develops the psychological skills and mindset of traders.