When you start Forex trading, It is important to learn what is Technical and Fundamental Analysis as the game of trading depends on your prediction, and the accuracy of the prediction depends on your market analysis.

What is Fundamental Analysis?

Fundamental analysis is the study of economical reports, news, current updates, political, social, and other events that cause price fluctuation in the market.

Fundamental Analysis Example:

Suppose the United States’s unemployment claims report was recently released. According to this report, unemployment will increase in the country. So this will have a negative effect on US currency.

That’s how based on the above-studied factors, traders make the buy or sell decision using Fundamental analysis tools.

A quick glance

Fundamental analysis is the study of economical reports, news, and other events that cause price fluctuation in the market.

Technical analysis is mainly affected by price movements. It uses indicators such as oscillators, moving averages and charts to predict the market.

If an indicator shows a consistent upward trend for a while, that indicator is a potential positive signal and vice versa.

The main difference between these two analyses is that technical traders look for patterns in price action while fundamental analysts look for trends.

For beginners, fundamental is better, and for advanced traders, technical is better. But to become a successful trader using both is best.

Advantages of fundamental analysis

The advantage of fundamental analysis is that it provides a more precise picture of market conditions. Unlike technical indicators, the fundamental analysis uses historical data, patterns, and trends to explain the economy’s state.

Many traders can tell when the economy is in trouble by examining the key economic indicators’ behaviour. Unlike technical indicators, the fundamental analysis gives you a much broader scope of what is happening in the economy.

What is Technical Analysis?

Technical analysis is mainly affected by price movements. It uses technical indicators such as oscillators, moving averages, lines, and other chart patterns to predict the market.

The patterns are interpreted as a trader’s perception of an economic situation. Technical analysis can analyze stock, commodity, and bond markets.

Technical Analysis Example

A good example is the candlestick chart. Candlesticks are graphical representations of trends and have been around in the trading world for hundreds of years.

Using candlesticks to interpret the market trend can be a great way to determine the market’s strengths or weaknesses that help you enter and exit the market more successfully.

Advantages of Technical Analysis

The main advantage of technical analysis is that it can give a trader a better market direction idea by observing the technical indicator’s movement. A trader can tell if the price will go up or down.

More importantly, technical indicators tell a trader about the price’s direction. So, using the specialized indicators alone, traders can play with their emotions and profit from their trades. However, this form of trading requires a lot of patience.

Use of Technical Indicators

There are plenty of technical indicators and oscillators that can help you analyze the market. Fundamental analysis in the Forex market is just interpreting the market and using technical indicators to support that movement.

On the other hand, technical analysis is all about anticipating a currency’s future price movement based on past price movements. Technical analysts spend their time charting price action from the long-term perspective, looking for similarities in the market behaviour.

How to read technical indicators?

If an indicator shows a consistent upward trend for some time, that indicator is a potential positive signal. If the trend is negative, that signal is usually a negative sign, indicating that the trend is headed in the opposite direction. There are several ways to analyze the market using technical indicators.

As they chart, some traders use technical analysis to watch the price movement over time. They look for trends that seem to go in one direction for a while and then reverse around the turn.

These technical indicators show repeated patterns in the movement of price. When these patterns are found, they are often used as a signal to invest in the currency.

Methods of Technical Analysis

There are three popular methods in technical analysis for identifying trends. These are moving averages, envelope patterns, and oscillators.

The moving averages method of technical analysis depends on the idea that the average price is a good indicator of the upcoming trend. It is a very traditional method with technical traders. The problem is subject to continuous change, and It will be challenging to predict future price movement.

That’s why envelope patterns and oscillators come into play. These technical analysis methods attempt to recognize trends based on a line’s shape. These trend lines are created by connecting the closing prices to any trading chart’s high and low points.

A good trader will often use this method as an indicator. It works better for smaller time frames, and smaller trend lines are easier to recognize.

What is technical and fundamental Analysis in Forex?

The technical and fundamental analysis in forex trading involves using fundamental and technical tools to predict the forex market and invest in the right currency pair.

Both fundamental and technical analysis is essential to successful Forex trading. Of course, it is easier to make profits. If you know about the market better than anyone else, both types of analysis are essential.

The information about trends and signals you gather using technical analysis can help you predict where the market will go, which results in profitable trading and lower risks.

While you need to learn the technical side of Forex trading, you don’t need to become an expert. Plenty of tools and websites are available to help you get started if you’re interested in learning more about technical analysis

Best analysis for advanced forex traders

If you are an experienced trader that doesn’t have much experience using technical indicators, then the fundamental analysis may be more suited to your needs.

Either way, it’s essential to understand the difference between the two kinds of analysis to choose which method is best for you. Forex traders can be confused about technical analysis and fundamental analysis.

There is a slight chance that those two terms mean the same thing.

However, they are not the same, and you have to determine which method of technical and fundamental analysis in forex you need for your trading.

Fundamental analysis vs. technical analysis

The main difference between technical and fundamental analysis is that technical traders look for patterns to make price action strategy while fundamental analysts look for trends. You can find both patterns in the price action, but there is more variety in the long term.

Traders use charts to identify the trend and then make trades based on the trend. If the price has an upward direction, you can make trades anticipating that it will continue upward. If the price moves downward, you have to look for resistance levels and then make a trade.

Fundamental vs technical analysis: which is better

After understanding what is technical and fundamental analysis, the most common question that arises in traders’ minds is which analysis is better.

You can make some excellent trades on fundamental analysis alone. But, to become a successful trader, you need more than just the skill of fundamental analysis. There are lots of indicators that you can use to supplement your knowledge of fundamental analysis.

Some technical indicators give you a clearer picture of currency price movements. Using both technical indicators and fundamental analysis can provide you with a better overview of the market and help you to decide where to enter and exit the market.

The similarities between technical analysis and fundamental analysis are the motive of both analyses is the same, but we can say that technical traders are better at spotting trends.

Fundamental analysts look for patterns as well. But the technical analysis provides the trader with the information they need to make a trading decision.

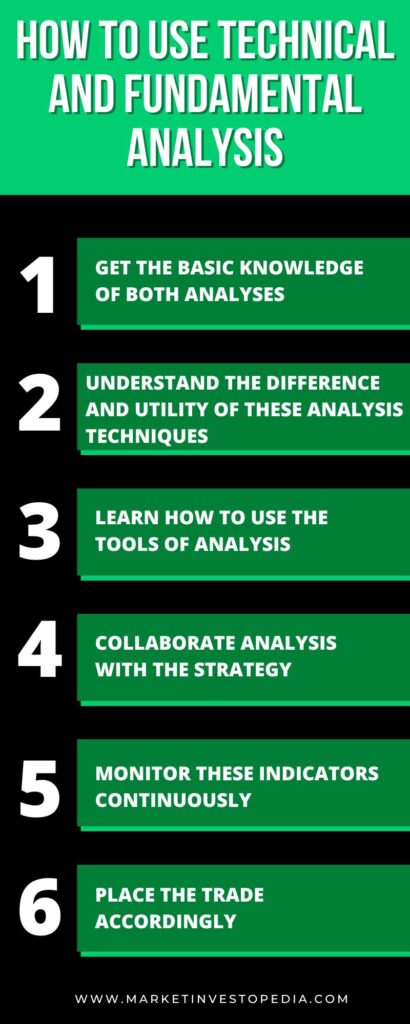

How to Use Technical and Fundamental Analysis

Learning how to use technical and fundamental analysis in forex can be done quickly.

Basic knowledge of Analysis: The first step is to familiarize yourself with the various methods and gain the necessary experience to implement them successfully. It can be done simply by having a basic understanding of two different analytical techniques.

Once you know the use of technical analysis effectively, it is possible to turn this skill into a substantial income source. Technical analysis is a very reliable method for predicting the market’s movement.

There are many Fundamental and technical analysis courses by which you can learn how to use technical and fundamental analysis. Some courses offer a quick learning curve, while others may take longer to fully learn and understand.

It is entirely dependent on individual learning ability and personal preferences. Most of the best training courses will offer a full money-back guarantee.

Use of Analysis Tools: Learning to use technical charts and fundamental trends can tell you much about the currency markets’ state. You can quickly determine which currencies are rising and falling in value. It allows you to place your trades accordingly to maximize your profits.

Although you must be careful when trading in the currency markets, understanding technical indicators can help you make better trades and decisions overall.

Conclusion

We have understood the detailed concept of What is Technical and Fundamental Analysis. However, a trader must understand the strength of analysis relies on effective technical indicators and fundamental tools.

0 Comments