Have you ever heard of Fibonacci retracement? It is amongst the most common and complex terms a beginner hears while starting his trading journey. Even many experienced traders do not know what it means, and they use it while trading. However, it is essential to understand these technical analysis tools for efficient trading. In this article, we will discuss the concept of Fibonacci retracement levels and how to use them.

An Introduction to Fibonacci retracement level

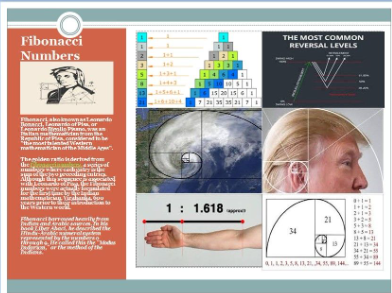

The Fibonacci level is a mathematical sequence discovered by the Italian mathematician Leonardo Fibonacci in the 1400s. However, there are theories that sequence was first found by an Indian Mathematician, Acharya Virahanka,

somewhere around 600 A.D. Leonardo Fibonacci had just introduced them to Western Europe.

Nevertheless, whoever is behind the discovery of Fibonacci levels, the important thing is that they are useful technical analysis indicators and help traders place trade.

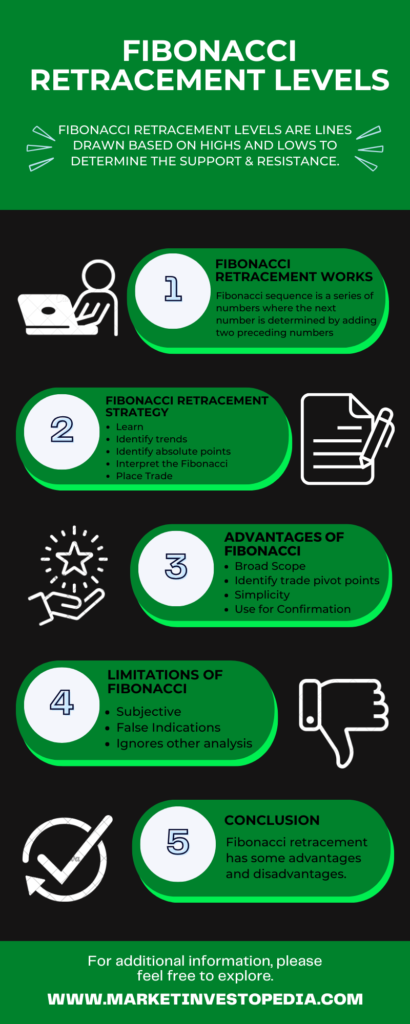

Fibonacci retracements are horizontal lines drawn to determine the support and resistance levels. It helps traders determine potential buying or selling opportunities. These lines are drawn on the chart based on the absolute highs and lows of an asset price over a period.

Fibonacci Numbers are found across different fields showcases their fascinating and versatile nature, making them a subject of interest and exploration in various disciplines.

Nature

Fibonacci numbers appear in various aspects of nature, such as the arrangement of leaves on a stem, the pattern of seeds in a sunflower, the spiral arrangement of pinecones, and the shape of certain fruits.

A quick glance

Fibonacci retracements are horizontal lines drawn based on highs and lows to determine the support and resistance levels. It helps traders identify potential buying or selling opportunities.

23.6%, 38.2%, 61.8%, 78.6%, etc are the major Fibonacci levels. 61.8% is known as the golden ratio of Fibonacci.

Fibonacci extension helps identify how far a price may reach after resuming a trend. 127.2%, 161.8%, 200%, 261.8%, 423.6%. Etc. are popular Fibonacci extension levels.

- Wide Scope

- Identify trade pivot points

- Simplicity

- Use for Confirmation

- Subjective

- False Indications

- Ignores other analysis

Art and Architecture

Fibonacci numbers are often used in art and architecture for their aesthetically pleasing proportions. They can be seen in the proportions of famous artworks and architectural designs.

Financial Markets

Traders and analysts use Fibonacci retracement levels in technical analysis to identify potential levels of support and resistance in financial markets.

Mathematics and Number Theory

Fibonacci numbers have interesting mathematical properties and connections to number theory. They are frequently used in various mathematical problems and puzzles.

Computer Science

Fibonacci numbers are used in computer science, particularly in algorithms and programming. They serve as a basis for understanding recursive algorithms.

Music

Some musicians incorporate Fibonacci sequences into their compositions, finding harmony and rhythm in the numerical relationships of these sequences.

How Fibonacci retracement works

The Fibonacci sequence is a series of numbers where the next number is determined by adding two preceding numbers like 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, etc.

Each number in the series is associated with the Fibonacci ratio, which helps determine potential price reversals. Following are the significant Fibonacci retracement levels and what they indicate:

- 23.6%: The most popular level used to identify mirror correction during an ongoing trend.

- 38.2%: Indicates moderate retracement within a trend

- 61.8%: Best Fibonacci level, used to identify potential solid reversal

- 78.6%: Indicate a significant pullback or reversal zone.

61.8% is also known as the Fibonacci retracement golden ratio. When you divide most of the numbers in series with the second number, you will get this ratio, like 21/34 = 0.617, 34/55 = 0.618, and 233/377 = 0.6180.

That’s all about Fibonacci’s mathematical or statistical aspects. However, there is good news: you don’t need to get into all these calculations.

You just need to select a time frame of the price movement of an asset and define the absolute highs or lows of that period. The charting platform will automatically calculate the retracement levels for you.

How to use the Fibonacci retracement strategy

Now, if you are wondering how to use the Fibonacci ratio in trading, here is the step-by-step procedure that helps you place trades efficiently.

Learn

The first step for using any strategy, tool, or indicator is getting well-versed in the basics. Get an in-depth understanding of Fibonacci retracement and how to use it in trading.

Also, knowledge of trading charts and indicators is necessary for trading. You can also practice demo trading to practice placing a trade using Fibonacci.

Identify trends

Trends refer to the directions of the price moving over time. The support and resistance are determined based on the prevailing trend. You can also draw trend lines to spot trends.

Identify absolute points

You don’t need to calculate the Fibonacci retracement; the charting platform can automatically provide it. You have to customize the Fibonacci retracement setting based on your time frame and indicators. Define the absolute highs or lows over a period, and the trading software will draw the lines to define the Fibonacci ratio.

Interpret the Fibonacci

Once you are done with the setting, it’s time to interpret charts using Fibonacci support and resistance levels.

Suppose there is an upward trend, so if the price of an asset touches the Fibonacci support level. It means that the price is expected to retrace or return backs, suggesting traders go long.

Or if there is a downward trend if the asset price touches the Fibonacci resistance level. It means that the price is expected to retrace or return backs, suggesting traders go short.

Place Trade

One of the biggest mistakes traders make is that they can make trade decisions solely using Fibonacci retracement, but that’s not how to deal with technical analysis tools.

Once you identify the potential bullish or bearish trade opportunity, it’s time to confirm the interpretation using other indicators. You can use Bollinger bands, moving averages, and oscillators for confirmation.

In addition, you need to consider fundamental and sentimental analysis factors. Once you are satisfied with the confirmation, you can place a trade accordingly.

Fibonacci retracement and extension level

Many traders confuse between Fibonacci retracement and extension level. So, let’s discuss how the Fibonacci extension level differs from the retracement.

Fibonacci extension is also an important technical analysis similar to retracement. It helps identify how far a price may reach after resuming a trend. 127.2%, 161.8%, 200%, 261.8%, 423.6%. Etc. are popular Fibonacci extension levels.

Suppose the price of an asset is 50$. It reaches 100$ and then comes to 75$. The price move from 100 to 75 is a retracement. In the same case, if the price now goes to 150$, it is an extension.

Fibonacci retracement and extension are both handy tools. Retracement levels are generally used to determine when to enter a trade, while extension is usually used to determine when to exit a trade or the take profit point.

Fibonacci retracement and extension each have different features, purposes, and uses. A trader should combine the retracement and extension levels to place trade effectively.

Advantages of Fibonacci retracement levels

We had a detailed study of Fibonacci levels; however, knowing the benefits and limitations is a must before using tools. Let us start with the help of retracements:

Broad Scope

One of the key advantages of Fibonacci instruments is that you can use these statistics tools for trading in different instruments, including cryptocurrencies, forex currencies, commodities, bonds, indices, and many other areas.

Identify trade pivot points: Fibonacci levels can identify trade pivot points, including entry, exit, support, and resistance. These help you to set your stop loss and take profit points. So, you identify potential trade opportunities and make a good profit.

Simplicity

Once you have understood the concept of Fibonacci and mastered the art of implementing the strategy in trading, it is easy to use these tools.

In the present time, due to top-notch software and charting tools, placing trade using technical analysis has become less complex.

Use for Confirmation

You can use the Fibonacci retracement level to confirm the interpretation of other indicators. Confirmation is an integral part of using technical analysis. So, if you use tools such as Bollinger bands, moving averages, trend lines, or any other indicator for place trade, you can use these Fibonacci for confirmation.

Limitations of Fibonacci retracement levels

With the above benefits, there are some restrictions to using Fibonacci. Let us discuss these restrictions. It will help you in using these tools efficiently.

Subjective

One of the significant disadvantages of Fibonacci is that, like any other technical analysis tool, these are subjective. Traders may identify different highs and lows, resulting in subjective interpretations.

False Indications

Traders should understand that Fibonacci is not foolproof or a guarantee for success. Every touch at key levels may not result in a trend reversal. Placing trade every time is a step towards a significant loss. So, the best way to deal with these false signals is to confirm the interpretation with other indicators.

Ignores other analysis

Fibonacci retracement is a technical analysis tool that does not take into sentimental and fundamental analysis conditions. However, these are essential factors and may change the entire market scenario. So, for the desired result, you need to watch elements like market perceptions, economic reports, speeches, geopolitical events, etc.

Conclusion

Fibonacci retracement has some advantages and disadvantages. Some people may find Fibonacci retracement levels the best trade tool, while others may find these useless. It depends on how effectively you have used these tools.

A trader should know that there is no guarantee that every trade you place using Fibonacci results in profit. In trading, there are some losing and some winning trades.

However, if you are using the Fibonacci retracement effectively, the winning trades are definitely more than the losing ones.

As these retracements are developed after in-depth research based on mathematical concepts and are widely used by many experienced traders. So, you can make profitable trades using these tools.