Free trading Journal in Forex

A trading journal is one of the most valuable tools a forex trader can have. Yet, many traders overlook its potential. A well-kept journal doesn’t just record trades—it reveals patterns, identifies mistakes, and sharpens your strategy.

In this guide, we’ll explore the best forex trading journal platforms for 2025, highlight the benefits of using one, and show you how to create a journal that actually improves your performance. We’ll also look at free and paid tools, plus a few semantic tips for those searching for a trading journal template or a trading journal free of cost.

What is a trading Journal?

A trading journal is a tool—digital or physical—that records details of every trade you make. This includes:

- Entry/exit points

- Trade size

- Currency pair

- Stop loss and take profit levels

- Timeframes

- Screenshots or charts

- Strategy and reasoning

- Outcome and post-trade notes

Whether you’re into forex, crypto, or options trading, a trading journal helps you review decisions, refine strategy, and improve consistency.

A quick glance

You can use Google Sheets, Notion, or Stonk Journal to journal trades for free. Platforms like TradesViz also offer a free plan with basic features.

Edgewonk is the best trading journal for serious traders, offering deep analytics and psychology tools. For beginners, Chartlog and TraderSync are great picks.

Yes, Notion is free to use and perfect for building a custom trading journal with templates, notes, and charts.

TradingView is the top free charting tool for traders, offering real-time data, indicators, and user-friendly charts across assets.

Best Forex Trading Journal Platforms in 2025

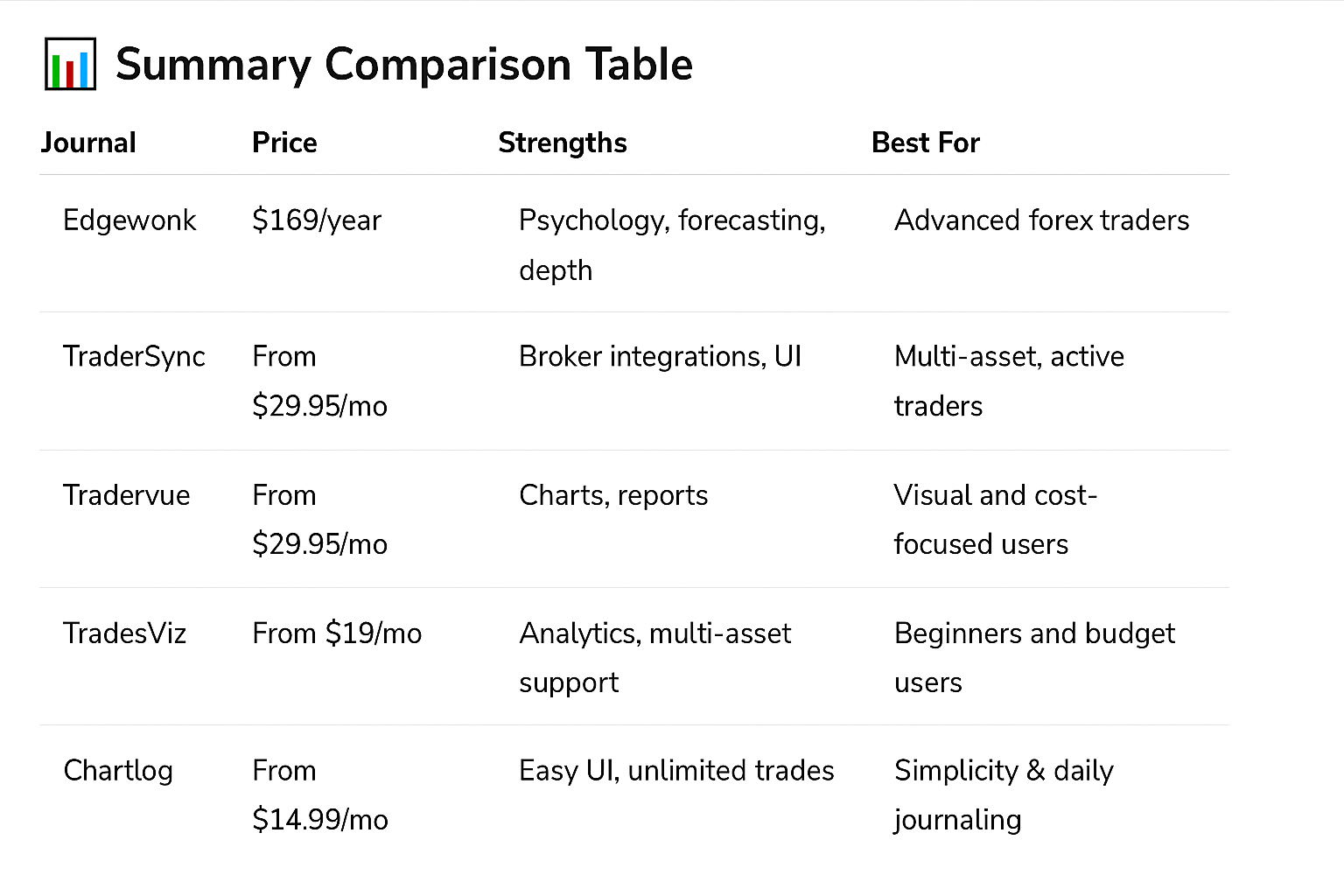

1. Edgewonk – Best for Serious Forex Traders

- Pros: Advanced analytics, psychology tracking, customizable tags, return forecasting

- Cons: No monthly plan, slightly complex for beginners

- Price: $169/year (14-day refund period)

- Best for: Traders focused on psychology and deep performance analysis

2. TraderSync – Great for Active and Options Traders

- Pros: Backtesting, broker integrations, iOS/Android apps

- Cons: Expensive, extra costs for key features

- Price: Starts at $29.95/month

- Best for: Active traders using multiple brokers

3. Tradervue – Best for Chart-Based Journaling

- Pros: Automated chart screenshots, commission reports

- Cons: Lacks MetaTrader support, no psychology tools

- Price: Free (30 trades/month), Paid from $29.95/month

- Best for: Visual learners and stock/forex traders

4. TradesViz – Best Value for Feature Access

- Pros: Automated reports, multi-asset support, free tier

- Cons: Dated interface, limited free plan

- Price: Free, Paid plans from $19/month

- Best for: Budget-conscious traders wanting data depth

5. Chartlog – Easy to Use and Sync

- Pros: Sleek interface, dynamic charts, multi-account support

- Cons: Limited broker integrations

- Price: From $14.99/month

- Best for: Beginner to intermediate traders

What should include in the trading journal?

Remember, statistical information plays a crucial role as it helps in determining your overall profit or loss. So fill in accurate data; otherwise, the whole result may change.

Market philosophy: Apart from your trade-related data, your trading journal should also include behavior, perception, trends or philosophy of the market.

It may include correlation between financial assets, important fundamental analysis events, exchange rate fluctuation factors, trade management rules etc. So, whenever you need this information, you can get it from the journal.

Missed Opportunities: With the trade you have placed, you should also maintain the list of opportunities you have missed, which result in a good profit.

So whenever you find similar market conditions in the future, you can place a trade. Also includes the mistake you have made while placing a trade like entering the market before, setting the wrong stop loss level or any other mistake that reduced your profit.

Benefits of Using a Forex Trading Journal

1. Identify Strengths and Weaknesses

A journal lets you see which pairs or setups work for you. If your GBP/USD trades underperform, that’s a clue to refine your approach.

So that you can make changes to deal with your weakness. Suppose you find that whenever you trade in GBP/USD pair, you lose money. It indicates that there is something wrong with your trade planning or implementation.

2. Make Better Decisions

3. Self-Improvement

Instead of relying on a mentor or manager, your trading journal is your best feedback tool. This is especially true with structured tools like a Notion trading journal.

However, a trading journal is a way of self-evaluation and improvement. You can identify what you need to change and continue using these diaries.

4. Maintain Consistency

Winning in forex isn’t about one lucky trade. Journals help you manage risk and stick to profitable strategies.

Profit and loss are part of trading. However, consistency is when you manage to keep your profits more than the losses. These records will help you to maintain your risk-to-reward ratio and eliminate the chances of significant losses.

5. Build Historical Records

Having a record helps when reassessing your strategy, speaking to mentors, or verifying your edge.

So when you feel like quitting or putting a significant amount in the forex market, you can determine whether it will benefit you. In addition to these, you can show these records to any experts to get improvement suggestions.6. Discipline and Professionalism

Using a trading journal template signals that you take your trading seriously. It builds the habits that separate amateurs from professionals.

A trader should understand proper planning and effective decision-making are only possible when you imply discipline. You are putting your hard-earned money in the market, and recording your trade is a sign that you are taking your trading career seriously.

Free Trading Journal Options

Looking for a free trading journal to get started? Try these:

Excel / Google Sheets Template – Create a spreadsheet or download a pre-made trading journal sample. Great for full customization.

Notion Trading Journal – Flexible, template-based tracking with easy visuals.

Stonk Journal – Donation-based online tool with custom fields.

TradesViz (Free Tier) – Allows tracking up to 3000 trades (stock only).

Conclusion

Choosing the right trading journal depends on your trading style, goals, and platform preferences. While Edgewonk offers serious depth for forex traders, platforms like TraderSync and TradesViz provide useful tools for those wanting automation or budget options.

Whether you opt for software or a spreadsheet, the key is consistency. A journal is only effective when used regularly and honestly. In 2025, with so many tools available, there’s no excuse not to track your trades and sharpen your edge.

Start journaling today, and watch your trading discipline and performance improve.