CFD Indices Trading Explained: How Index CFDs Work for Beginners

CFD Indices trading allows you to trade on the price fluctuations of the major stock market indices without having to own the underlying shares. It is a common method of entry into international markets, such as the S&P 500 or FTSE 100, for novices who are learning trading CFD for beginners. When you are new, it is important to know what is CFD and how it works. Such trading concepts related to contract for differences can be simplified with the help of platforms such as MarketInvestopedia, which makes it easier to learn and make informed decisions using an indices trading platform.

What is Indices CFD Trading?

Indices CFD trading refers to the trading of contracts that are pegged to the price changes of stock market indices such as the S&P 500, Dow Jones, or FTSE 100 without having to own the underlying stocks. CFD is an abbreviation of Contract for Difference, also known as contract for differences, which enables traders to speculate on the direction of the value of an index using index CFD instruments.

An index is a collection of the best-performing firms in a nation or industry. As an example, the S&P 500 consists of 500 large US-listed companies, and the DAX 40 reflects large German companies. When trading CFD indices, you do not have to purchase all the stocks in the index. Rather, you simply bet on the general direction of the index using indices CFD or stock CFD products.

This form of trading is elastic. You may go long (when you believe the index will increase) or short (when you believe the index will decrease). It is popular with beginners as it provides access to international markets on a single indices trading platform and does not need as much capital as purchasing all the stocks individually, similar to CFD forex or crypto CFD trading.

Most new traders begin with CFD indices trading since they are simple to track and tend to respond to international news. With the knowledge of how indices CFD trading operates, you will be able to manage your trades better and exploit both the rising and the falling markets.

A quick glance

CFD indices are agreements that allow you to buy and sell based on the price of some index of the stock market, such as the S&P 500 or FTSE 10,0 without actually being a stockholder in any company represented there.

To trade in CFD index, select an index to trade in, such as S&P 500, a reliable trading platform to use, whether to buy or sell the index, the size of the position to take and the risk with a stop-loss order.

The price of 1 future of CFD indices varies with the broker and the index. Other brokers provide mini or micro contracts, and thus, 1 CFD may reflect a smaller part of the entire index.

The typical trading strategies in CFD indices cover news-based trading, trend following and breakout. Some basic techniques utilised by the newbies include trading along the market trend and a stop-loss order.

How Does CFD Indices Trading Work?

Trading indices CFD trading is simply a matter of guessing whether a stock market index will rise or fall. You do not purchase the real shares, but you enter into a contract to trade on the price movement of the index. This makes trading CFD for beginners simple and approachable even to the novice.

To illustrate, let us take a case. Assume that the NASDAQ 100 index is at 15,000 points. When you think it will go up, you open a long (buy) position. When it reaches 15,200 and you close your trade, you will have profited on the 200-point move. Conversely, when you believe that the index will decline, you can go short (sell). When the market drops as anticipated, you make money out of the drop, similar to stock CFD or CFD vs stock trading mechanics.

Leverage is one of the main characteristics of CFD indices and CFD handel. Leverage allows you to trade a big position with less capital. As an example, you can trade 10,000 dollars of an index with only 1,000 dollars with 1:10 leverage. This highlights both CFD benefits and risks, so risk management is essential.

CFD indices can be traded at the same time as the underlying markets. There are even platforms that provide extended hours trading.

The most attractive aspect of indices CFD trading is the opportunity to trade international markets such as the S&P 500, DAX 40, or FTSE 100, all on the same platform. Even a novice can start with confidence using cfd trading strategies, real-time charts, stop-loss tools, and news updates.

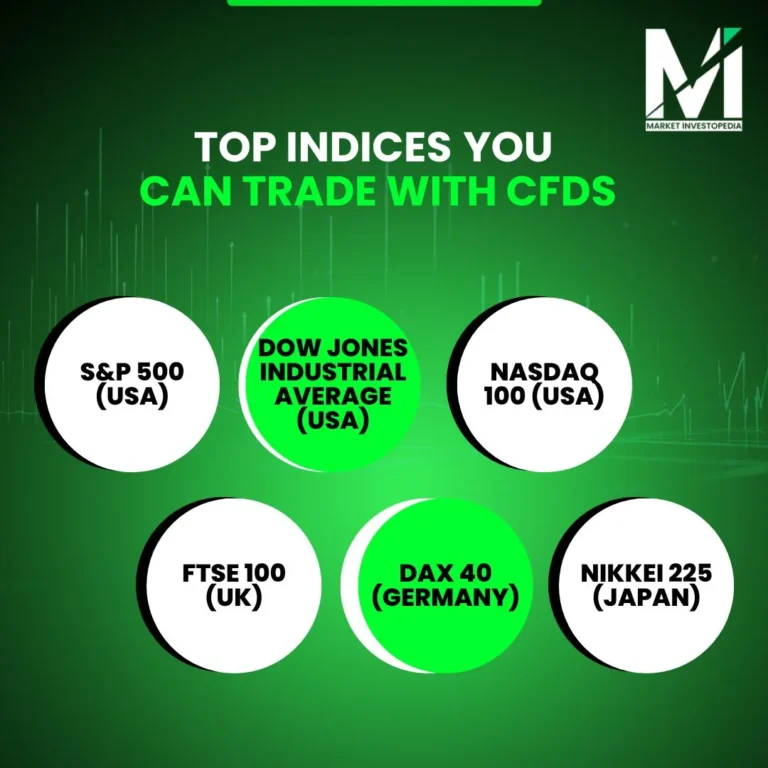

Top Indices You Can Trade with CFDs

In the case of CFD indices trading, you can trade in some of the most popular and powerful stock market indices in the world. These indices reflect the performance of a collection of large companies, and thus, they are suitable for traders who desire exposure to whole markets rather than individual stocks using index CFD products.

Some of the popular CFD indices traded are:

S&P 500 (USA):

Monitors 500 of the most prominent firms in the U.S. It is one of the most tracked indices in the world, and it is highly sensitive to economic news, earnings reports and Federal Reserve decisions.

Dow Jones Industrial Average (USA):

It consists of 30 large companies in the U.S. This index is commonly referred to as a snapshot of the U.S. economy.

NASDAQ 100 (USA):

Specialises in the technology industry. Perfect for traders familiar with CFD vs stock movements of companies such as Apple, Microsoft, and Amazon.

FTSE 100 (UK):

It is the index of the 100 largest firms on the London Stock Exchange. A favourite of European traders.

DAX 40 (Germany):

Monitors 40 leading firms that are listed in Frankfurt. It is a sign of the power of the largest economy in Europe.

Nikkei 225 (Japan):

Represents 225 large companies in Japan, providing a glimpse of Asian markets.

These CFD investing indices are characterised by liquidity, volatility, and frequent price movement, which makes them suitable for short-term and intraday trading. Trading indices CFD allows you to track the trends in the global markets and react to world events all on a single trading platform.

Why Trade Indices Using CFDs?

CFD indices trading has gained a lot of popularity, particularly among novices, and rightly so. It provides an easy method of trading the performance of whole markets as opposed to individual stocks. Now, let us examine some of the main CFD benefits.

1. Global Markets Access

When you trade CFD indices, you can trade the major markets such as the S&P 500, FTSE 100 or DAX 40 all through a single account. You do not have to create various accounts in various countries.

2. Two-Way Profit:

The possibility to go long or short is one of the greatest advantages of indices CFD trading. You can profit when the market is rising or falling, unlike traditional CFD vs stock ownership.

3. Diversification:

Trading an index allows you to invest in a portfolio of companies simultaneously. As an example, when you trade the NASDAQ 100 index CFD, you get exposure to 100 technology companies.

4. Leverage:

CFDs enable you to trade on leverage, which is a key feature of CFD handel and CFD forex markets. However, leverage can multiply profits as well as losses.

5. Reduced Costs and No Ownership

You do not own the physical shares, similar to crypto CFD or stock CFD trading, and thus avoid stamp duties or ownership costs.

Things to Know Before You Start Indices CFD Trading

Before jumping into indices CFD trading, it’s important to understand some basic things that can help you trade better.

1. Get to Know the Basics First

Begin with learning what is CFD, the meaning of an index, and how economic events affect price movements.

2. Begin with a Demo Account

The majority of trading platforms provide a free demo account. Trade CFD indices using virtual money on it. This assists you in learning the platform and trying out strategies without any actual risk.

3. Selecting the Appropriate Indices

Use popular indices such as S&P 500, NASDAQ 100 or FTSE 100. They are highly liquid, have frequent price action, and are more convenient to track, particularly by new traders.

4. Watch the News

The world news, interest rate decisions, inflation figures, and company earnings influence index prices. Keeping yourself informed will assist you in making better decisions during trading.

5. Stop-Loss Risk Management

Never forget to put a stop loss order to save your capital. It automatically exits a trade when the market moves against you to a predetermined amount, which helps you to minimise losses.

6. Learn Costs and Leverage

Watch out for trading expenses such as spreads, overnight swap charges and leverage effects. Although leverage allows you to trade more with less capital, it can multiply profits and losses.

Risks Involved in Indices CFD Trading

Although there are numerous advantages of CFD indices trading, it is also necessary to know about the risks involved, particularly when you are new to it. Being aware of these risks can prevent you from losing large sums of money and trade more intelligently.

Leverage amplifies losses

Market volatility impacts index CFD prices

Overnight gaps affect CFD handel

No dividends in stock CFD

Emotional trading risks

Conclusion

Indices CFD trading is an easy and versatile method of trading in the global markets. It enables you to speculate on price fluctuations using CFD indices without owning the underlying assets. While there are strong CFD benefits, understanding the risks is essential. Platforms such as Market Investopedia help beginners learn trading CFD for beginners in a structured way. For further guidance or support, you can reach out via the contact page.