XAUUSD Signal

Do you also get trouble in selecting the right XAUUSD signals for placing trade? Worry not. Discover amazing ways to check the strength of gold signals.

Trading in XAUUSD is like walking on fire with too much volatility, uncertainty and unpredictability. The pair is quite sensitive to economic events and reacts quickly in different market conditions.

However, with all the above factors, the pair gives traders a huge amount of profit, which is why it attracts a large number of traders. But not every trader can trade this difficult forex pair. And therefore they go for XAUUSD signals.

If you also want to start trading using these signals then wait and read our article. Here we will discuss all the important aspects of XAUUSD trading signals. It will help you to use these trade alerts effectively.

What are XAUUSD trading signals?

XAUUSD signals, popularly known as gold signals, can be defined as trade recommendations to buy or sell XAUUSD at a particular price at a specific time.

A gold trading signal includes the entry price, exit price, stop loss, take profit, support, and resistance levels. It also includes fundamental and technical analysis aspects that can impact the gold trade.

Gold is a highly sensitive asset that is affected by different global factors. Predicting the gold market and identifying potential opportunities is a complex task.

Especially for beginners, it became more complex to watch the gold market and place a trade. Thus, they can seek gold signals and place trade accordingly.

Example of an XAU/USD Signal

Suppose gold is trending at the level of 2325 USD. You have received a signal that gold prices are expected to rise due to weak US economic data and tensions in the Middle East. The criteria for Gold trading signal are:

Position: Long

Entry Price: 2330 USD

Take Profit: 2360 USD

Stop Loss: 2320 USD

Risk to Reward Ratio: 1:3

Now, suppose you are satisfied with the gold signal, and according to research, you also feel the same. So, in that case, you will enter the trade using the following guidelines. Here, if the trade hits take profit, you will make a profit of 30 USD, and if the trade hits a stop loss, you will suffer a loss of 10 USD.

Above, we have seen how to use gold trading signals with a simple example. However, not all signals are reliable for placing trades, so examining their credibility is a must before putting your hard-earned money in the market.

A quick glance

Bollinger Bands is a popular technical analysis indicator developed by John Bollinger in the 1980s. It is used to measure valuable market insight.

There are three bands in bollinger: Upper, lower, and middle. The middle band represents the simple moving average of a particular range while the upper and lower band represents the standard deviation of the data set.

Bollinger bands are used to determine volatility, breakouts, price reversals, entry, exit, support, resistance, overbought, and oversold conditions.

- Learning

- Multiple Confirmation

- Be aware of false signals

- Be Patient

How to identify the strength of XAUUSD signals

Gold trading is amongst the most popular ways to make money today; however, beginners find it difficult to identify the right opportunity at the right time. In such cases, seeking the help of XAUUSD signals is not a bad idea.

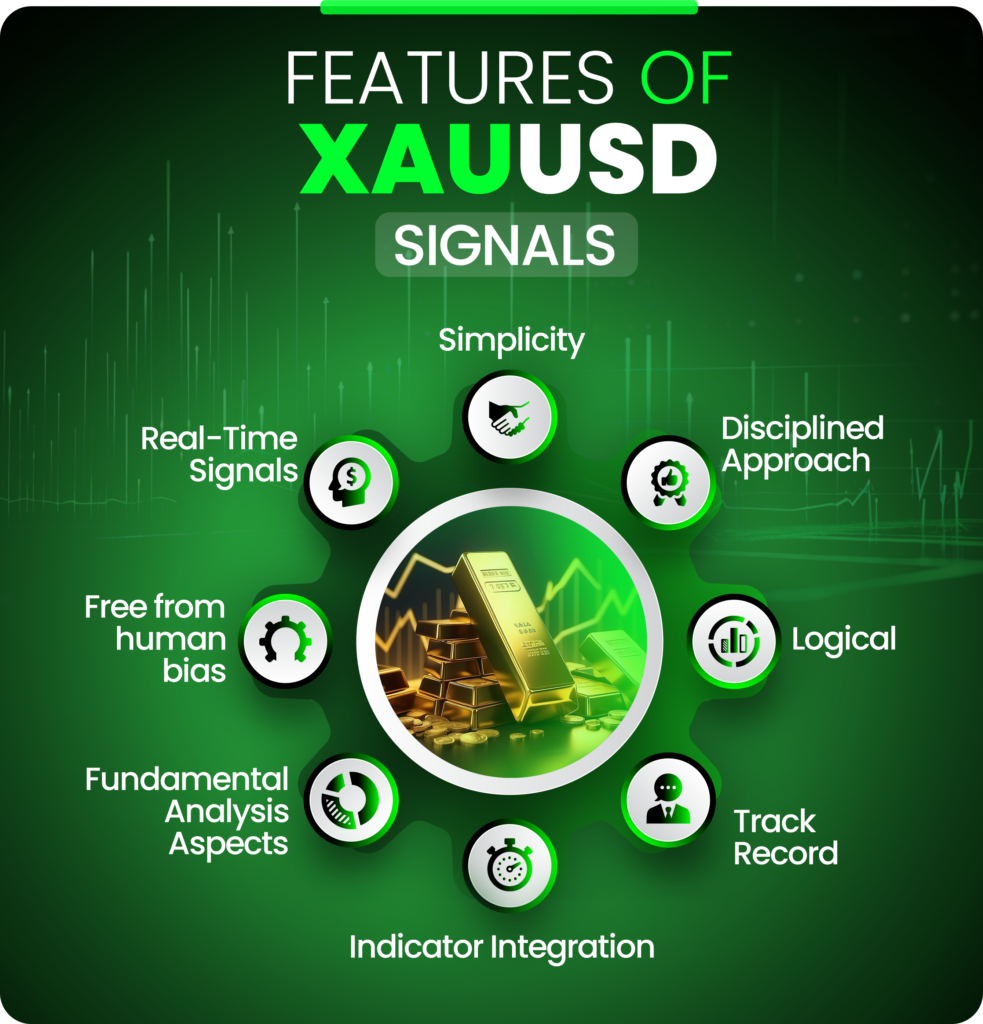

However, directly placing trade based on these signals without checking the reliability is no lesser than gambling. So here we will discuss the feature of a comprehensive gold signals that will help you to determine their strength:

Simplicity:

The first on the list is simplicity. One of the biggest mistakes gold traders make while selecting signals is looking for too much information. However, too much information means too much complexity.

It becomes difficult to execute the trade effectively. Go for a simple, specific, clear, and concise signal that provides all the vital information about the trade.

Disciplined Approach:

Another aspect you need to consider while selecting a good gold signal service is the disciplined approach. You may have come up with signals that do not follow proper risk management and leverage ratio rules.

Some of the signals do not even include the stop loss level. Such signals lure traders with a probability of high profit. However, with profit, the chances of loss are also high. So, give priority to rule-based trading, especially if you are a beginner.

Logical:

There is always a reason behind the rise and fall of the price of the financial asset. Especially when it comes to gold trading, precious metal moves due to different fundamental, sentimental, and technical analysis factors.

Therefore, go for a signal that provides you with the specific reason behind the interpretation. And place a trade only if you believe that the reason is logical. Remember, never place a trade based on the gold signal that lacks logical reason.

Track Record:

Nobody can predict the gold trading market with 100% accuracy. Even the best signals are not 100% foolproof. However, ensure that the overall accuracy of XAUUSD signals is good.

The best way to check the accuracy of a gold trading signal is the track sheet. Check the previous record of a gold signal provider and determine their success rate. If the success rate is somewhere around 70 to 85%, then you can go for such signals.

Indicator Integration:

Technical analysis is very important for trading gold. So ideal gold signal must include technical analysis indicators like moving averages, bollinger bands, relative strength, oscillators, fibonacci retracement, etc.

However, one thing to remember is that including too many indicators is also not good. So, a gold signal that provides price interpretation of two indicators combination.

Fundamental Analysis Aspects:

The safe-haven asset has maintained its price throughout history. There have been events when gold saw a rise or fall throughout history. For example, during inflation, gold rises, or when the USD falls, gold rises, or wars also positively impact gold prices.

This means fundamentals such as economic factors, financial news, geopolitical aspects, and supply and demand mechanisms impact gold trading. A gold signal should include fundamental analysis aspect and their impact for effective results.

Free from human bias:

It is human nature to make trade decisions based on instinct or gut feeling, but the trading world does not work like that. One wrong decision can change the entire trading outcome.

In the market, there are many self proclaimed signals providers who provides signals based on their instinct. However, one should go for signal services that are free from human bias and errors.

Real-Time Signals:

Time is the most critical factor while checking the strength of XAUUSD trading signals. Firstly, the time frame of the signals should be clearly stated. Secondly, delayed signals may result in missing opportunities or errors while trade execution. So go for real-time and live gold trading signals.

Conclusion

Gold is also known as a safe-haven asset due to its ability to produce profitable results during unfavorable events and inflation. However, trading XAUUSD is risky due to high volatility in the market.

Therefore, going for XAUUSD signals is a good option for a novice trader. However, solely placing a trade based on these signals is not good. Your own research and analysis of the market is important.

Also, checking the strength of gold signals before placing a trade is a must; otherwise, it may result in negative outcomes. So, use gold signals but with a right trading strategy and in the right manner.