Forex Market Hours: When to Trade Forex & Session Explained

You may have heard that the forex market is open 24 hours. However, that is limited information. And if you want to become a professional forex trader, then there is much more you need to know about the forex market hours and how the world market clock works to keep track of global sessions.

In this blog, we will conduct an in-depth study of the forex market timings, forex trading sessions in EST, sessions market, and the best time to trade. It will help you determine hidden market aspects and plan your trade accordingly.

What are the Forex Market Hours?

Forex market hours are the time between the opening and closing of the foreign exchange market. During this period, traders can buy or sell currencies and earn a profit.

You may have seen the stock market open and close for a few hours in a day. The market timings are generally based on geographical locations and exchanges.

However, forex is a global, decentralized market. One can trade in currency 24 hours and 5 days a week except on weekends. But one thing to note here is that not all sessions market are open for 24 hours.

The forex market has four sessions: Tokyo, Sydney, Europe, and London. Each session market has a different opening and closing time during the day, depending on the IDT time zone or other local time zones.

Forex is regarded as a 24-hour market, as at least one of these sessions remains open for trading throughout the day. Traders can trade in any of these sessions, irrespective of their geographical locations.

Forex Market Opening and Closing Times

A Forex market week starts from timezone Sydney locations at 10:00 pm GMT on Sunday and ends in New York, USA, session at 10:00 pm GMT on Friday.

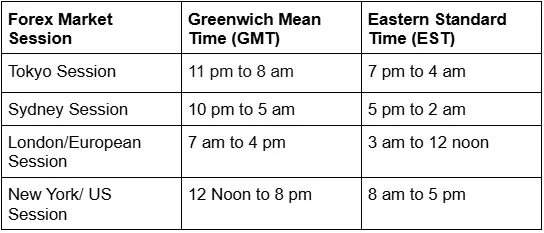

However, the forex market sessions’ daily opening and closing times are different. So here is a table with different forex sessions and their timings:

Sydney Session:

The forex market starts with the Sydney session. Sydney sessions have low liquidity and volatility, as well as low trading volume. However, it offers great market conditions for trading Australian and New Zealand dollar pairs.

Tokyo Session:

The Sydney and Tokyo sessions are called the Asian Session together. The Tokyo session observes data releases and economic calendar events from Japan, Russia, China, Australia, and New Zealand.

These activities cause significant price fluctuations in Asian Currencies. Therefore, the forex session is suitable for trading JPY, AUD, NZD, CNY, and RUB.

London Session:

London is the key center for financial activities, and the EURO is the second strongest currency. Also, the United Kingdom has a good influence on the entire world.

As a result, the European session offers great market conditions for forex trading. Major data from the United Kingdom and other big European nations result from these forex market hours.

According to data, 30% of forex transactions occur during the European session. So that forex traders can experience excellent liquidity, volatility, and volume during this session.

The European Session is suitable for trading numerous currencies. You can trade majors, minors, and even exotic pairs during this time. However, the session is the best for trading GBP/USD, EUR/USD, EUR/GBP, and EUR/JPY pairs.

New York/ US Session:

The US dominates the world, and USD dominates the global financial market. The US dollar is the strongest currency in the forex market. According to data, around 88% of traders trade in US Dollars.

So, naturally, forex market liquidity is at its peak during this session. Also, this session saw the release of US economic data, such as core CPI, PPI, employment, NFP, crude oil inventories, the Fed interest rate decision, the FOMC, and many others.

The big data releases provide key insights for currency trading, especially for major forex pairs. This session is also crucial for commodities such as gold, where XAUUSD trading hours closely align with the US market activity. Therefore, the session is the best for trading pairs like USD/JPY, USD/CAD, EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CHF, etc.

A quick glance

Asian Market opens from 11 pm to 8 am GMT.

No forex market is closed on weekends or major holidays.

The forex market opens for 24 hours a day and 5 days in a week.

The crypto market opens for 24 hours and 7 days. However, the liquidity is low during weekends and holidays.

Difference Between Asian Session, London Session, and New York Session

We have discussed all three sessions separately. However, for a better understanding, it will help you in framing the time trade strategy efficiently. Let us see a comparison chart:

Best Forex Market Hours to Trade

The Forex market is open for 24 hours to trade. However, that does not mean you should trade 24 hours. Forex market time can significantly impact your overall profit or loss.

Therefore, knowledge of the right time to trade is a must. Here are the market hours that are best to trade in:

Best Forex Sessions:

US sessions are the most favorable sessions to trade in for beginners, especially if you are trading in USD pairs. Even the European session offers overall great market conditions to the traders.

Overlapping Hours:

Forex overlapping occurs when two sessions remain open at the same time. Overlapping offers great market conditions as it combines traders from two sessions. As a result, liquidity and volume increase.

Forex overlaps take place three times a day. The timing of the US and European Session overlap is considered best, while Sydney and Tokyo overlap for trading Asian pairs.

Forex Market Session Overlaps Timing in UTC, GMT, and EST

Best Months and Days

Tuesday, Wednesday, and Thursday are the best days of the week to trade in the forex market. When it comes to the best month, the early months from January to June are good. Even October and November offer good trade conditions to traders. While August and December are the hardest.

Based on Currency Pairs

The best time to trade forex depends on the type of currency pair. The overlapping time of European and United States sessions offers great market conditions. However, for a person trading in AUD/JPY, it is not the right time to trade.

A trader should consider the currency pair to decide the right trade time. For Asian pairs, the overlapping time of Sydney and Tokyo is good; for USD pairs, one can trade in New York & London overlaps; for minor pairs, the European session is good.

High Liquidity Hours

The reason why London and European overlapping hours are considered best to trade is high liquidity. High liquidity means significant price movement, good trade volume, and many opportunities.

In the forex market, high liquidity indicates a large number of buyers and sellers. As a result, one can easily enter and exit a trade during such hours. However, liquidity hours differ from pair to pair. So, a thorough analysis is conducted to determine a particular pair’s liquidity hours.

How to Determine the Best Forex Trading Hours

Well, we have discussed the best trading hours. However, the time that suits the majority of traders may not suit you. An ideal time depends on different factors. So, for determining your ideal time for trading, you need to consider the following factors:

Currency Pair:

The currency pair you trade in can impact your forex trading timing choice. The ideal time for a trader trading in the EUR/JPY pair is the overlap hours of the Asian and European sessions. Similarly, the London and New York sessions are ideal for EUR/USD traders.

Trading Strategy:

Multiple currency trading strategies are present in the market. These include scalping, day trading, news trading, automated trading, copy trading, position trading, swing trading, and many others. For news trading, scalping, or day trading US and European sessions are good. While Position trading can be ideal to start in any session. Some traders follow ICT trading concepts to align their strategies with specific market times.

Risk and Reward:

The same pair can give you different profit and loss at different times. In the Asian session, both risk and reward are low. While in the European and American sessions, both are high. So, consider your profit expectations and loss-bearing capacity. Traders must also be aware of risk off meaning, as global sentiment can influence when and how you trade.

Knowledge and Experience:

The hours of top news releases may generate high profit, but they also lead to greater loss. Thus, traders with in-depth knowledge and good experience should trade during these hours. A novice with a lack of market understanding should trade during stable market conditions.

Liquidity and Volatility:

High volatility means more risk, uncertainty, and unpredictability. While High liquidity means significant trading volume and overall good market conditions. A Beginner should trade during liquid hours, while aggressive traders can go for highly volatile periods.

Gold Market Trading Hours and the Forex Market Clock

While the forex market is open 24 hours, the XAUUSD trading hours also follow specific patterns and can affect overall trade strategies. Keeping track of the world market clock helps traders monitor active sessions, whether they’re in IDT time zone or any other region, and adjust their trade times accordingly.

Wrapping Up

The Forex Market Hours have the power to change the entire trade outcome. Placing a trade without considering the world market frames is the biggest mistake one can make.

Changes in time frame result in changes in volume, liquidity, volatility, and market risk. Even the currency pair choice changes with a change in time.

So, intelligent traders always give importance to the forex market timings. Remember, forex trading is all about identifying the right opportunities at the right time. Therefore, give importance to time frames for a smooth trading journey.

Want to Learn More?

Forex market sessions are a complex yet useful topic when placing actual trades. Practical knowledge is important along with theoretical understanding.

Our exclusive webinar with forex market experts helps you gain in-depth knowledge on market hours. So that you can determine the best time to trade according to your strategy.

Join our Exclusive Webinars Today & Expand Your Market Knowledge.