Inverted head and shoulders

Charting patterns are of different kinds, shapes, and appearance. Each and every pattern is quite helpful and suggests key points for asset price movements.

In this Market Investopedia blog, we will discuss an important pattern, “Inverted head and shoulders.” Explore what this pattern looks like and ways to interpret it. This chart formation is also referred to as an inverse head and shoulders, reverse head and shoulders, or even head and shoulders inverted depending on trading communities and platforms.

What is an inverted head and shoulders pattern?

An inverted head and shoulder is a reverse formation of what a human body’s head and shoulder structure looks like.

It’s a bullish reversal pattern that forms during the end of a downtrend and suggests the start of the uptrend. Thus, when the patterns appear on the chart, traders tend to open a buy position in the asset. It is also commonly known as an inverse head and shoulder pattern or upside down head and shoulders pattern.

How to Identify Inverse Head and Shoulders

Trouble identifying inverted head and shoulder patterns? Well, spotting it is pretty easy. You just need to watch the below components to do so:

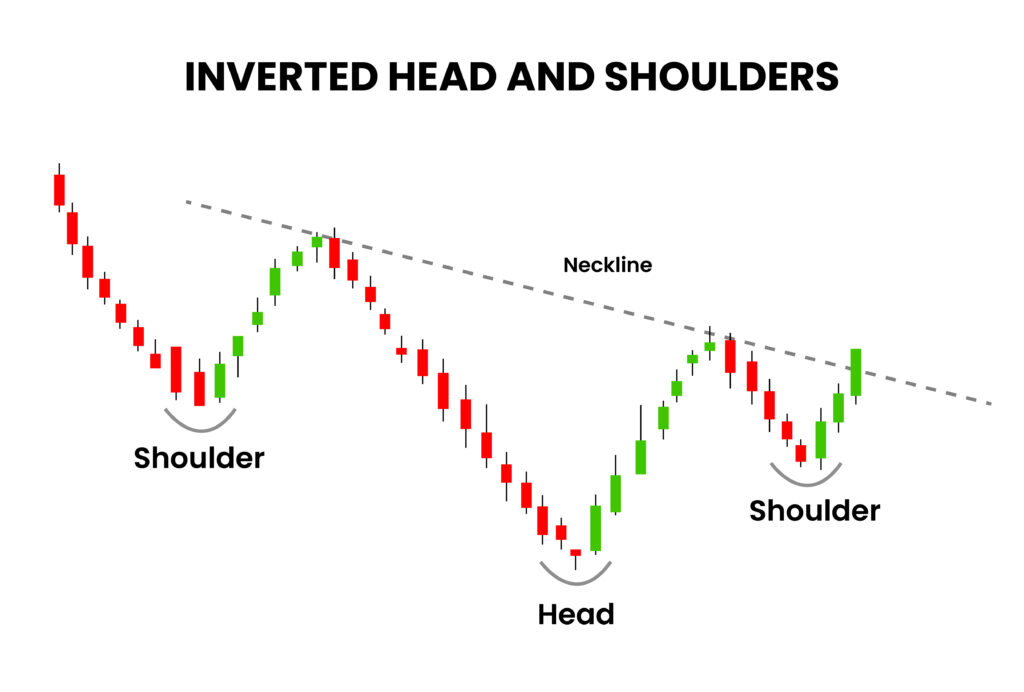

Shape: An inverse head and shoulders contains three troughs. It includes two shoulders and one lower head.

Trend: The pattern appears during the prolonged downtrend. It ends the downtrend and starts the uptrend.

Left Shoulder: The pattern starts with the formation of the left shoulder, which forms after the downtrend and represents the first lower high.

Head: After the shoulder formation, the bottom-most portion appears to be regarded as the head. It represents the lowest point and forms below the two shoulders.

Right Shoulder: The price, after a significant rise, again starts declining to reach the same level as the left shoulder.

Neck: A neck is a line that connects the two lows of the shoulder, and it even acts as a breakout level representing the second lower high.

Volume: Volume is the key component for the inverted head and shoulders pattern. High volumes are generally seen as an indication to confirm the effectiveness of the bullish reversal. It can confirm the appearance of the pattern.

Some traders also refer to this as a slanted head and shoulders pattern when the neckline isn’t perfectly horizontal.

A quick glance

An inverted head and shoulder is a reverse head and shoulder forms during a downtrend, suggesting a bullish trend reversal.

The inverted head shoulder has a bullish reversal pattern. It appears at the end of the downtrend, indicating the start of the uptrend.

Inverse head and shoulders are a popular charting pattern that helps you identify potential opportunities. However, the tool is not 100% reliable, and there is a chance of false signals.

High volume and Breakout of the Neckline are the key indicators of the pattern confirmation. Traders can even seek the help of other technical analysis tools for confirmation

How to use an Inverted head and shoulders Strategy

- First, look for a pattern that has two higher low levels on the side and one lower low in the middle.

- Once you have identified the pattern and are satisfied with its formation, wait for the breakout. Only a breakout above the neckline can confirm the pattern.

- When the price breaks above the neckline, it is seen as a confirmation. However, for a clear picture, traders can combine the pattern with technical analysis indicators such as Bollinger bands, moving averages, oscillators, RSI, or any other.

- The trader can consider opening a trade once the bullish reversal is confirmed with other indicators. As the pattern indicates the start of an uptrend, traders can consider opening a buy position.

- Place a buy order. Traders can keep the entry price just above the breakout, the target level equal to the pattern’s height, and the stop loss level just below the right shoulder.

Advantages of Inverted Head and Shoulder

Easy to identify and interpret:

The pattern forms a structure similar to the human body structure. So, a trader doesn’t need to remember the shape, and identifying it is quite easy.

Also, once you have identified the pattern, interpreting it is quite easy. Especially if you are an experienced trader, then trading based on an inverse head and shoulders is not a big deal.

Gives Exact Trade Point

Numerous technical analysis patterns can suggest trading moves. However, when it comes to giving the exact trade levels for placing trades, only a few are sufficient. And the inverse head and shoulder is one of them. Traders can identify the trade entry, exit, stop loss, and take point level by using it.

Helpful in confirmation

Under technical analysis, irrespective of the indicator and charting pattern a trader is using, confirmation is a must. An inverted head and shoulder can be used to confirm the findings of many other indicators.

Traders can combine the charting pattern with their favorite indicator. It is suitable to pair with moving averages, RSI, oscillators, Fibonacci retracement, Bollinger Bands, and volume indicators.

Diverse Market applicability

The best part is that a trader can use the pattern to trade a diverse range of assets. With the right knowledge, traders can identify opportunities in commodity, forex, stock, indices, ETFs, CFDs, and other markets. Whether it is a reverse head and shoulders or head and shoulders inverted, the strategy remains consistent.

Disadvantages of Inverted Head and Shoulder

Use of Multiple Confirmation Indicators:

The pattern is specific and has clear criteria for formation. So, at the appearance stage, the trader needs to check whether the head, shoulder, and neck are in proper sequence and level.

Also, once the patterns appear properly, a trader needs to wait for a breakout. Even after the breakout, confirming it with other indicators is a must for effective results.

Lack of Reliability

Even after identifying the pattern correctly and conducting proper confirmation, there is no guarantee of a bullish reversal. Most of the time, the pattern appears; the price tends to move in a particular way. However, it is not 100% reliable and can even give false signals to traders.

False Breakouts

Unexpected changes in market volatility and sudden swiftness in trading conditions may lead to false breakouts. In such cases, the prices may move in the opposite direction, which ultimately leads to traders’ loss.

Limited Opportunities

As we have studied above, the formation criteria of the pattern are quite specific. Thus, as compared to other charting patterns, it appears less frequently. And a trader cannot wait for its occurrence every time for placing trades.

Conclusion

Inverted head and shoulders, whether you call it upside down head and shoulders, inverse head and shoulders, or head and shoulders inverted, can be an ideal tool to identify bullish opportunities in an asset. It may have some limitations, but that is common with every strategy.

No strategy, tool, or pattern is perfect. But remember how a trader uses it matters a lot. It can give highly profitable results if used properly. And you can do so with the right knowledge.

If you are struggling to learn technical analysis, join Market Investopedia. Our research team will assist you in understanding, spotting, and interpreting different patterns like the inverted head and shoulders pattern and many others. Reach out to get started.