You may have heard or used the word ‘Gap,’ but do you know this term plays a crucial role in the trading market? A gap is amongst the most useful technical analysis terms that helps to identify potential opportunities. In this article, we will have a detailed study of the concept of trading gaps with its types and some effective tips.

What is a Gap?

The gap is a term used to define a break or pause in continuity. We use the word gap in our daily lives to define the pause in education, learning, or any other activity.

In trading also Gap is used to define a pause or break in the continuity of the asset’s price.

Simply, a gap refers to the difference between the previous day’s closing price and the opening price of the next day of a financial asset.

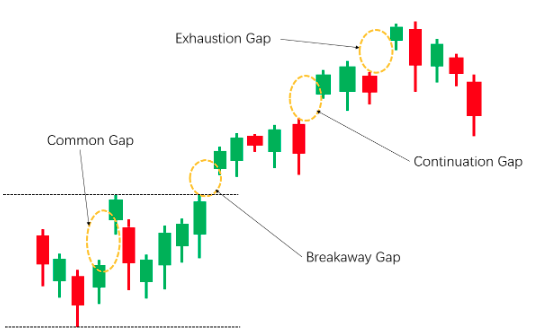

A gap can also be termed as an empty space between the candlesticks in a chart pattern; it reflects little or no trading between the periods. You can easily spot gaps in the above example.

What is Gap trading?

Gap trading is the buying and selling of assets based on price gaps. A gap defines the imbalance between the market orders.

Gaps enable traders to identify the pivot points of trade, including entry, exit, support, and resistance, and place trade accordingly.

Simply put, gap trading is the process of making trade decisions and speculating whether a gap will be filled or if the price will continue to move in direction.

Let us have a look at an example for a better understanding of trading gaps. Suppose the closing price of the EURO/USD pair on Monday is 1.1550, and the opening price on Tuesday is 1.1600.

In this case, the price of the pair rises, suggesting bullish sentiment in the market. So the trader decided to go long. If his prediction goes right, he can make a profit and suffer a loss in the opposite scenario.

That’s how one can place a trade using a gap trading strategy. Also, like forex, you can trade in stocks, comex, indices, and other financial instruments using this strategy.

A quick glance

A gap refers to the difference between the previous day’s closing price and the opening price of the next day of a financial asset.

Gap trading is the buying and selling of assets based on price gaps by identifying the pivot points of trade, including entry, exit, support, and resistance.

- Common gaps

- Breakaway Gaps

- Continuation gaps

- Exhaustion gaps

- Combine with other indicators

- Monitor news and economic events

- Be Aware of Gap Filling

- Consider market hours

- Volume Analysis

Gap Trading Strategies

Gap trading is among the popular ways to take your trading expedition to the next level. However, before that, you need to get well-versed with different types of gaps in trading and how to trade them.

Common gaps

The first in the list is a common gap, these are also known as area gaps. As the name suggests, these are common, and you can easily spot these gaps in chart patterns.

Common gaps may occur due to little change in market conditions. These are small and less indicative, so they cannot give any such useful market signals or insights. As a result, you cannot make place trade decisions based on these gaps.

Variance:

It is the dispersion or spread of the data set. Variance is calculated by subtracting each data set from the mean.

Breakaway Gaps

Breakaway is a popular gap trading strategy to get crucial market insight and place trade accordingly. This gap occurs above pivot points line support and resistance or trend lines.

Breakaway is when the price breaks a well-established range at the end of a pattern. These gaps indicate the beginning of a new trend in the direction of the breakout. So, you can open a position expecting that the price of the asset will move in the direction of a breakout.

Suppose the breakaway is a downside; then the price of an asset is expected to move in a downward direction so a trader can open a short. Meanwhile, if the breakaway is the upside, then the price is expected to move in an upward direction so a trader can open a long position.

Continuation gaps

As the name suggests, a continuation or runaway gap is the continuation of the existing trend after a gap. These gaps generally occur in the middle of a trend or pattern.

These are usually the large gaps indicating to a trader that the price will move in the same direction, so trade accordingly. Suppose the price of a EUR/USD trend moves in the downward direction, and a bearish continuation gap occurs. In this case, a trade will open a short position, expecting that the price will continue the trend.

Exhaustion gaps

An exhaustion gap is the opposite of the continuation gap; under a gap, the direction of the trend occurs; however price then moves in the reversed direction.

Generally, when a trader spots a gap during an ongoing trend, expecting that trend trader will rush place trade. However, during such overbought or oversold conditions exhaustion gap occurs, and the price starts moving in the reverse direction.

Tips for trading Gaps

Gap trading is surely a popular way to place a trade. However, while trading gaps, it is important to follow some rules to avoid any unfavorable results.

Combined with other indicators

Gap trading is a technical analysis method based on the concept of historical price patterns. However, a trader should not place a trade at every gap as it may generate false signals.

The best way to trade in gaps is to combine them with other technical analysis components and indicators, including support and resistance, trend lines, Bollinger bands, moving averages, etc. These will help you to make effective decisions eliminating the chances of huge losses.

Monitor news and economic events: Gaps in trading are often caused by events like major financial news, speeches, geopolitical factors, economic reports, etc.

These fundamental analysis events play a crucial role in trading and make a significant difference between the closing price of a day and the opening price of the next day. Therefore, to trade gaps, it is a must to keep an eye on these events.

Be Aware of Gap Filling

When the break or pause in the price movement is filled due to a change in the market condition, it is known as gap filling.

Trading gap is the game of speculating whether the gap will continue or if it will fill which helps traders in making the trade decision accordingly. Therefore, the knowledge of the concept of filling is a must to start trading in gaps.

Consider market hours

As we have studied above, the gap is the difference between the closing price of a day to the opening price of the next day. So, the time frame plays a crucial role in the trading gap.

Therefore, a trader should consider the hours before and after the opening and closing of the market. It helps you identify potential opportunities for dealing with gaps.

Volume Analysis

Volume refers to the number of buyers and sellers in the market over a period. Volume analysis provides significant market insight. It also helps traders in providing gaps confirmation and measuring their strengths.

So, a trade should consider volume analysis for trading gaps. Generally, high volume during gaps is more significant than low volume gaps.

Wrapping Up

Trading gaps can surely generate potential returns. Many experienced traders use these technical analysis patterns to make profitable returns. However, one can not rely solely on these gaps.

Also, gap trading requires technical knowledge and an in-depth understanding of price trends. In addition, technical and fundamental analysis factors may result in the filling of gaps.

So, a trader should embrace analytical and risk management skills to use gap trading strategies properly. Also, a trader should practice gap trading in demo trading before placing real trades.