Understanding Forex Dynamics For Better Trade Prediction

The Foreign exchange market is the most dynamic, with changing market conditions. A single event or news has the power to change the entire trade conditions.

Thus, if you want to make money in the changing market, then understanding forex dynamics is a must. This Market Investopedia’s blog will teach you about currency trading dynamics with key elements and tips to trade it. But first, let’s have a basic overview of Forex trading.

An Introduction to Forex Trading

Forex trading is the buying and selling of currencies to take advantage of price fluctuations over time.

Currency value does not remain fixed but keeps changing as per the market conditions. Retail traders and institutional traders take advantage of these value fluctuations and make money in trading.

Confused?

Here is an example of how the global marketplace operates.

A forex trader sees a good growth potential for the USD, especially against the EURO. At that time, the exchange rate of the EUR/USD pair consisting of two currencies was 1.14.

Now, if you think the first currency in the pair will rise against the second, you buy the pair and sell it in the opposite case.

In this case, as the trader believes that the USD will rise against the USD, the trader will open a sell position.

And if the prediction becomes true and the market dynamics turn in the trader’s favor, the exchange rate decreases, and the trader will make a profit.

A quick glance

No forex trading is not halalf if it done following proper shariah rules and with Islamic account.

You can get basic understanding of forex in three to fourth month. However the process never ends, continous learning and updation is important.

Price action is the most powerful trading strategy in forex trading.

International trade involves buying and selling goods between countries that use different currencies. A currency exchange system ensures smooth transactions by converting one currency into another at fair market rates. This helps businesses trade easily, supports fx for business, and keeps the global marketplace stable for both retail and institutional traders.

What is Forex Dynamics?

Forex dynamics simply refers to the change in the currency trading conditions that moves the currency price.

Suppose the market for USD is all positive in favorable economic data, sentiments, and technical indicators.

Now, suppose a News report from the United States surfaced that the country is observing a huge labor strike that turns the market sentiment negative.

The change from positive to negative market conditions for the USD happens because of the forex market dynamics.

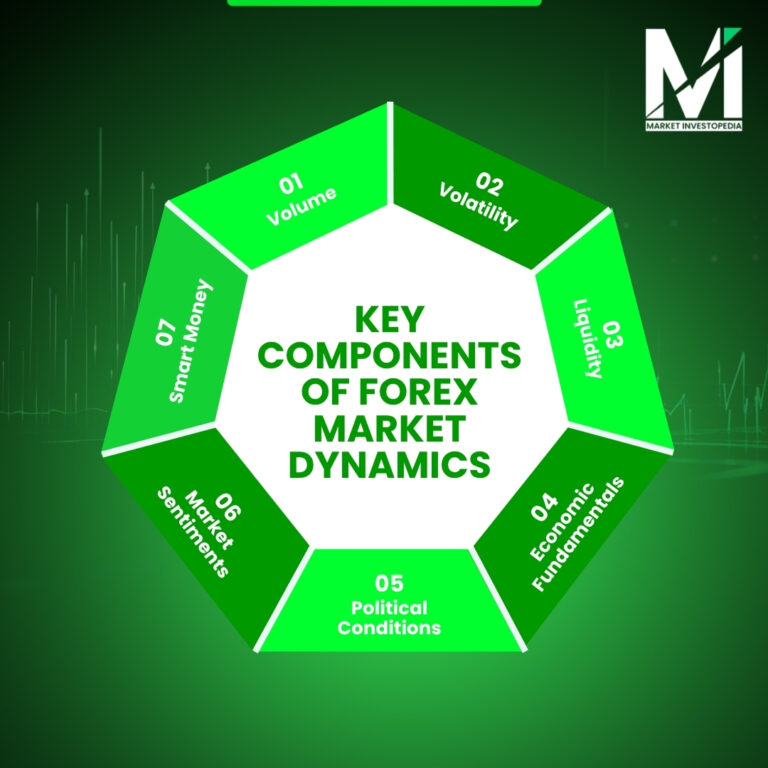

Key Components of Forex Market Dynamics

Forex Dynamics is what gives birth to buying and selling opportunities. The dynamic nature of forex causes a rise and fall in currency values.

Learning what factors contribute to changes in forex dynamics helps you in making the right decisions. So let us have a look at the key drivers of the forex market:

Volume:

Volume deals with participation or the number of buyers and sellers in the forex market. The more the participation in the market, the better the conditions and positive the dynamics, and vice versa. How many buying and selling activities over a period directly affect the market dynamics.

Volatility:

Volatility is the rate of increase and decrease in the currency pair price over the period. The price swings can be big or small, depending on the market conditions. The higher the volatility, the dangerous the market dynamics, while the lower the volatility, the stable the market conditions.

Liquidity:

Liquidity in the forex deals with the ease of entering and exiting a position at a favorable price. Liquidity directly impacts the forex market dynamics. Better liquidity means favorable market dynamics and vice versa.

Economic fundamentals:

Economic fundamentals mean any change in economic factors. It includes employment reports, inflation, central bank announcements, economic calendar events, etc. Whenever important economic data is released, the foreign exchanges and fx derivatives markets shake.

Political Conditions:

The geopolitical conditions of the countries whose currencies you are trading can change the entire market dynamics. It includes elections, government change, conflicts, diplomatic ties, export and import rules, and many other factors.

Market Sentiments:

In the forex world, market behaviour plays a crucial role in impacting the overall dynamics. Bullish sentiments lead to positive market dynamics, while bearish sentiments lead to negative market dynamics. So, overall sentiments can guide you to changing market conditions.

Smart Money Activities:

Smart money means institutional traders who make big trades. They are also called market makers, as their trading activities can cause significant changes in the prices. So watching their activities helps you in tracking the market.

How to Trade Forex Market Dynamics

Now you know what causes a shift in the forex market dynamics. However, for making the right decisions, predicting these changes is a must. Here are some exclusive tips for you to do so:

Watch the Market Conditions:

Keep an eye on overall market conditions. It includes supply and demand dynamics, economic calendar events, reports, central bank announcements, financial news, authorities’ speeches, etc. These will give you better forex market insights.

Organize Technical Analysis:

Technical analysis can guide you to market dynamics by examining historical data. Traders can use technical analysis concepts, candlestick patterns, tools, and indicators. Trendlines, support and resistance levels, repetitive patterns, and price statistics can help you in doing so.

Risk Management:

Tracking dynamics is not as easy as it looks. Sometimes, even with proper analysis, predicting the market conditions becomes difficult. Trading following proper risk management criteria helps in minimizing losses in case of a wrong prediction.

Manage Glitches:

You need to understand that even algorithm trading is not error-free. Technological risks, network issues, and software bugs have the power to disrupt your trade.

In addition, algorithmic trading works based on historical data and statistics. Unpredictable market conditions and highly volatile events will have a significant impact, and automated bots may not adapt to these conditions. So here, human intelligence and your knowledge will help you manage these glitches effectively.

Diversification:

The dynamic can change frequently. It can even turn to your favor or against you. That’s where diversification can help you. With dynamics, even if dynamics turn against you, managing losses becomes easy.

Wrapping Up

Forex Dynamics is amongst the most important trading concepts that pave your way to profitability. Whether you are beginner, intermediate or an advanced trader, how accurately you predict the market dynamics defines your trading journey.

Retail traders and institutional traders both rely on understanding fx derivatives, foreign exchanges, and economic fundamentals to make informed trading decisions. Traders can manage risk, frame strategy, and set profit expectations watching dynamics. Predicting the market condition changes can be difficult.

We can help you in that. Join our exclusive webinars to track the FX dynamics and learn fx for business with ease.