5 Brokers That Don’t Penalize You for Winning

Earning a large amount of profit is a situation that every trader dreams of. Now, suppose you have made your first big profit, and the broker penalizes you or closes your account. How does it feel?

Frustated? Well, the anger is genuine. How can a platform penalize you for winning? But there are instances where such incidents have happened with our clients.

In this Market Investopedia, we will have a detailed discussion on this situation and find out how to deal with it. Also, we will learn about the top 5 brokers that don’t penalize you for winning. Stay tuned.

Why Brokers Penalize For Winning?

The term broker penalizes for winning determines the scenario when your broker either closes your account or penalizes you after earning a big profit.

A broker is generally an online trading platform that provides you with an interface to buy or sell financial assets. They don’t have any relation to your wins or failures.

Penalizing your account may occur due to a breach of any rule, identification of manipulated or unethical trading activities. If these are the reasons, your broker needs to take necessary actions. You can seek assistance to resolve it.

However, if you have not been involved in any of these activities but your broker has penalized you, then it’s a serious issue. There are different types of trading brokers in the market.

Some brokers earn in the form of commission or spreads and provide access to the market. And then comes the B Broker, who takes the opposite position of a trader.

In the case of B Broker, the broker is making money from your loss. So the platform may manipulate or penalize your winnings.

A quick glance

No, generally, brokers don’t penalize winning. But unregulated platforms can engage in such manipulated practices.

No reputable brokers limit or ban profitable traders.

Not all brokers, but B Book brokers take the counter position of traders.

No, brokers generally don’t restrict your withdrawals. However, some platforms’ withdrawal process takes significant time and effort.

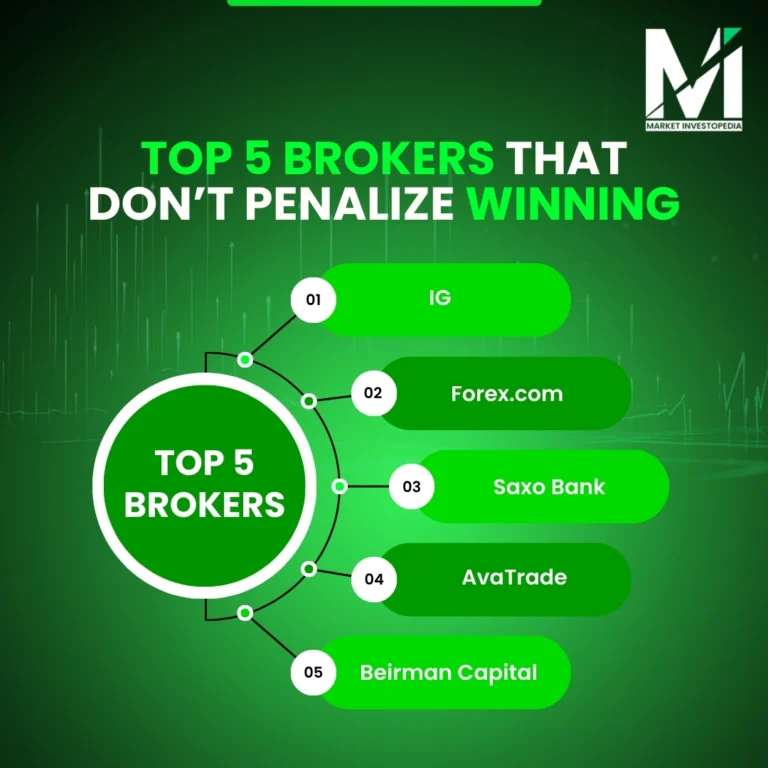

5 Brokers That Don't Penalize You for Winning

Penalizing for winning is quite rare in the market. It generally happens when you are with the wrong broker. With a reputable and safe broker, such things will not happen. Here are the platforms you can consider:

IG:

IG is one of the safest brokers globally for starting to trade in any financial asset. With multiple licenses from top financial institutions, the broker is suitable for diverse traders.

It even offers premium features such as negative balance and segregated accounts. You can trade in over 17000 trading instruments on the platform. The spreads, overnight charges, and commission are all available on site. The broker has good feedback and negligible cases of penalizing for winning.

Forex.com:

Forex.com is another leading, regulated, and transparent platform. You can get a diverse range of educational resources and materials. It includes news, calendars, courses, blogs, articles, etc.

You can trade in forex, energy, crypto, and other CFD products. The fees are competitive; however, the broker charges inactivity fees. The platform is suitable for global traders, but the US clients get limited services.

Saxo Bank:

Saxo Bank is a professional platform with a global client base. It offers over 70,000 trading instruments with prop trading services. When it comes to security, the platform is the best.

The clients enjoy bank-level regulations, top-notch security, and deposit protections. So closing of accounts or penalty incidence and negligible. The broker’s fees and commissions are quite expensive. It doesn’t even have integration with MT4 and MT5, but its own app, Saxo+1.

AvaTrader:

Automated traders and copy traders who make good profits and are afraid of penalties can go for AvaTrade. It’s not only secure, but the platform offers exceptional tools. You can get access to the algorithm-based tools, copy trading software, and user-friendly apps.

With client protection features like negative balance protection and segregated funded accounts, you can experience a transparent trading environment. From tools to services, all are available at AvaTrader.

Beirman Capital:

Beirman Capital is a growing broker for trading CFD products such as Forex, stock, indices, crypto and others. Recently, at the Forex Expo Summit in Dubai, the platform even got the best emerging broker award.

The brokers offer timely payouts, hassle-free withdrawals and deposits, and top-notch security to clients. The customer reviews are also good, and no complains regarding the broker penalizing winning found. Traders looking for a low-cost trading platform can go for this one.

Precautions to Stop Brokers Penalizing Winning

- Before opening an account, go through the broker’s terms and conditions. Make sure to follow the rule while planning your trades to avoid the broker penalizing your trading accounts.

- Avoid the B Book Brokers platform that makes a profit from your loss. As the chances of manipulation are higher with such platforms.

- Read the customer reviews before going for a broker. You can find out broker penalizing stories in the client reviews and feedback section.

- Go for a regulated broker with a license from top financial authorities. The penalizing or account closing is less with a reputable broker.

Technical Knowledge:

Algo training is all about automated software, robots, and tools, so technical knowledge is a must-have skill for starting Algo trading. In algorithmic trading course, you will learn complex programming like C, C++, R, Python, and many more.

Even in the financial trading world, if you are thinking of starting algo trading, basic knowledge of these complex languages is essential. A little bit of coding knowledge will help you to use this trading strategy and plan your trade effectively.

Complexity:

To start algo trading, you need a combination of hardware and software. Installing and maintaining these resources can be quite complex for a beginner.

In addition, there is a range of automated trading strategies and indicators, including Arrival price algorithms, Time-weighted average price, Volume-weighted average price, Risk-aversion parameters, Basket algorithms, Implementation shortfall algorithms, and many more. Automated trading courses enable you to learn about all these and turn the complexities into simplicities.

Proper Execution & Customization:

Many people feel that algo trading is a way to place a trade automatically through robot and computer programs.

That’s true, however, automated software works on predefined rules set by the trader or derived from historical data. Thus, properly setting trade execution rules and customizing them according to the current market conditions is important. A trader will be able to do so when he is well aware with the algo trading concept.

Manage Glitches:

You need to understand that even algorithm trading is not error-free. Technological risks, network issues, and software bugs have the power to disrupt your trade.

In addition, algorithmic trading works based on historical data and statistics. Unpredictable market conditions and highly volatile events will have a significant impact, and automated bots may not adapt to these conditions. So here, human intelligence and your knowledge will help you manage these glitches effectively.

Effective Backtesting:

Backtesting is a way to test the strategy before implementing it in the real market. Algo Trading is highly useful for backtesting. Algo courses will help you develop the ability to backtest the software and eliminate all the errors that may affect your trade.

Wrapping Up

Brokers penalizing winning is a serious issue. An ideal trading platform should provide you with an interface and facilities to buy or sell financial assets. When brokers start controlling your profit or losses, you lose control of their capital.

Ensure you do proper research before selecting a broker platform to avoid such a scenario. Market Investopedia is a leading platform that assists traders in choosing the right broker. Reach out to trade with a well-regulated platform.