What is a scalp trading strategy?

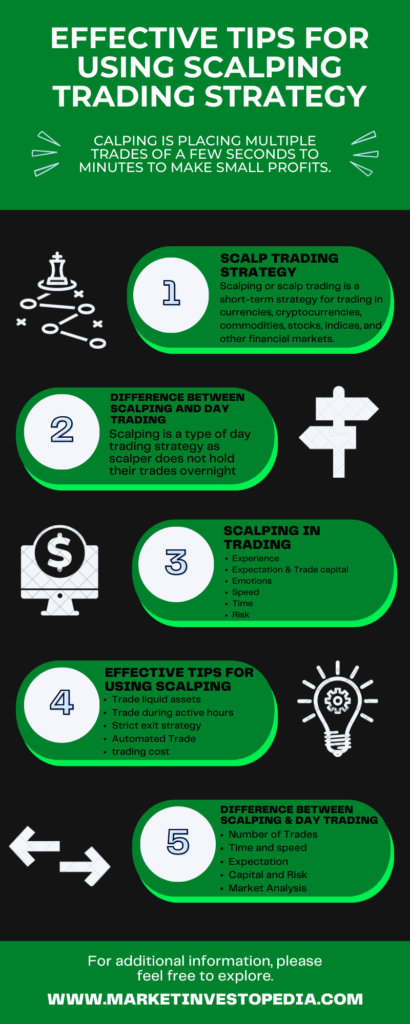

Scalping or scalp trading is a short-term strategy for trading in currencies, cryptocurrencies, commodities, stocks, indices, and other financial markets.

Scalping trading is placing multiple trades of a few seconds to minutes to make small profits from short-term price fluctuation.

A scalping trading strategy is used by experienced or advanced traders. Scalpers generally place trades between 10 to 100 daily to make small and quick profits.

Scalp trading examples

Let us look at Scalp Trading Forex’s example for a better understanding. Suppose a scalper trades in EUR/USD using the combination of Bollinger Bands and Relative Strength Index technical analysis chart. The trader set the target profit of six pips and stop loss two pips.

Based on the indicators, he has placed around 25 trades on a particular day, of which 16 trades hit TP and nine trades hit SL. In this case, he has made an overall profit of 78 pips (96-18).

It may be possible that the SL of a trader is more than the TP. In this opposite scenario, suppose nine trades hit TP and 16 trades hit SL. Even in this case, a trader will profit 36 pip (54-18).

Like any other method, one can make or lose money in scalping. However, in the above case, the trader used the risk-to-reward ratio of 1:3. That’s why strategy and effective implementation play an important role in trading.

A quick glance

Scalping is a short-term trading strategy of placing multiple trades of a few seconds to minutes to make small profits from short-term price fluctuation.

Scalpers generally place trades within 10 to 100 daily to make small and quick profits in a day.

Day traders generally place trade within the range of one to four. Meanwhile, scalpers generally place trade multiple trades within a day.

- Experience

- Expectation and trade capital

- Emotions

- Speed

- Time

- Risk

Difference Between scalping and day trading

Many people confuse scalp trading with day trading. However, these are different. Scalping is a type of day trading strategy as scalper does not hold their trades overnight; they open and close trade on the same day. So, let us understand how scalping is different from day trading.

Meaning

Scalping is the placing of multiple trades to take advantage of short-term price fluctuations. |

Day trading is the opening and closing of a position within a single day. |

Number of Trades

Scalpers generally place trade within the range of 10 to 100 trades. |

Day traders generally place trade within the range of one to four.

Time and speed

Scalpers place the trade for a few seconds or minutes. Therefore, they need to make decisions quickly. |

Day traders place trades of hours. Therefore, they get proper time for making the trade decision. |

Expectation

Scalper aims for a small profit per trade, but the overall outcome from all the trades is huge. |

Day trades usually place only one or two trades. So they aim for big returns.

Capital and Risk |

Scalpers place multiple trades in a day, so the capital requirement is high. However, the risk is comparatively low as it is diversified within trades. |

Day traders require comparatively less capital. However, the risk is comparatively higher as they rely on one or two trades. |

Market Analysis

The time frame for scalpers is less. That’s why they mainly focus on technical analysis.

| Day traders usually combine technical, fundamental, and sentiment analysis for making trade decisions. |

Is scalping in trading a good strategy?

Scalp trading is a widely used strategy that results in huge gains. However, it may only be suitable for some kinds of traders. Each trader in the market is different based on expectations, goals, and requirements. So here are the factors that you should analyze to find out whether the method suits your needs

Experience

Trading experience plays a crucial role in selecting the strategy. Scalping Trading strategy requires quick decision-making, analytical skills, impeccable knowledge, market order management, and many other skills that come with experience. So, scalping trading for beginners is not that good, but for advanced trader it is best.

Expectation & Trade capital

Every trader enters the market expecting to make a particular amount according to the capital over a period. The profit or loss per trade is small in scalping but quick.

Also, the overall return from all trades makes a potential amount. So basically, if you have significant capital and expect a good return in a day, you can go for this strategy.

Emotions

One of the most crucial things that even experienced traders find difficult to master is emotional control. In scalping, you cannot afford to let your emotions like greed, fear, stress, instinct, overconfidence, and excitement affect your trade. So, this strategy is not for traders who cannot control their emotions.

Speed

Scalping is the game of making quick decisions, which means traders enter and exit a trade within minutes. Meanwhile, some traders take hours in financial markets to identify a single trade opportunity. So, scalping requires superfast trading execution; it is a good strategy if you can do it.

Time

Scalping trading strategy requires all of your time. Scalper places many trades daily, so you need to monitor the market and watch chart patterns continuously.

It requires full concentration, focus, alertness, and responsiveness. So, if you are a side hustle trader with a job or business, this strategy may not be right for you; however, it is the best for a full-time professional trader.

Risk

The capital requirement in scalping is higher; however, the risk associated is comparatively less. Due to placing multiple trades, the risk of scalpers is diversified.

]For example, if a day trader places one trade in a week, he may suffer a loss, while a scalper places ten trades in a day, and there are very few chances that he will suffer a loss from all his trades. So, the losses from a few trades will be managed from the profit from others.

Effective Tips for Using Scalping Trading Strategy

Well, trading is a fun game when you have some hacks or tips. Scalping is an adventurous strategy, and it becomes more interesting when you know how to do it effectively. Here are some tips to take your scalping journey to the next level.

Trade liquid assets

You can trade in gold, currency pairs, commodities, indices, and others using scalping. However, while selecting the trading instrument, you should always look for highly liquidity assets.

Market liquidity is the ability to buy or sell assets quickly. High liquid assets mean large numbers of buyers and sellers and tight spreads or commissions, which benefits scalpers.

Major currency pairs like EUR/USD and USD/JPY, stock indices like S&P 500 and Dow Jones Industrial Average, and commodity products like gold, silver, or oil are highly liquid assets to trade in.

Trade during active hours

Another hack for scalping is trade during the most active market hours. During these hours, the spreads are tight, and the opportunities are more. Active hours depend on the market; the best time for scalpers in the forex market is during trading session overlaps

Go for a strict exit strategy

The key to success in scalping is to adopt a strict and rule-based exit strategy. Scalpers generally aim to make a small profit; however, one late exit may result in a huge loss that overweighs all small gains. That’s why discipline is the must-have quality for scalping.

Use automated Trade

Handling multiple trades manually for traders is not a good idea. One delay or distraction may result in a big loss. Therefore, scalpers should use automated software for order management and execution. So, even when the traders are occupied, the software can enter or exit a trade on their behalf.

Consider the trading cost

Scalpers place many trades daily, and each trade broker charges them to spread or trading commission. This trading cost can affect the overall profit and change your profit into a loss. So, you must consider the trading costs or fees in high-frequency trading, such as scalping.

Get an impeccable knowledge of technical analysis

Scalpers usually identify trading opportunities using technical analysis indicators. They monitor the charts of seconds to minutes to place a trade accordingly. Therefore, knowledge of technical analysis, charts, patterns, tools, and theories is necessary to start a scalping career.

Conclusion

In the trading world, every trader is different; some traders are afraid to take risks, go for less complicated strategies, and rarely place a trade. Meanwhile, some traders are exotic; they love to take risks, place multiple trades, and go for complicated yet powerful strategies.

Scalp trading is for those who understand the market well, and for those, it is not like a side hustle trading but an only option and passion. In addition, scalping demands extraordinary trading skills like quick and effective decision-making, killer analytical skills, hunger for trading opportunities, etc.

Scalping can be profitable or painful, depending on your approach. So, one should understand the concept of this strategy well and then decide whether it is suitable for you based on the factors we have studied above.

0 Comments