Subscribe to Market Updates

Enter your email below to receive weekly market insights.

Weekly Forex News & Market Pulse

This week may bring strong movement in the forex market as traders react to rising geopolitical tension following the United States’ large-scale strike on Venezuela. Market focus will remain on key US economic data, including PMI reports and major labour market releases. During the New York session, the ISM Manufacturing PMI could drive short-term USD volatility. Eurozone inflation data, oil price movement, and changing risk sentiment may also impact gold, crypto, and major currency pairs throughout the week.

Key Economic Events & Market Impact

ISM Manufacturing PMI & Prices – Monday, Jan 5

Measures US manufacturing strength and inflation pressure. Strong data supports the USD, while weak numbers may weaken the dollar and increase volatility.

German CPI MoM – Tuesday, Jan 6

A key inflation gauge for the Eurozone’s largest economy. Higher inflation supports the euro, while weaker data may pressure EUR pairs.

Eurozone CPI YoY – Wednesday, Jan 7

Influences ECB policy expectations. Strong inflation supports EUR; weak data increases dovish expectations.

ADP Nonfarm Employment – Wednesday, Jan 7

Provides an early signal for US labour market strength ahead of NFP.

Nonfarm Payrolls & Unemployment Rate – Friday, Jan 9

The most important US data release of the week. Strong jobs data supports USD, while weak numbers may trigger sharp volatility.

Geopolitics & Central Banks

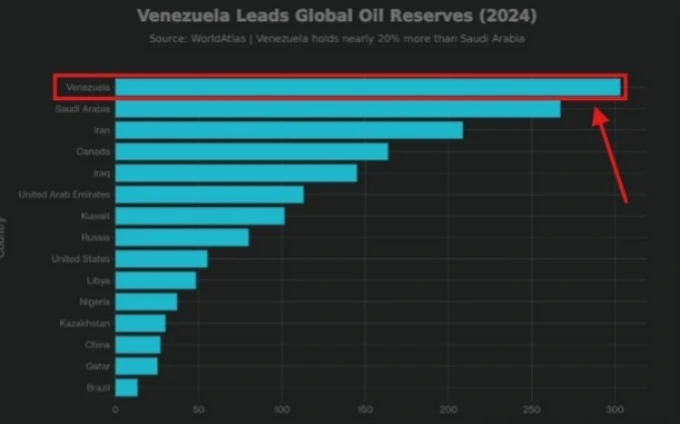

US Action in Venezuela

Rising geopolitical tension has increased uncertainty, supporting safe-haven assets like USD and gold while keeping oil volatile.

OPEC+ Oil Output Decision

OPEC+ kept production unchanged, limiting upside in oil prices and impacting oil-linked currencies such as CAD.

Fed Officials’ Speeches (Jan 6–7)

Comments from Fed officials Tom Barkin and Michelle Bowman may influence interest rate expectations and USD volatility.

Forex Market View

- USD: Driven by PMIs and Friday’s jobs data

- EUR: Reacts to Eurozone inflation trends

- GBP: Follows overall USD sentiment

- JPY: Benefits from risk-off sentiment

- CAD: Tracks oil prices and USD strength

- CHF: Supported during market uncertainty

- AUD/NZD: Perform better in risk-on conditions

Key Pairs to Watch

- EUR/USD – Driven by CPI and US jobs data

- GBP/USD – Moves mainly with USD strength

- USD/JPY – Sensitive to yields and risk sentiment

- USD/CAD – Impacted by oil and US data

- USD/CHF – Influenced by safe-haven flows

Gold, Oil & Crypto Outlook

- Gold: Supported by risk-off sentiment and weak US data

- Oil: Remains volatile amid steady OPEC+ output

- Crypto: Likely unstable around major US data releases

Trader’s Edge – Week Ahead Tips

- US jobs data will likely set the week’s direction

- Expect sharp USD moves around major releases

- Wait for confirmation after data before large trades

- Watch EUR/USD and USD/JPY closely

- Track USD and yields for gold direction

- Use strict risk control in crypto markets

Disclaimer

This newsletter provides market insights and expectations, not guarantees. Market conditions can change rapidly due to unexpected events. Always trade responsibly and manage your risk.

Rajat Mehrotra

Rajat Mehrotra is a forex market analyst and researcher with expertise in technical analysis, macro trends, and risk management.

Read More About the Author