What is Spread in Forex? Its Impact on Profitability

Spread is one of the most complex forex market terminologies that directly affects your profit and loss. So, a detailed understanding of what is spread in forex, its calculation, and factors affecting their amount is a must to be a consistent trader.

Introduction

In the forex market, traders buy or sell one currency for another to take advantage of price fluctuations and make money.

There are two prices in forex, Ask and bid. The price at which a trader can buy a currency pair is the ask price. Meanwhile, a price at which a trader can sell a currency pair is Bid.

What is spread in currency trading?

Spread is the difference between the buy and sell price of a currency pair for a trader. Simply put, it is the difference between a trader’s ask and bid price.

Forex Spread can also be the transaction cost a trader pays to exchange currencies. Forex Brokers Platform charges spread from the traders for their services.

The amount of spreads in forex trading depends on the lot size, risk and currency pair. Pips is the measuring unit of spread to represent the smallest price movement.

Forex trading is also popularly known as forex spread betting. Under this, traders predict the rise and fall of currency spreads to make money from the difference between the ask and bid price.

A quick glance

In forex trading, the “spread” represents the difference between the bid price (the price at which a broker will buy a currency pair) and the ask price (the price at which a broker will sell it). Essentially, it’s the cost of executing a trade, acting as the broker’s commission. A narrower spread indicates lower transaction costs, while a wider spread means higher costs. Traders need to consider the spread as it directly impacts their profitability, especially in short-term trading strategies.

- Fixed Spread

- Variable Spread

A 1 to 6 pips spread is good in forex. Some forex brokers offer zero spread, but these are just sales tactics with fewer services.

Different market conditions such as volatility, liquidity, time, type of currency pair and broker cause changes in spreads.

Types of spreads in currency trading

Fixed Spread: As the name suggests, these kinds of spreads do not change and remain unaffected by market factors.

Simply put, Market volatility, current affairs and news, and political and economic change do not cause a change in this spread. Therefore it is best and safest for beginners.

However, it also remains unaffected by the positive market change, which means the spread neither increase nor decrease due to market conditions.

Pros

Best for traders with less money.

Spreads are always fixed, so there is always transparency.

Cons

Brokers only offer fixed spreads for some currency pairs.

Always the same, even with better market conditions.

Fixed spreads are usually high.

Variable Spread: As the opposite of fixed spread, these spreads change with the change in market factors such as volatility, liquidity etc.

Positive change results in lower variable spreads, and negative change results in higher variable spreads. Generally, these spreads are lower than fixed spreads.

But due to quick changes, these are not suitable for beginners and short-term traders. Also, it is difficult to predict these spreads. As a result, you are not aware of the transaction cost.

Pros

You can trade in a wide variety of currency pairs.

Usually lower than fixed spreads.

Unpredictable

Cons

Depend on the Market Condition

Not suitable for scalpers.

Change may occur very quickly, that too in high amounts.

Which type of spread is better?

It depends on the amount of your capital and experience. Traders with less experience and small trades should trade with fixed spreads.

Conversely, Advanced traders trading with large amounts and having good experience should go for variable spreads.

How to calculate the spread in currency trading?

In the fx market, currencies are traded in pairs such as JPY/EUR, USD/GBP, CAD/NZD, etc. In the example, USD/GBP, USD is the base currency, and GBP is the quote currency.

If you think that the value of the USD will rise against GBP, you will buy this pair, and if not, you will sell it. Suppose the exchange rate of USD/GBP is 1.10.

The value of a base currency is always one. In this case, to buy 1 USD, you have to pay 1.10 GBP, i.e., 1 USD = 1.10 GBP.

Suppose a trader thinks that the value of USD arise against GBP. So he decided to buy the pair. Now the current trading price in the pair is 1.1115/1.1120.

It means if a trader want to buy the pair, the ask price will be 1.1120, and if a trader wants to sell the pair, the price will be 1.115.

As we all know, the spread is the difference between Bid and Ask price.

So your spread is 0.0005, which means 5 pips. You can also calculate pips from Forex spread calculator softwares.

Spreads = Ask Price – Bid Price

GBP/USD

1.1115/1.1120.

Spread = 1.1120-1.1115 = 5 pips

What is a good spread in forex?

Spread is the price forex brokers charge for exchanging currencies. So it can be high and low as per your brokers. More the pips, the wider the spread, and the fewer the pips, the tighter the spread.

High Spread GBP/USD 1.11220/1.11280 1.11280 – 1.11220 = 60 Pips |

A high spread in forex is when the currency pairs are less volatile means pairs with fewer trading volume. AUD/USD, USD/CAD, USD/CNY, and USD/CHF are the pairs with a high spread.

Tight Spread

EUR/USD

1.11220/1.11222

1.11220 – 1.11222 = 0.2 pips

A tight spread is when the transaction cost is low. Generally, currency pair with high volatility has a tight spread. EUR/USD, USD/JPY, GBP/USD, USD/CHF, and EUR/JPY are pairs with tight spreads.

If you are wondering about the Best spread in currency trading, then 1 to 6 pips spread is good. Some forex brokers offer zero spread, but these are just sales tactics with fewer services.

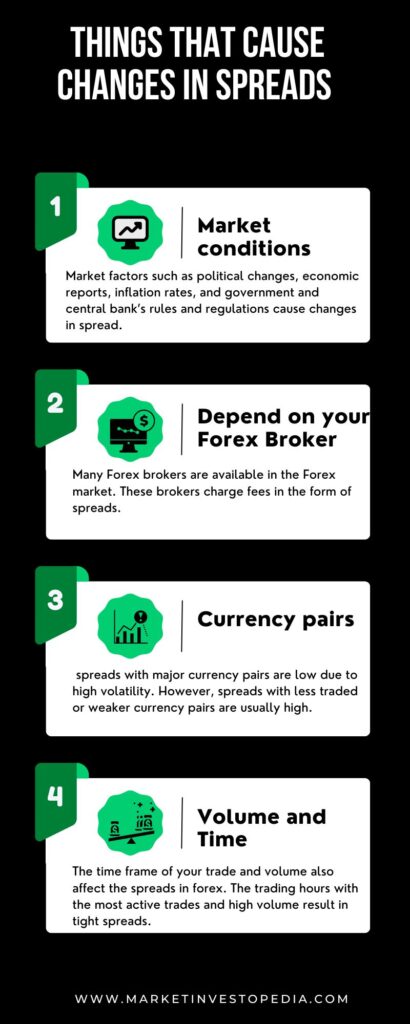

Things that cause changes in spreads

Market conditions: Market factors such as political changes, economic calenders, inflation rates, and government and central bank’s rules and regulations cause changes in spread.

Therefore it is a must to monitor live forex spreads to place a trade at the right time and avoid high spreads.

Depend on your Forex Broker: Many Forex brokers are available in the Forex market. These brokers charge fees in the form of spreads.

The amount of spread depends on the fee structure of your broker. So it is essential to select your broker by analyzing its earning style.

Some brokers also claim zero spreads; there is no such thing. They are earning from hidden commissions.

Currency pairs: Another factor that causes changes in fx spreads is the type of currency pair you are trading.

Generally, spreads with major currency pairs are low due to high volatility. However, spreads with less traded or weaker currency pairs are usually high.

Volume and Time: The time frame of your trade and volume also affect the spread in currency trading. The trading hours with the most active trades and high volume result in tight spreads.

And trading hours, with less active trades and low volume, result in wide spreads. So you can reduce the amount of spread by trading during the most active hours.

Conclusion

Spread may affect your profit while trading. Many forex brokers take advantage of traders’ lack of knowledge and charge high spreads.

Therefore an effective understanding of the concept of spread in currency trading and how to calculate it is a must for traders.

Also, monitoring liquidity, volatility, and socioeconomic factors that affect spreads is essential for traders.