Pin Bar Candle

Have you ever spotted a Pin-like structure on a chart? Visual formation can give traders valuable trading insights. The pin bar candle can assist you in planning your trade entries and exits effectively.

Wait, you don’t know how to spot, identify, and interpret these technical analysis tools? No need to worry. In this Market Investopedia blog, we will discuss trading pin bars in-depth with the pros, cons, and tips.

What is a Pin Bar?

The pin bar is a valuable technical analysis pattern that suggests a strong potential for price reversal or continuation. It has a small candle, one long wick, and one small wick. Traders can identify potential long-term and short-term opportunities by watching it.

A quick glance

The pin bar is a valuable technical analysis pattern that suggests a strong potential for price reversal or continuation. It has a small candle, one long wick, and one small wick.

A hammer has a tiny body and a longer lower wick, and it suggests a bullish reversal. Meanwhile, a pin bar can be bullish or bearish. It has a small body, one long and one small wick, and it suggests a trend reversal or continuation.

Doji looks like a plus sign with a similar lower and upper wick. It indicates indecision in the market. While a pin bar has a small body, one long and one small wick, and it suggests a trend reversal or continuation.

Key Components of Pin Bar Pattern

Struggling to identify the pin bar? Look for the below components on a chart:

Small Body: The Pin bar consists of a small body. It can be green or red. The small body reflects little difference between opening and closing prices. It means that buyers and sellers are pushing the price in the opposite direction.

Wicks: A pin bar contains two shadows or wicks below and above. One is small, and one is long. The long wicks represent the level at which the price was rejected.

Closed Bar: A pin bar is incomplete till the bar is closed. So, ensure the candle is closed before entering the trade.

Types of Pin Bar

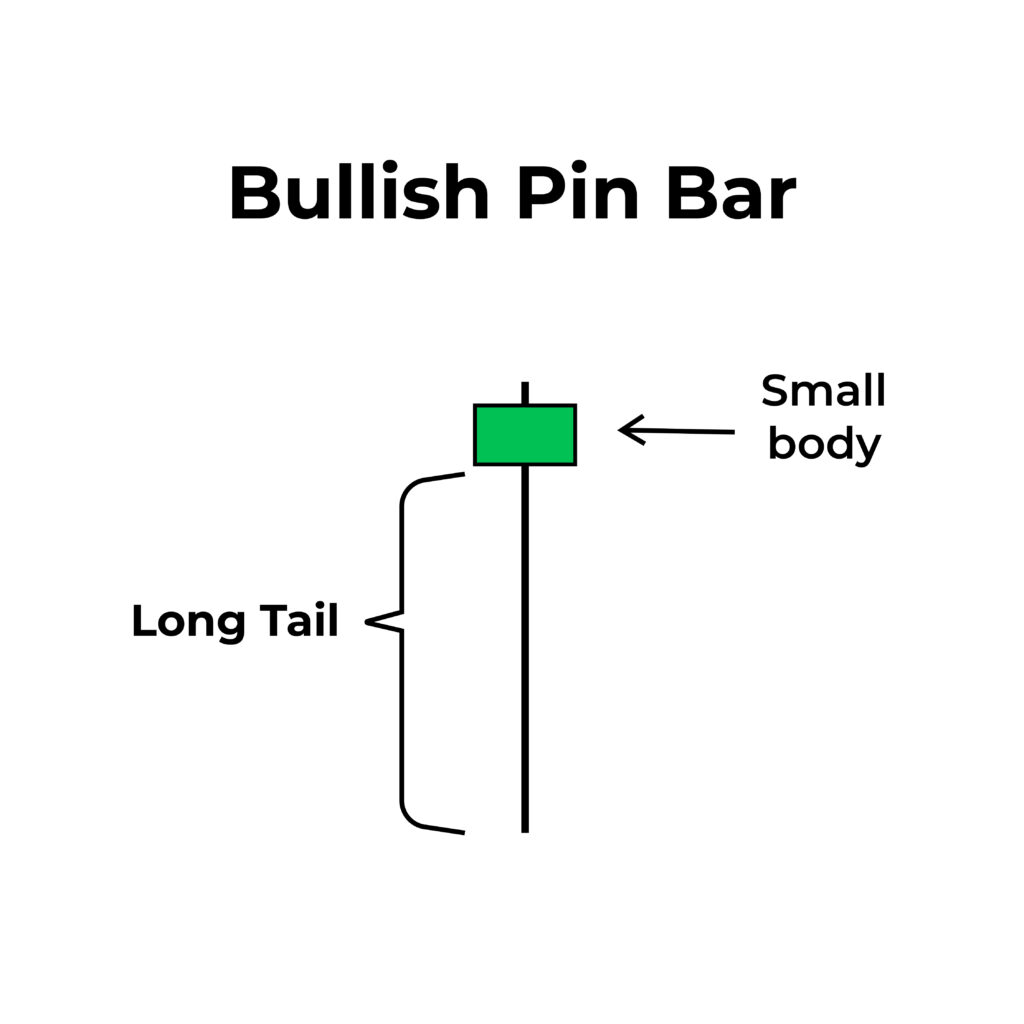

Bullish Pin Bar

A Bullish pin bar has a small green body. It occurs in a downtrend and suggests a bullish reversal. It has a little upper and a much longer lower tail or wick. The lower tail reflects that sellers have tried to push the prices, but they got rejected, and now the price is expected to rise. It indicates traders to open a buy position in an asset.

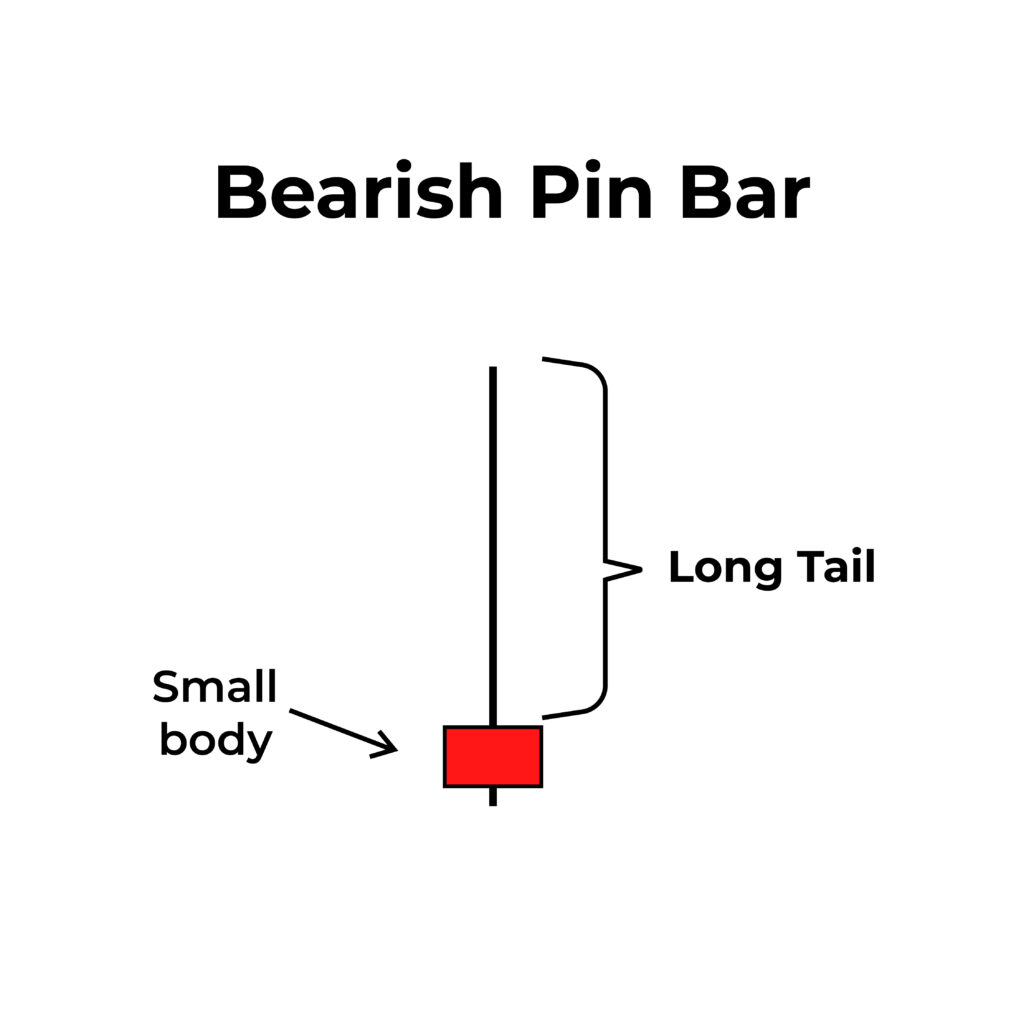

Bearish Pin Bar

A Bearish pin bar has a small red body similar to the bullish one and appears during the uptrend. It has a long upper and a small lower wick. The upper tail reflects that a higher price was rejected, and now the price is expected to fall. It indicates traders to open a sell position in an asset.

How to Trade Pin Bar

Identify Pin Bar

Watch the chart according to your desired time frame. Look for a bullish or bearish pin bar with a small body, one big and one small wick.

Plot Trading Indicators

Combine pin par with technical analysis indicators such as the Relative Strength Index, Bollinger Bands, or Fibonacci retracement. So, plot a compatible indicator on the chart to seek confirmation.

Trade Trend Reversal

A pin bar generally appears at the bottom of the prevailing trend and suggests a trend reversal. With this strategy, a trader needs to place in the opposite direction of the long wick and in the direction of the body color.

Trade Trend Continuation Strategy

A pin bar does not always suggest a trend reversal. In certain conditions, it also indicates a trend continuation. For example, during an uptrend pause, when a bullish pin bar appears on a chart, it suggests trend continuation. So, in such cases, a trader should consider opening a trade in the direction of the prevailing trend.

How to select High-Quality Pin Bars

When trading pin bars, finding out the strength of the pin bar is a must. A vague or weak pin bar may result in wrong trading decisions. Thus refers to the following tips for spotting and trading high-quality bars:

A Pin bar is effective or strong when it appears on key levels. So, consider trading a bullish pin bar when it appears on support and a bearish one when it appears on resistance.

Pin bar candlesticks can form on both shorter and longer time frames. However, the pin bar appearing on a longer time frame (4 hours/daily/weekly) is more effective than a pin bar appearing on a shorter time frame ( 5 minutes, 15 Minutes, or 1 Hour).

The length of the longer wick plays a crucial role and can help you track the pin bar’s strength. The Longer the wick, the more effective the pin bar pattern. So, ensure the longer shadow at least has a length of ⅔ of the entire candle.

The smaller the body of the candle, the better the pattern. So trade the pin bar where the difference between the asset’s opening and closing price is little.

A pin bar accompanied by high volume is more powerful.

Pros of Pin Bars

- The pin bar can be used to trade any financial asset, including currency pairs, major cryptocurrencies, stocks, etc.

- The pin bar can help you generate profitable trading signals. Traders can even identify the trade entry and exit levels.

- A pin bar accompanied by support or resistance, trendlines, and moving averages provides high-probability trade entries.

- The pin bar candlestick pattern is relatively easy to spot. You just need basic knowledge of technical analysis to trade them.

Cons of Pin Bars

A pin bar can be effective on a bullish or bearish trend. However, in a sideways or choppy market, it doesn’t work well.

The pin bar works on the basis of probability. However, the probability that the market may not move according to the interpretation is also there. In such cases, these tools may generate false or unreliable signals.

Bottom Line

The pin bar is a great tool to identify potential trend reversals or continuations. You can trade diverse assets in diverse time frames using the candlestick patterns. It is easy to spot and simple to interpret.

Like any other tool, even a pin bar is not foolproof. Thus, trading every pin bar is not a great idea. First, check its strength and confirm its interpretation before placing trades.

Also, they should grab the in-depth knowledge to get the desired outcomes. You can seek the help of Market Investopedia to enhance your technical analysis knowledge. Explore our blogs or reach out to attend our exclusive webinar for a practical understanding of these complex concepts.