Subscribe to Market Updates

Enter your email below to get our weekly research reports and trading insights.

Weekly Forex News & Market Pulse

This week, markets may move quickly as important data comes out from the US and the Eurozone. US PMIs, Powell’s speech, and job numbers will guide the US dollar, while Eurozone inflation will decide the direction of the euro. The NATO meeting may affect safe-haven currencies like JPY. CAD, AUD, and NZD could see fast swings based on risk mood and US data. Overall, traders should expect high volatility and quick price reactions across major forex pairs.

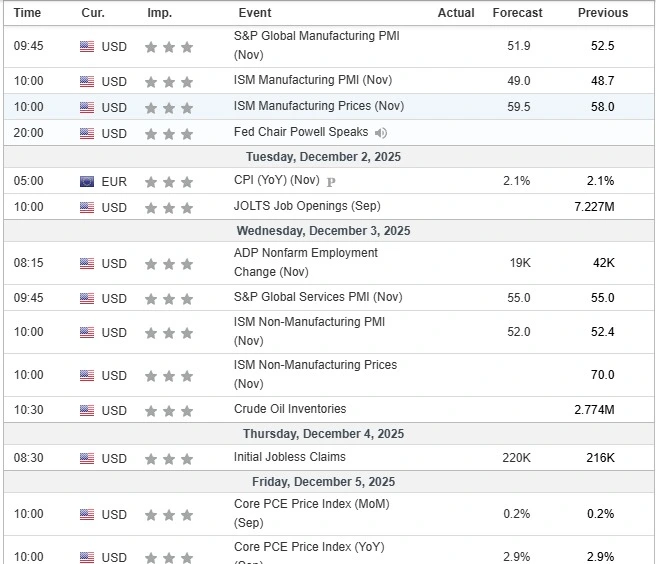

• US Manufacturing PMIs – Monday, Dec 1

The US Manufacturing PMI (S&P Global & ISM PMI) report will show how strong the factory sector is. Traders, investors, and policymakers will track this data to understand economic growth, industrial demand, and inflation pressure. This indicator also helps shape expectations for future Federal Reserve policy.

• Fed Chair Powell Speech – Monday, Dec 1

Fed Chair Jerome Powell will speak about the US inflation outlook, interest rates, and future monetary policy guidance. Markets will closely follow his tone to understand whether the Fed is preparing for rate cuts or staying cautious about inflation. This speech could set the direction for global markets.

• Eurozone CPI Release – Tuesday, Dec 2

The Eurozone CPI (Inflation Report) will reveal whether inflation is cooling or staying sticky. ECB officials, analysts, and traders will use this data to predict ECB interest rate decisions and the economic health of Europe. It’s a key indicator for understanding price stability in the region.

• US JOLTS Job Openings – Tuesday, Dec 2

The JOLTS Job Openings report shows how many jobs US businesses are trying to fill. This data is closely watched by economists to measure labour market strength, business confidence, and potential wage inflation. It plays a key role in shaping the Fed’s employment outlook.

• ADP Jobs + US Services PMI Trio – Wednesday, Dec 3

A major data day featuring ADP Employment Change, S&P Global Services PMI, and ISM Services PMI. These releases are crucial for understanding US job growth, service-sector strength, and inflation trends within the economy. Analysts use these numbers to predict NFP, market volatility, and consumer demand.

• US Crude Oil Inventories – Wednesday, Dec 3

The weekly Crude Oil Inventory Report will show whether the US is facing oversupply or strong demand. Oil traders and energy investors rely on this update to forecast WTI price movements, supply trends, and global oil outlook.

• GCC Summit – Dec 3 (Tue–Wed)

Gulf leaders from Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman will meet to discuss oil supply strategy, regional cooperation, and energy policy. This summit is important for the global oil market and can influence Brent and WTI prices.

• NATO Foreign Ministers Meeting – Wednesday, Dec 3

NATO foreign ministers will discuss European security, the Ukraine conflict, and future defence strategy. Geopolitical analysts and investors track this meeting to measure global risk sentiment and safe-haven demand.

• India–Russia Annual Summit – Dec 4–5 (Thu–Fri)

Prime Minister Narendra Modi and President Vladimir Putin will hold high-level discussions on defence cooperation, oil trade, energy deals, and strategic partnerships. Global markets watch this summit closely due to its impact on energy supply and geopolitical alignment.

Forex Market View

USD: PMI data & Powell speech may drive big moves. Strong numbers can lift USD; weak data may drag it down.

EUR: Eurozone CPI will decide direction. Soft inflation may pull the EUR lower; higher CPI may support the EUR.

GBP: Likely to track USD trends. Weak USD may help GBP rise.

JPY: NATO meeting could boost safe-haven demand. Rising tension may push JPY higher.

CAD: Oil data + GCC Summit may move CAD. Higher oil prices can support CAD; lower oil prices may weigh on it.

AUD/NZD: Risk-on mood favours both. USD weakness can lift AUD/USD and NZD/USD.

Key Pairs to Watch

EUR/USD: Sensitive to Eurozone CPI and overall USD moves.

GBP/USD: Follows USD direction and US data tone.

USD/JPY: Watch safe-haven flows driven by geopolitical updates.

USD/CAD: Impacted mainly by USD strength and CAD sentiment (plus oil moves).

AUD/USD: Moves with global risk sentiment and USD weakness/strength.

NZD/USD: Reacts to risk mood and US economic data.

Gold, Oil & Crypto Outlook

Gold

Gold will move mainly with US economic data and dollar strength. Strong US numbers can lift the USD and put pressure on gold, while weak data may increase safe-haven demand.

Strong USD → Gold may fall | Weak USD → Gold may rise

Oil

Oil prices will react to this week’s US Crude Oil Inventories. With low liquidity, quick intraday swings are possible.

Higher inventories → Oil may fall | Lower inventories → Oil may rise

Cryptocurrency

Crypto will follow overall risk sentiment and the direction of the US Dollar. No major crypto-specific events are scheduled this week.

Strong USD → Crypto may see selling | Weak USD → Crypto may see mild recovery

Trader’s Edge: Week Ahead Tips

- Watch US PMIs, Powell’s speech, and job data; strong readings may lift USD, while weak numbers may push it lower and support risk assets.

- EUR will react to Eurozone CPI; higher inflation may support EUR upside, while softer CPI may pressure EUR.

- GBP moves mostly with the USD direction; a softer USD may help GBP recover, while strong US data may cap gains.

- JPY may strengthen on safe-haven flows; geopolitical headlines from the NATO meeting could pull USD/JPY lower if risk sentiment weakens.

- CAD may see movement from US Crude Oil Inventories; higher stock levels may keep CAD soft, while lower inventories may support it.

- AUD and NZD follow global risk mood; weak USD and positive sentiment may lift both pairs, while strong US numbers may limit upside.

- Gold reacts to USD swings; a strong USD may pressure gold, while weak data or geopolitical tension may support it.

- Crypto follows volatility and USD trend; a strong USD may trigger selling, while a softer dollar may help prices stabilise.

Stay Ahead This Week with MarketInvestopedia!

Get accurate technical analysis and market insights delivered straight to your inbox. Subscribe now to MarketInvestopedia and never miss key updates that could move the markets.

Disclaimer

This newsletter provides market insights and expectations for the week ahead. These are predictions, not guarantees. Markets can change at any time due to new information or unexpected events. Always trade carefully and manage your risk.