Subscribe to Market Updates

Enter your email below to get our weekly research reports and trading insights.

Weekly Forex News & Market Pulse

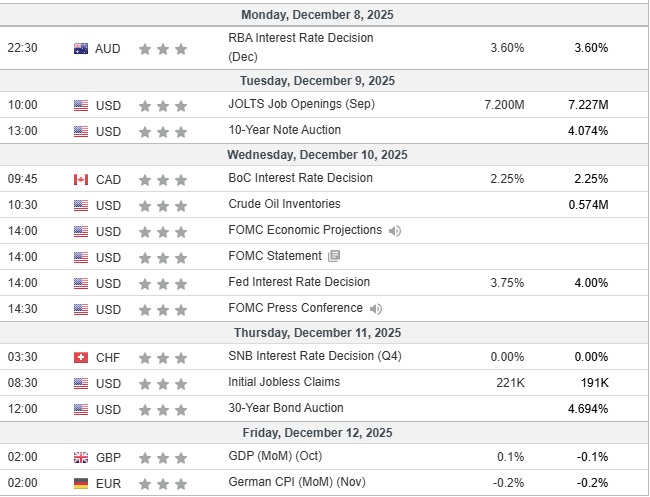

This week brings several major economic events that can create strong movements across forex, gold, oil, and crypto markets. Traders should be prepared for higher volatility as the FOMC decision, SNB announcement, BoC meeting, and key data releases set the market tone. Our weekly outlook gives you a clear heads-up on what to watch, how it may impact prices, and where opportunities may appear.

• US 10-Year Treasury Auction – Tuesday, Dec 9

The 10-year Treasury auction affects US bond yields, which influence the US dollar, gold, and crypto. Higher yields usually support the dollar and pressure gold, while lower yields help gold rise and support risk assets like crypto.

• FOMC Interest Rate Decision – Wednesday, Dec 10

This is the biggest event of the week. The Federal Reserve decides whether to raise, cut, or hold interest rates — a decision that affects the US dollar, gold, crypto, and all major forex pairs. Markets often show strong moves during and after this announcement.

• FOMC Statement, Projections & Powell Press Conference – Wednesday, Dec 10

The Fed will publish its statement and projections, followed by Chair Powell’s press conference. Powell’s comments can trigger sharp market reactions and help traders gauge the Fed’s next steps on inflation and rates.

• Bank of Canada Interest Rate Decision – Wednesday, Dec 10

The BoC decision will guide CAD pairs and may influence oil-linked sentiment. Even a neutral rate call can move markets depending on the policy guidance and growth outlook provided.

• SNB Interest Rate Decision – Thursday, Dec 11

The Swiss National Bank decision often creates clear and quick moves in CHF pairs. Any policy change or guidance will be quickly priced into USD/CHF and EUR/CHF.

• US Initial Jobless Claims – Thursday, Dec 11

This weekly report shows how many people filed for unemployment benefits. Because it follows the FOMC, the market reaction can be amplified if claims surprise expectations.

• UK GDP (Monthly) – Friday, Dec 12

The UK monthly GDP release reveals whether economic growth is accelerating or slowing. The result directly impacts GBP pairs and market sentiment around the pound.

Forex Market View

USD: The Fed meeting and Powell’s comments will largely decide USD direction. A hawkish message can push USD up; a softer outlook may pull it down.

EUR: EUR will mostly react to USD moves after the Fed. USD weakness tends to lift EUR/USD; USD strength can pressure it.

GBP: UK GDP is a key driver this week, though GBP will also follow USD trends.

JPY: JPY may gain if markets turn cautious after the Fed — safe-haven demand typically supports JPY in risk-off moves.

CAD: The BoC decision and oil sentiment will guide CAD; hawkish comments or stronger oil prices can lift CAD.

CHF: The SNB decision can create quick CHF moves; a firmer SNB may strengthen CHF.

AUD/NZD: Both pairs tend to rise in risk-on conditions and when the USD weakens after the Fed.

Key Pairs to Watch

EUR/USD: Sensitive to FOMC outcomes and the post-Powell USD reaction.

GBP/USD: UK GDP plus FOMC moves will determine direction.

USD/JPY: Driven by US yields and safe-haven flows after the Fed.

USD/CHF: SNB guidance is the main catalyst.

Gold, Oil & Crypto Outlook

Gold

Gold will react to the Fed’s tone and US yields. A strict Fed tone and higher yields typically pressure gold; a softer Fed may lift it.

Strong USD / higher yields → Gold may fall | Weak USD / lower yields → Gold may rise

Oil

Oil prices will move with demand signals and USD direction. Stronger demand or a weaker dollar may support oil; the opposite may push prices down.

Stronger demand / weaker USD → Oil may rise | Weaker demand / stronger USD → Oil may fall

Crypto

Crypto will track risk sentiment and the dollar. A softer Fed tone that weakens the dollar may help crypto recover; a hawkish Fed may lead to selling pressure.

Trader’s Edge: Week Ahead Tips

- The FOMC rate decision is the main driver this week — expect large moves in major forex pairs.

- Wait for the post-Powell market direction before taking larger positions to avoid unnecessary volatility.

- EUR/USD and USD/JPY remain key pairs because they react quickly to interest rate news and yield moves.

- For gold traders, monitor US yield moves and USD strength closely — these usually dictate short-term gold direction.

- Oil may shift with CAD flows and global risk sentiment — track both to spot opportunities.

- Crypto markets can show sharp swings after the Fed update — use smaller position sizes and tight risk controls.

- Expect higher volatility and keep risk management tight with well-placed stops and defined position sizing.

Stay Ahead This Week with MarketInvestopedia!

Get accurate technical analysis and market insights delivered straight to your inbox. Subscribe now to MarketInvestopedia and never miss key updates that could move the markets.

Disclaimer

This newsletter provides market insights and expectations for the week ahead. These are predictions, not guarantees. Markets can change at any time due to new information or unexpected events. Always trade carefully and manage your risk.