Subscribe to Market Updates

Enter your email below to receive weekly market insights.

Weekly Forex News & Market Pulse

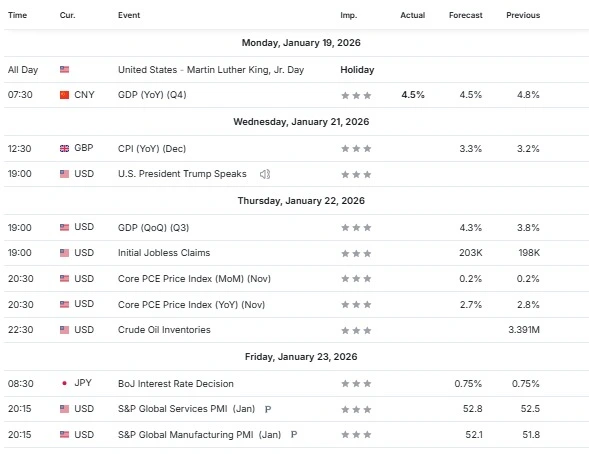

This week may bring fast market moves as traders react to key economic data, global headlines, and changing market sentiment. Events like China growth data, UK inflation numbers, and major political discussions can influence forex, gold, oil, and crypto prices.

Volatility is expected, and small news can create big moves. If you trade this week, staying informed and prepared will be key. Below, we break down the important events and market outlook to help you trade with more clarity and confidence.

China GDP Data Release | 22 Jan 2026 | Global Growth Outlook

China will release its quarterly GDP data, showing how fast the economy is growing. Investors track this report to understand demand, manufacturing activity, and trade strength. As the world’s second-largest economy, China’s growth data strongly influences global markets and commodity prices.

Impact:

Strong GDP may support Asian stocks and commodities, while weak data could increase global risk-off sentiment.

UK CPI Inflation Data | 22 Jan 2026 | Pound and Interest Rate Focus

The UK CPI inflation report will be released mid-week. This data shows how fast prices are rising and helps investors predict future interest rate decisions by the Bank of England. Inflation data often drives movement in the British pound and UK stock markets.

Impact:

Higher inflation may strengthen GBP, while lower CPI could raise expectations of rate cuts.

Trump Speech | 23 Jan 2026 | Trade and Economic Policy Signals

US President Trump is scheduled to speak on Thursday. Markets will watch closely for comments on trade policy, economic plans, and global relations. Political speeches can quickly change market sentiment, especially if strong statements on tariffs or growth outlook are made.

Impact:

Unexpected remarks may trigger volatility in USD, equities, and commodities.

World Economic Forum Discussions

The World Economic Forum continues in Davos with global leaders, central bankers, and CEOs. Discussions on trade, geopolitics, energy security, and AI regulation often influence markets through headlines and policy signals.

Impact:

Surprise comments can increase volatility across currencies, stocks, and commodities.

Energy and Geopolitical Talks

Alongside major meetings, global discussions on energy supply, oil prices, and geopolitical risks remain active. These topics are not tied to direct data releases but can strongly impact oil, gold, and overall market sentiment.

Impact:

Energy prices and safe-haven assets may see sudden moves based on geopolitical headlines.

Global Central Bank Commentary

This week, several central bank officials from major economies are expected to speak in public forums and interviews. Investors will watch their comments on inflation, interest rates, and economic risks to understand future monetary policy direction.

Impact:

Rate-related comments may increase volatility in currencies, bonds, and equity markets.

Corporate Earnings Season Begins

The US earnings season starts gaining pace this week, with major companies from banking, technology, and consumer sectors reporting results. Earnings guidance and profit outlook will help investors judge business confidence and economic strength.

Impact:

Strong earnings may support equities, while weak guidance could pressure stock indices.

Geopolitical Headlines Remain in Focus

Ongoing geopolitical developments related to global trade routes, regional conflicts, and diplomatic talks remain in focus. Even without scheduled events, sudden headlines can quickly impact market sentiment and investor risk appetite.

Impact:

Negative news may support gold and safe-haven currencies, while positive updates could boost risk assets.

Oil Market Supply Talk

Discussions around oil supply, production levels, and energy security continue this week. Comments from energy officials and producers often influence oil prices, even without official OPEC announcements.

Impact:

Supply-related headlines may cause sharp moves in crude oil prices.

Global Equity Volatility Due to Low Liquidity

Early in the week, lower trading volumes due to global holidays and cautious positioning may increase volatility. In such conditions, even small news updates can cause larger-than-usual market moves.

Impact:

Low liquidity may lead to sudden price swings across stocks, forex, and commodities.

Forex Market View

- USD: US dollar sentiment may stay mixed as traders react to political headlines, central bank comments, and risk sentiment. Strong confidence supports USD, while uncertainty can cap upside.

- EUR: The euro may remain range-bound as investors focus on global growth signals and central bank commentary. Risk sentiment from global meetings can influence short-term EUR moves.

- GBP: British pound volatility may stay high due to UK inflation data. Higher inflation supports GBP strength, while softer numbers may increase pressure on the currency.

- JPY: Japanese yen could see sharp moves on policy expectations and global risk mood. Any hint of policy change increases JPY volatility, especially during risk-off phases.

- AUD and NZD: Commodity-linked currencies may react to China's growth data and global risk appetite. Positive China signals support for AUD and NZD, while weak data may weigh on them.

- CHF: The Swiss franc may attract demand during geopolitical uncertainty. Risk-off headlines often support CHF as a safe-haven currency.

- Overall Forex Bias: Expect increased volatility this week. Traders should watch headlines, speeches, and sentiment shifts closely, as forex markets may react quickly even without major data releases.

Key Pairs to Watch

- EUR/USD: This pair may stay volatile due to shifting USD sentiment from political headlines and global risk mood. Traders will watch if USD strength holds or fades after key speeches and discussions.

- GBP/USD: UK inflation data keeps this pair active. Higher inflation supports GBP upside, while soft CPI numbers may push GBP lower against the US dollar.

- USD/JPY: One of the most sensitive pairs this week. Risk-off sentiment or policy-related comments can strengthen JPY, while stable risk appetite may keep USD/JPY supported.

- AUD/USD: Strongly linked to China's growth outlook. Positive China GDP data may lift AUD, while weak numbers could pressure the pair lower.

- USD/CHF: Safe-haven flows will drive this pair. Rising geopolitical or political uncertainty may support CHF, while calm market conditions favour USD strength.

- EUR/GBP: This pair depends mainly on UK inflation versus Eurozone stability. Strong UK data may push EUR/GBP lower, while weak CPI could support upside moves.

- XAU/USD: Gold may remain volatile as traders react to global uncertainty and currency moves. Risk-off sentiment supports gold, while strong USD can limit gains.

Trader Focus: Watch headlines closely, manage risk carefully, and expect quick moves. This week favors short-term trading setups rather than long-term positions.

Gold, Oil & Crypto Outlook

Gold Price

Gold prices may remain strong this week due to global uncertainty, geopolitical headlines, and safe-haven demand. Traders will watch US dollar movement and political news closely. If risk sentiment weakens, gold price could see further upside, while a strong USD may slow gains.

Oil Price

Crude oil prices may stay volatile as markets react to supply discussions, energy security news, and demand expectations. Any positive outlook on global growth could support oil prices. However, oversupply concerns or weak demand signals may keep oil under pressure.

Crypto Market

The crypto market may see mixed movement this week, driven by overall risk sentiment and US dollar strength. Bitcoin price may attempt recovery if market confidence improves. High volatility is expected across major cryptocurrencies due to changing global headlines.

Gold, Oil and Crypto Market Prediction

Overall, expect short-term volatility in gold, oil, and crypto markets. Traders should closely track global news, sentiment shifts, and USD movement for better trade opportunities.

Trader’s Edge: Week Ahead Trading Tips

- Trade the News, Not the Noise: This week includes major speeches and global discussions. Focus on confirmed news and strong price reaction instead of rumors to avoid false market moves.

- Watch USD Strength Closely: US dollar movement will guide forex, gold, and crypto markets. A strong USD can pressure gold and crypto, while a weak USD may support risk assets.

- Respect Volatility Around Key Events: Expect sharp moves during major data releases and political speeches. Use proper stop-loss levels and avoid over-leveraging during high-impact news hours.

- Focus on Key Currency Pairs: Pairs like EUR/USD, GBP/USD, and USD/JPY may offer better trading opportunities this week due to high liquidity and clear market reactions.

- Use Smaller Position Sizes: High volatility increases risk. Trading smaller positions helps protect capital and keeps emotions under control.

- Follow Market Sentiment Daily: Track global headlines, risk-on or risk-off sentiment, and commodity price trends. Sentiment shifts can change market direction quickly.

- Plan Trades, Do Not Chase Moves: Wait for clear setups and confirmation. Chasing fast moves often leads to poor entries, especially during news-driven markets.

- Trader Takeaway: This week favours disciplined, short-term trades. Focus on risk management, clear setups, and market sentiment for consistent trading decisions.

Stay Ahead This Week with MarketInvestopedia

Make smarter trading decisions with clear market analysis, weekly forecasts, and actionable insights.

Join thousands of traders who rely on MarketInvestopedia for timely updates on forex, gold, oil, and crypto markets.

Subscribe now for FREE and get market-moving insights delivered straight to your inbox, before the moves happen.

Disclaimer

This newsletter shares market insights and expectations for the week ahead. These are forecasts, not guarantees. Market conditions can change rapidly due to new data or unexpected events. Always trade responsibly and manage your risk.

Rajat Mehrotra

CMT, CFTe

Rajat Mehrotra is a forex market analyst and researcher with expertise in technical analysis, macro trends, and risk management.