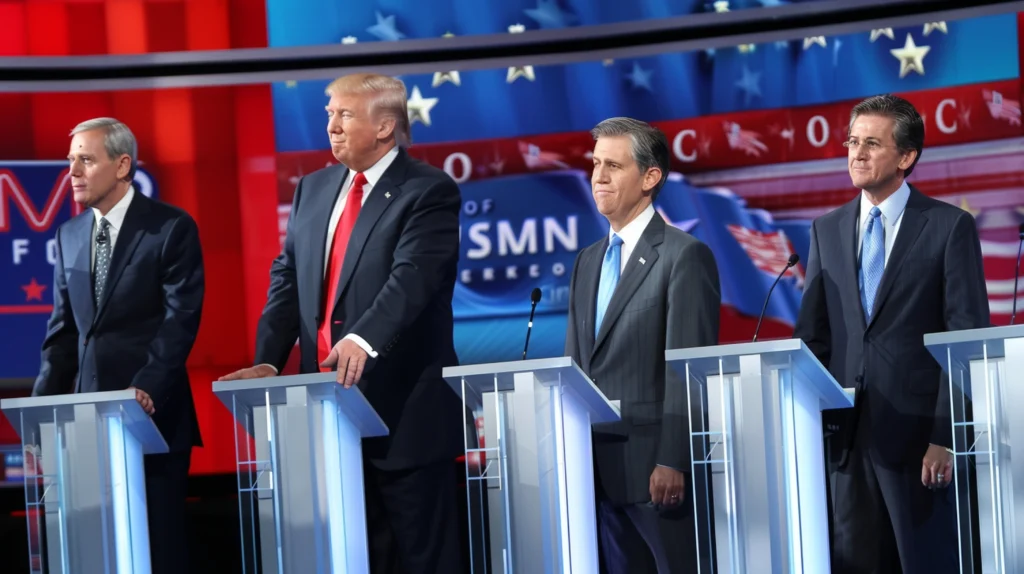

Trump vs The Fed: Is Politics Driving Rate Cuts?

Earlier this week, many analysts said the September rate cuts, if they happen, would be “more political than policy.” And now, just a day later, big news hit—Fed Governor Lisa Cook has been fired.

The timing looks suspicious. People are asking if Trump is trying to control the Fed to get his way. For months, he has attacked the central bank, calling it “incompetent” and demanding lower interest rates.

By removing people who don’t agree with him, Trump could be making space for officials who support rate cuts—a move that might boost the stock market, weaken the US dollar, and give him a political advantage ahead of elections.

For the forex market, this is a red flag. If traders believe the Fed is no longer independent, confidence in the dollar may drop. That could push currency pairs like EUR/USD, GBP/USD, and USD/JPY into sharper moves.

Impact:

* Dollar may weaken if politics takes over Fed decisions.

* Forex traders should prepare for more volatility in the coming weeks.