Subscribe to Market Updates

Enter your email below to receive weekly market insights.

Weekly Forex News & Market Pulse

The forex market may remain active this week as traders closely watch key economic data, bond yield movement, and global headlines. The US dollar is likely to stay in focus, while major currency pairs, gold, oil, and crypto may react to changes in sentiment. With several important updates scheduled, markets could see gradual moves and short-term volatility as traders adjust positions.

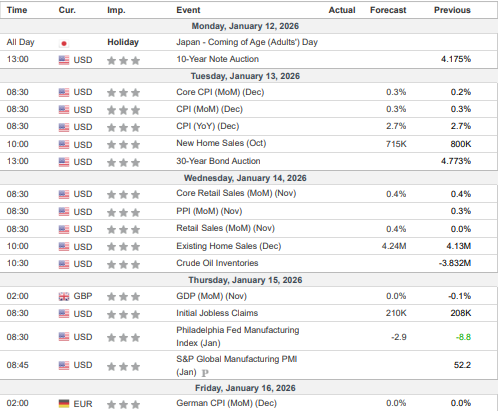

US 10-Year Treasury Auction – Monday

The US 10-year Treasury auction shows how much demand there is for US government bonds. This auction directly affects US bond yields, which play a major role in currency, gold, and crypto price movements.

Impact: Higher yields usually strengthen the US dollar and pressure gold, while lower yields can weaken the USD and support gold and crypto.

US CPI & Core CPI – Tuesday

US CPI measures inflation at the consumer level and shows how fast prices are rising. It is one of the most important indicators used by the Federal Reserve to decide future interest rate policy.

Impact: Higher inflation supports the US dollar and pressures gold, while softer inflation can weaken the USD and support gold and risk assets.

US Retail Sales – Wednesday

U.S. retail Sales data show how much consumers are spending. Since consumer spending drives economic growth, this report helps traders understand the strength of the US economy.

Impact: Strong retail sales support the US dollar, while weak spending data can pressure the USD and increase market volatility.

UK GDP (MoM) – Thursday

UK GDP measures monthly economic growth and reflects how well the UK economy is performing. This data is closely watched by traders to assess the outlook for the British pound.

Impact: Strong GDP supports the British pound, while weak growth data can lead to GBP weakness.

German CPI (MoM) – Friday

German CPI measures inflation in Germany, the largest economy in the Eurozone. It plays an important role in shaping expectations around European Central Bank policy.

Impact: Higher inflation supports the euro, while weak CPI keeps pressure on EUR and limits upside moves.

G7 Finance Ministers Meeting on Critical Minerals

G7 finance ministers are meeting to discuss supply chains and pricing of critical minerals like rare earths, which are widely used in technology, electric vehicles, and battery production. These discussions can influence long-term commodity supply and global trade flows.

Impact: Any policy shift can affect commodity prices, tech sector sentiment, and currencies of resource-exporting countries.

CES 2026 Highlights AI and Technology Growth

Major technology companies showcased new AI models, chips, and computing infrastructure at CES 2026. The event highlighted a strong global focus on artificial intelligence, data centres, and next-generation technology investment.

Impact: Positive AI developments support tech stocks and improve risk sentiment, which can benefit risk-sensitive currencies and broader markets.

Growing Focus on AI and Energy Ahead of Global Policy Meetings

Global leaders and policymakers increased discussions around AI regulation, energy transition, and supply chain resilience ahead of upcoming global economic forums. These themes continue to influence long-term investor positioning.

Impact: Strong focus on AI and energy can support related sectors, commodities, and currencies tied to global growth expectations.

China Tightens Silver Export Controls

China introduced tighter controls on silver exports, a key metal used in electronics, solar panels, and electric vehicles. Supply restrictions may impact industrial demand and pricing across global markets.

Impact: Silver prices may remain supported, influencing industrial metals sentiment and commodity-linked currencies.

Gold Hits Record High on Safe Haven Demand

Gold prices moved to record highs over the weekend as investors looked for safety amid geopolitical uncertainty and concerns around central bank independence. Strong demand reflected rising caution across global financial markets.

Impact: Gold strength signals risk aversion, supports safe-haven assets, and can increase volatility across forex and risk-sensitive markets.

Legal Pressure on Fed Chair Raises Market Uncertainty

News over the weekend about legal scrutiny involving the US Federal Reserve Chair increased concerns around Fed independence. Investors became cautious as uncertainty grew over future US monetary policy decisions.

Impact: Increased volatility expectations, pressure on USD sentiment, and stronger demand for safe-haven assets like gold.

Oil Prices Supported by Middle East Risk Sentiment

Oil prices remained supported over the weekend due to ongoing geopolitical tensions in the Middle East. While no major supply disruption was confirmed, the risk premium stayed priced into energy markets.

Impact: Oil price support can drive short-term volatility in energy markets and impact commodity currencies like CAD.

Ongoing Iran Unrest Keeps Geopolitical Risk Elevated

Political unrest in Iran continued over the weekend, adding to broader regional uncertainty. While not a new event, it remains an ongoing risk factor for global markets.

Impact: Sustained geopolitical risk can support safe-haven demand and keep market sentiment cautious during the week.

Forex Market View

USD: USD direction will be driven by US inflation data and bond yield movement. Strong CPI or higher yields can keep USD firm, while softer inflation may slow momentum but not reverse the trend easily.

EUR: EUR will mainly react to US dollar strength and German CPI. Strong USD can keep EUR/USD under pressure, while weak German inflation limits any meaningful euro recovery.

GBP: UK GDP is the main driver for GBP this week. Weak growth data can pressure the pound, while USD strength may continue to cap upside in GBP/USD.

JPY: JPY remains weak due to uncertainty over the timing of the next Bank of Japan rate cut. This keeps USD/JPY biased higher despite periods of market caution.

CAD: CAD will track oil price movement and overall USD strength. Supported oil prices can limit losses, but a strong USD keeps upside for CAD restricted.

CHF: CHF may see limited strength as USD momentum dominates. Without a strong risk off trigger, USD/CHF may stay supported to the upside.

AUD/NZD: AUD and NZD remain sensitive to global risk sentiment. Strong USD and cautious markets can keep both currencies under pressure this week.

Key Pairs to Watch

EUR/USD: Under pressure due to strong US dollar momentum and weak German inflation.

GBP/USD: UK GDP is the main trigger. Strong USD keeps downside risk in focus.

USD/JPY: Supported by a strong USD and continued weakness in the Japanese yen.

USD/CAD: Guided by oil price movement and overall US dollar strength.

USD/CHF: Supported as long as the US dollar strength dominates market sentiment.

AUD/USD: Under pressure due to the strong USD and cautious risk mood.

NZD/USD: Likely to stay soft, tracking risk sentiment and USD strength.

Gold, Oil & Crypto Outlook

Gold: Gold prices are holding firm as investors stay cautious due to global uncertainty. A strong US dollar may slow gains, but gold remains supported as a safe option.

Oil: Oil prices are steady with some volatility due to geopolitical tension. Even without major supply cuts, price swings may continue and affect oil-linked markets.

Crypto: Crypto prices remain unstable. A strong US dollar and cautious market mood may keep pressure on crypto, with sharp moves possible during the week.

Trader’s Edge: Week Ahead Tips

Focus on the US dollar trend, as USD strength is driving most forex moves this week.

Watch US inflation data and bond yields, as they can quickly change market direction.

Keep an eye on USD/JPY, since yen weakness may continue if BoJ uncertainty remains.

For EUR/USD and GBP/USD, expect limited upside while the dollar stays strong.

Gold traders should track USD and geopolitical headlines, as both influence gold prices.

Oil traders should be prepared for volatility due to ongoing geopolitical risks.

Crypto traders should use smaller positions, as a strong USD and cautious sentiment can cause sharp swings.

Manage risk carefully by using clear stop losses and proper position sizing.

Stay Ahead This Week with MarketInvestopedia!

Get accurate technical analysis and market insights delivered straight to your inbox. Subscribe now to MarketInvestopedia and never miss key updates that could move the markets.

Disclaimer

This newsletter provides market insights and expectations for the week ahead. These are predictions, not guarantees. Markets can change at any time due to new information or unexpected events. Always trade carefully and manage your risk.

Rajat Mehrotra

CMT, CFTe

Rajat Mehrotra is a forex market analyst and researcher with expertise in technical analysis, macro trends, and risk management.