Many people are now familiar with cryptocurrencies or may have heard about them. But they don’t know how did cryptocurrency started and became a popular medium of exchange. In this article, you will learn the history of cryptocurrency and its development.

What is cryptocurrency?

Before moving ahead with when cryptocurrency was invented, let us have a quick look at the meaning of cryptocurrency.

A cryptocurrency is a digital currency that acts as a medium of exchange in the decentralized market with the help of blockchain technology. At present, there are more than 23000 cryptocurrencies.

One can use cryptocurrency for online purchases, trading, investing, raising funds, etc. Cryptocurrency transactions are recorded, analyzed, and verified to maintain their value.

A quick glance

American Researcher David Chaum is considered the godfather of crypto. He founded Digi Cash in 1980 to provide a secure electronic currency using cryptography.

Bitcoin is the first and most successful cryptocurrency invented by

Satoshi Nakamoto in 2008.

On January 2009, Santoshi Nakamoto mined the first block of cryptocurrency consisting of 50 bitcoins, popularly known as Genesis blocks.

In the year 2017, the price of bitcoin and crypto price reached the sky. That’s when the crypto market became the destination of frauds and scams such as fake ICO, Ponzi Scheme, etc.

History of cryptocurrency

The thought of developing a digital or electronic currency emerged in the early 1980s. Various researchers started thinking and making efforts to invent digital money.

The first known invention was by American Researcher David Chaum in the 1980s. He founded Digi Cash in 1980 to provide a secure electronic currency using cryptography.

However, due to scalability and other challenges, it crashed. After this, in 1998, a scientist named Wei Dai developed B- Money, and a person named Adamback introduced Hash Cash with the aim of providing decentralized digital currency.

B-Money and Hash Cash were also unable to deal with market challenges and failed. However, these early inventions pave the path for the development and success of the first cryptocurrency.

Introduction of Bitcoin

If you are wondering about what was the first cryptocurrency, then the answer is Bitcoin. Let us have look at history of bitcoin.

In 2008, Satoshi Nakamoto invented Bitcoin, the best innovation in cryptocurrency history. He published a paper regarding creating a digital currency system and started the cryptocurrency revolution.

- When did cryptocurrency start?

On January 2009, Santoshi mined the first block of cryptocurrency consisting of 50 bitcoins, popularly known as Genesis blocks. It grabbed all the limelight, and this news was also published in various newspapers.

However, even six months after its launch, bitcoin has no value. After some time, it was available for only a few cents, and then its price started increasing and decreasing. That’s when trading in Bitcoin started.

- Bitcoin Market Expansion

Bitcoin’s popularity started increasing due to its decentralized nature, which eliminates the need for government and banks.

In 2011, when a big magazine published news about the first digital currency, the price of Bitcoin rose from 1$ to 9$. That was the first and most significant jump in Bitcoin prices.

After this, several people started trading in Bitcoin. The popularity of Bitcoin resulted in the invention of various other digital currencies.

Ethereum, Litecoin, Ripple, Bitcoin Cash, and other digital currencies were invented with different features and functions.

Bitcoin is considered the most significant invention in the history of cryptocurrency because it plays a significant role in expanding the crypto market.

- Bitcoin price fall

In 2013, the price of Bitcoin quickly fell and resulted in a massive loss of traders. During this year, the price of one bitcoin reached $1000, then its price started decreasing and reached $300.

At the start of the year, bitcoin prices were rising, and suddenly bitcoin exchange stopped withdrawal process due to technical issues.

It created panic among investors, and people started selling Bitcoin. That was the reason for its price fall. At that time, many traders lose money in the crypto market.

However, soon, the price again started increasing. Over the years, bitcoin prices rapidly declined and increased.

Expansion of the Crypto Market

In the year 2017, the price of Bitcoin reached the sky. Bitcoin’s value became 20 times in 12 months. That’s when the crypto market grabbed all the limelight and became the destination of Financial Trading scams and frauds.

Bitcoin and other cryptocurrencies value also started increasing in 2017, which gave birth to crypto scams. During this year, many big nations, including Japan, have recognized Bitcoin as a legal cryptocurrency.

As a result, people’s trust and confidence started increasing on digital assets. Also, in the same years, the popularity of Initial coin offerings (ICO) started increasing.

ICO allows investors and traders to raise capital using their tokens. At that time, many investors started using crypto, especially Bitcoin and ethereum, for funding ICO.

As a result, the demand for Bitcoin started increasing in 2017 compared to the supply, and the value of digital currencies reached the sky.

With Bitcoin, the demand for another crypto, Ether, also started growing due to ICO expansion. The number of people using Ethereum also increased during this time.

Crypto Scams

In the history of cryptocurrency, scams also have a significant place—expansion of the crypto market results in an increase in people’s confidence and trust in cryptocurrencies. In the name of ICO funding and crypto investing, scammers stole money from innocent people.

In 2018, a digital currency platform bitconnect shut its operation after looting the public with a Ponzi scheme. Another cryptocurrency exchange named Onecoin claims to have a transparent system booked for fraudulent activities.

These were not the only scams. Many scammers in the market were taking advantage of the crypto craze among people during that time.

Present status of cryptocurrencies

During the years 2020 to 2022, the crypto market was re-established. Bitcoin, Ethereum and various other currencies value started increasing.

Also, the crypto market’s popularity has increased due to digitalization and the expansion of digital payment. There was a time when Bitcoin even reached 70,000 US Dollars.

Many countries started accepting cryptocurrency as a legal currency. However, even today, some countries like China and Nepal have banned crypto, but major economies such as the USA and Britain have legitimized crypto.

There are many crypto exchange platforms with thousands of cryptocurrencies. As per the current scenario, Bitcoin is the most popular and expensive digital currency. One bitcoin is equal to 26220 US Dollars, and one Ethereum is equal to 1800 US Dollars.

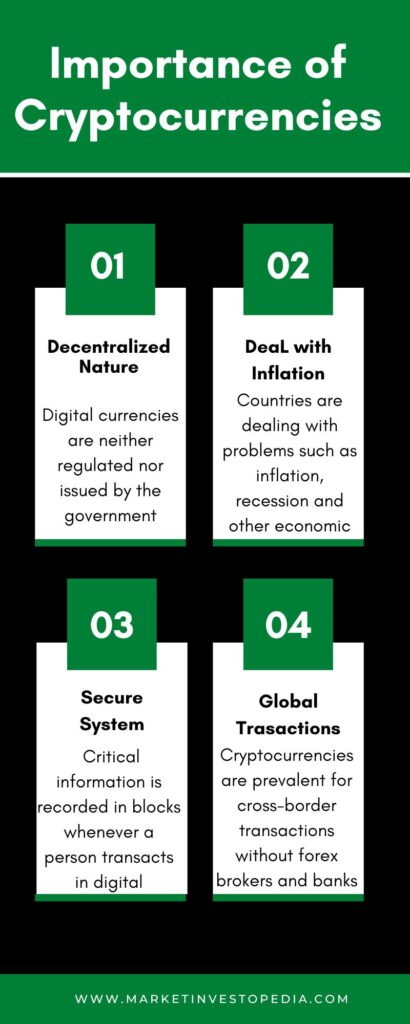

Importance of cryptocurrencies

It is essential for personal development to change according to technology and market conditions to stay profitable in the financial market; investing in the asset of modern times is best. Investing in cryptocurrencies has the following benefits.

Decentralized Nature: The main aim behind the origins of Cryptocurrencies is to provide decentralized money system. Digital currencies are neither regulated nor issued by the government.

So, you don’t need banks, brokers and other intermediaries and can control your funds independently. Also, blockchain technology provides a transparent and secure system.

Deal with Inflation: The present economic condition is weak in many parts of the world. Countries are dealing with problems such as inflation, recession and other economic uncertainties.

These economic issues have a significant impact on forex currencies. However, using cryptocurrencies result in protection against inflation and risk management. As these are digital currencies used globally, so are not affected by regional problems.

Secure System: Cryptocurrencies are based on blockchain technology, meaning critical information is recorded in blocks whenever a person transacts in digital currencies.

After verification, these blocks are connected to previous blocks and make a blockchain of all the transactions. So all the translations of crypto are well recorded and verified, which helps to maintain the value of digital currencies and eliminate the chances of fraudulent activities.

Global Transactions: Cryptocurrencies are the best way for online purchases on different crypto exchanges. Many trading platforms allows its user to buy their product and services using them.

Also, cryptocurrencies are prevalent for cross-border transactions without forex brokers and banks. That too in the minimum time and lowest cost.

Conclusion

The history of cryptocurrency is full of up and downs. With the high profit and a secure system, the crypto market also has significant risk and fraudulent activities.

Investing in cryptocurrencies is overall good. According to several reports, cryptocurrency will soon capture the foreign currencies market due to its transparency, security, hedge against inflation, fastest, time-saving transaction, straightforward approach, high profit and several other benefits.

However, the market is entirely based on technology and not regulated by any authorized institution. So it is affected by network issues, hacks, supply and demand and other challenges.

So traders, investors and users first need to understand how cryptocurrency works and then put their money by following proper crypto trading strategies to ensure profitability.