Free and AI Crypto Signals

Cryptocurrency traders do not predict the market in 2026. Industry research shows that more than 70 per cent of active retail traders rely on some type of trading signals related to cryptocurrency. The fluctuations in the crypto prices tend to be three times larger than the ones typical in the traditional markets, hence the necessity to have good signals, particularly the AI signals and free signals. Thousands of signal channels exist in Telegram, yet few of them have a regular value. This guide will introduce you to the reliable providers, the comparison between the free and AI signals, and the process of intelligent traders filtering useful signals and noise. The goal is uncomplicated: wiser decisions, risk management and restraint.

What are Crypto Trading Signals, and why do traders use them in 2026?

Cryptocurrency trading signals are understandable trade concepts that assist you in fast markets. Rather than guessing that it is time to buy or sell, a signal informs you of the entry price, the level at which to sell and the target profit. This structure is more significant in 2026 since the crypto is quicker than ever, and emotional errors may cost bodily cash.

Signals are used by most traders to prevent over-trading and remain disciplined. Novices acquire signals to learn. Seasoned traders cut through market noise using them. Good crypto signals do not promise a lot of money, but concentrate on risk management regardless of whether the signals are generated manually or automatically, by an AI. This specialisation ensures that there is sustainability in trading and not just speculation.

A quick glance

Learning websites, community groups, and certain providers provide free crypto signals to a limited extent. There are such websites as MarketInvestopedia, Learn2Trade, Crypto Inner Circle, and structured Telegram communities with systematic notifications.

Free crypto signals may assist beginners to learn how to trade and what the risks are. They demonstrate the time to buy and sell and the market trends. But they are not guarantees. You should make sure to check them before putting them to real trades.

The most reliable indicators are reputable learning sources, skilled merchants, and properly constructed algorithm services, which are aimed at risk and precise definitions, rather than hype. Find providers with actual outcomes and clarify how every trade functions.

Yes, AI is able to produce crypto signals based on historical data, market trends, price fluctuations, and technical analysis. The AI signals become ubiquitous in the year 2026, and they assist traders in making decisions quicker, more predictive and minimise mistakes that are emotional.

Best Free Crypto Signal Providers in 2026

No-cost crypto signals attract traders who wish to know the mechanics of signals before risking their money. In 2026, predictive trust providers save more time and effort on clean processes, risk, and consistency. Traders learn to use and apply signals in various ways, which is assisted by schools, trading firms and big communities among others.

The following five are some of the most popular platforms which provide free crypto or currency signals in various formats. They help traders to view trades, message transmissions and risk management.

1. ProfitFarmers

ProfitFarmers provides free access to crypto trading signals as part of its platform based workflow. Signals are integrated with trading tools, allowing users to understand entries, exits, and position logic within a structured environment. The focus is on simplifying execution while maintaining basic risk controls, which makes it useful for beginners exploring signal based trading.

• Free access to crypto trade setups

• Web-based platform, no Telegram dependency

• Integrated signal and execution workflow

• Beginner-friendly interface

2. Cryptohopper Marketplace

Cryptohopper offers a marketplace that includes several free crypto signal providers. These signals can be accessed directly through the platform dashboard and connected to supported exchanges. Traders often use free marketplace signals to test automation, observe signal consistency, and understand how algorithmic alerts behave in live markets.

• Free signal providers available in the marketplace

• Delivered via platform dashboard

• Supports exchange integrations

• Useful for testing automated workflows

Suitable for traders interested in platform-based signals without subscriptions.

3. Binance Killers

Binance Killers is a large community of crypto signals, which exchanges a vast range of trade ideas. The free signals are used by traders to monitor active markets.

- Many crypto trade signals

- Active on Telegram

- Popular liquid pairs: just strive to focus on them.

- Fast‑paced style

- Appropriate in the case of traders who prefer fast markets.

4. Learn2Trade

Free crypto and currency signals are provided by Learn2Trade to enable traders compare setups across various markets.

- Covers crypto and forex

- Technical analysis-based signals.

- Free to test signal clarity

- Includes learning material

- Appropriate in the case of traders desiring more than one market.

5. Crypto Inner Circle

Crypto Inner Circle provides free crypto signals primarily to gain an understanding of basic trade structure. The signals are straightforward and uncomplicated.

- Simple signal format

- Big cryptocurrencies are to be targeted.

- Community based

- Beginner-friendly chats

- New traders are also welcome to use trading with signals.

Best AI Crypto Signals Providers in 2026

Use of AI crypto signals is increasingly being applied in the year 2026 by traders who would rather have information to support their decisions rather than trading based on emotions. These are platforms based on algorithms, historical price data, volatility models, and technical indicators to come up with concrete trade ideas. AI signals do not get a trader out of risk, but rather assist traders to be more consistent, to act swifter, and to be disciplined when the market is moving blisteringly.

The following are the developed platforms which apply AI or algorithm-based systems to provide crypto trading signals differently.

1. Carlos and Company

Carlos and Company is known for combining crypto market analysis with structured signal-style insights. Alongside trade setups, the platform emphasises trader support through research discussions, educational webinars, and consultative guidance. This approach helps traders understand market context rather than relying only on signals.

• Crypto signal style trade insights

• Free consultancy-style guidance available

• Educational webinars and research sessions

• Support focused on understanding risk and structure

Suitable for traders who value guidance and learning alongside signals.

2. Market Investopedia

Market Investopedia positions crypto signals as part of a broader educational framework. Traders often use the platform for free learning resources, market breakdowns, webinars, and assisted guidance around trade structure. The focus remains on clarity, risk awareness, and decision-making support rather than high-frequency signals.

• Educational crypto signals and examples

• Free learning resources and webinars

• Structured assistance for beginners

• Strong focus on risk understanding

Suitable for traders who want education, support, and structured market insight.

3. altFINS

altFINS is also an AI-based market scanner rather than providing direct buy and sell calls. Its system analyses hundreds of cryptocurrencies with technical indicators and data filters. The platform is appropriate for those who are analytical or self-directed traders because they use it to reduce opportunities and verify setups instead of acting on signals.

- AI drives market screening

- Trend and technical filtering.

- Favours independent decision-making.

- Ideal to use as a data-driven trader.

4. Token Metrics

With their machine learning technologies, Token Metrics assesses the cryptocurrencies on their trend strength, volatility, and risk-adjusted performance. Unlike the short-term calls, it provides signal-type ratings that enable traders and investors to identify stronger and weaker assets in the crypto market.

- AI gives crypto ratings

- Risk‑adjusted analysis

- Long and short-term visions.

- research-based Signal approach.

5. Signals Blue

Signals Blue offers algorithmic and AI-assisted trading signals across multiple asset classes, including cryptocurrency. Their system focuses on probability-based setups and volatility conditions. Traders typically use these signals as part of a broader strategy rather than as standalone trade instructions.

• Automated signal generation

• Volatility-based trade logic

• Multi-asset coverage

• Systematic trading approach

The optimal use of AI Crypto Signals in 2026

Arbitrage AI crypto signals are most effective in the presence of risk management and discipline. They enhance uniformity and velocity, but the traders must regulate position magnitude and comprehend the market background. In 2026, the clever traders will think of AI as an assistance, rather than a way to win money.

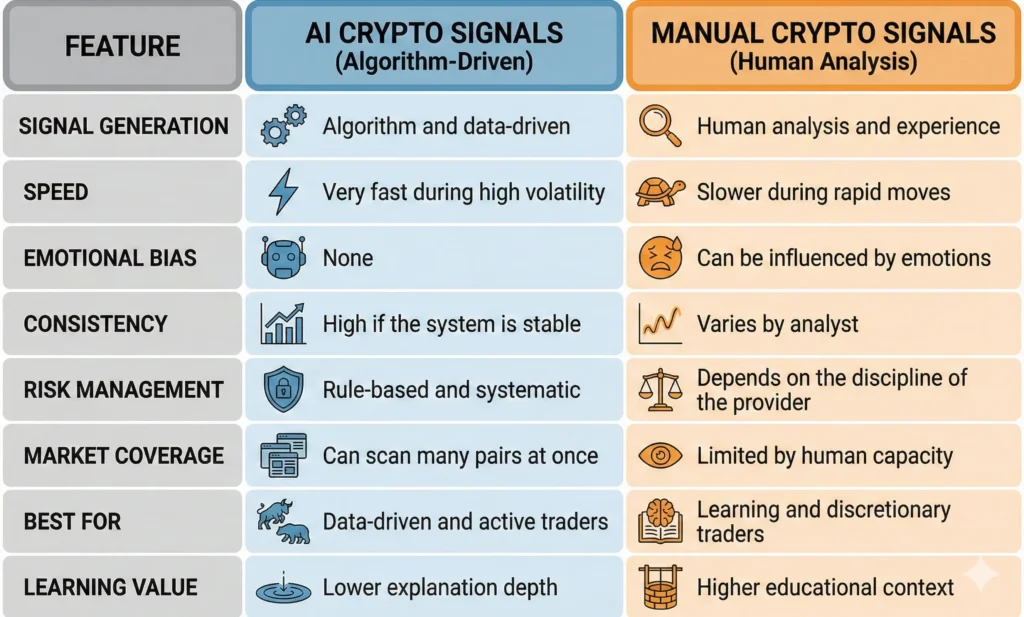

How to Use This Comparison in Real Trading

Neither AI nor manual crypto signals are perfect on their own. In 2026, many traders use AI signals to identify opportunities and manual signals to understand market context. This hybrid approach helps reduce emotional mistakes while maintaining situational awareness.

For beginners, manual signals are often easier to learn from. For experienced traders, AI signals provide speed and consistency. The right choice depends on trading style, risk tolerance, and time availability.

How to Choose the Right Crypto Signals in 2026

What Traders Really Do Before Following Any Signal.

The question of the best crypto signals will stop being asked in 2026. They inquire about what signals are their risk and style. This change is important since poor decisions and misuse are the main causes of most losses, not the signals themselves.

Traders tend to consider several fundamental aspects before adhering to any crypto or AI signal.

1. Signal Structure and Clarity.

Good signals indicate the entry range, stop loss and target very clearly. Another common sign of weak discipline is the presence of vague signals that fail to indicate the level of risk.

2. Risk Management Approach

Capital protection is of first importance to professional providers. Irregular stop-losses and impractical targets are alarming.

3. Consistency Claims Over Accuracy Claims.

Large accuracy figures are insignificant when the signal is not clear. It is better to have a steady execution and the truth in reporting losses than inflated win rates by a trader.

4. Market Suitability

There are those signals that have better performance in trending markets than others in volatile situations. Traders ensure that a signal conforms to the existing market behaviour.

5. Learning Value

Providing the signals explaining their reasoning aids traders in enhancing their decision-making in the long term. It is particularly for beginners.

The selection of the appropriate crypto signals does not rely on the imitation of the trades as much as the alignment of the tools to the discipline, the risk tolerance, and the long-term objectives.

Common Mistakes Traders Make When Using Crypto Signals

Most traders fail with crypto signals, not due to the incorrectness of the signals but because of the inappropriate usage of the crypto signals. This trend is among the largest causes of loss of confidence and capital by the beginning players in 2026.

1. Ignoring Risk Management Value

There are numerous traders who only consider the entry point and the target price and overlook stop losses. The most effective signals fail miserably when you fail to mitigate your risk. Placingan excess of your account in one trade may kill it in a short period of time.

2. Mindlessly imitating all Signals.

Signals are not supposed to be followed blindly. The market evolves, and what works decently with one individual may not be effective with another person. Replication of all signals may create excessive trading and emotional decisions.

3. Applying High Leverage Inexperience.

Profit and loss increase with leverage. Newcomers like combining free crypto signals with a high degree of leverage cause the account to become jumpy, and the odds of survival in the game become low.

4. Anticipation of Guaranteed Precision.

Not all the time the market forecast by any signal company. Traders who believe that they will never lose tend to lose self-control after a couple of unsuccessful trades.

5. Omission of Learning and Review.

Signals are most effective when you go back to your trades and see the reasons why the trade was won or lost. Unless you learn, you are repeating your mistakes.

Conclusion

Crypto signals in 2026 can optimally be used when the traders are aware of their role. They are aids to make decisions and not sure ways to make money. Free signals, AI models, and manual signals are all useful, but you need to be disciplined, have sensible expectations and control risk. Long-term traders do not make predictions; they concentrate on the process.

Signals assist novices in organising structure and prevent emotional errors. Their use by experienced traders saves time and ignores market noise. Select signals which suit your style, maintain stop loss and continue to monitor the results rather than trading on every signal.

Market Investopedia provides free crypto signals, in case you want to start practically. They elaborate on trade set-up, risk, and market movements such that you are able to be a disciplined trader. It aids in confidence creation, improved decision-making, and a risk-first attitude for the year 2026.