Beirman Capital is a growing broker for trading forex, comex, & Indices. Here is a quick Beirman capital review with its products, features, pros, and cons.

Overview of Beirman Capital

Beirman Capital is a growing broker platform to trade different financial assets. That’s why we have decided to conduct a BM Market Review, which will include its distinct features, services, pricing policies, customer support, and pros and cons.

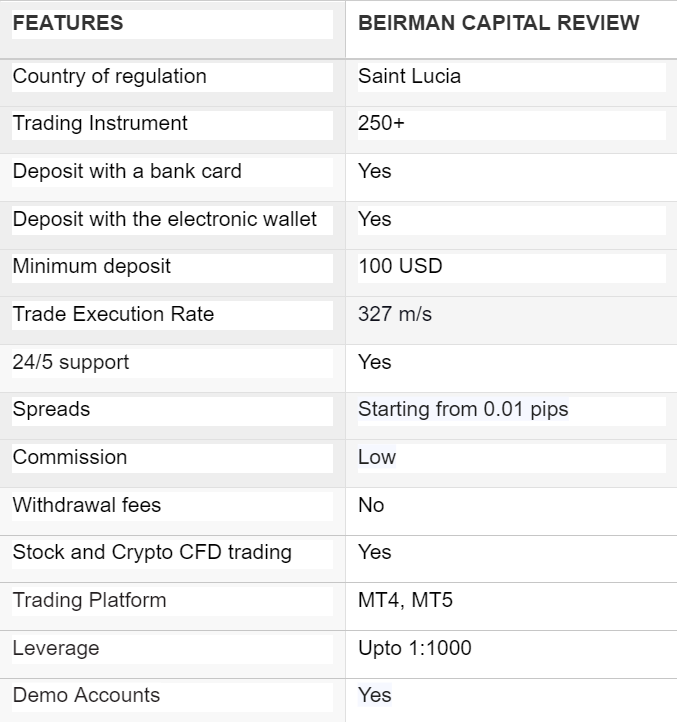

Beirman Capital is regulated by the Financial Services Authority of Saint Lucia under license number 2023-00347. The broker platform has over 10 years of experience providing financial trading services and is available in most countries.

- Minimum Deposit: 100$

- Trust Score: 98

- Tradeable Symbols: 250+

You can trade in a wide range of financial instruments on the platform, including forex, commodities, cryptocurrencies, stocks, indices, NDFs, and Bonds. Both Meta Trader 4 and 5 users can go for this broker. When it comes to account type, the broker provides raw ECN account, standard account, and Islamic account options to traders. So, both Islamic and non-Islamic traders can open an account with the platform.

Beirman Capital Review

Beirman Capital provides its clients with a good range of trading instruments to diversify their investment portfolio. When it comes to pricing, the trading fees are quite competitive compared to those of other brokers. The currency spreads start from as low as 0.01 pips. The commission is somewhere around 5 dollars for trading one lot. Also, the pricing structure is quite transparent; all the information is available on the website. The broker claims to charge no hidden fees. It does not charge any additional fees for deposits or withdrawals.

Beirman Capital can be the right choice for beginners or traders with a lack of market knowledge, as the educational resources are really good. You can access blogs, videos, webinars, books, training and educational material on the platform. In addition, you can find a range of fundamental and technical analysis tools like economic calendars, top news, trading charts, and indicators on the platform.

One of the best parts about this broker is it provides round-the-clock customer support. The broker claims to provide 24/5 customer support to its clients. Also, the account opening process is smooth and hassle-free; you can get access to your trading account in minutes. However, the broker may ask for KYC documents to complete the registration process.

Our Assessment of Beirman Capital

We have analyzed the products and services of Beirman Capital. It is a growing platform; you can find almost everything you need to begin your trading journey. The broker offers leverage up to 1:1000, which is high as compared to other platforms. This means that traders can also make large trades with small capital. Also, the broker provides traders with guaranteed stop loss, and segregated funds accounts features that are crucial to safeguard traders’ capital.

One of the key features that makes Beirman Capital different from other platforms is client relationship management services. The broker provides its client with a relationship manager. These managers assist clients at every stage of their trading journey.

Traders are generally concerned about the withdrawal and deposit of the capital. However, Beirman Capital claims to provide timely withdrawal and deposit facilities to its clients. It takes a maximum a day to withdraw the amount, and the method is quite smooth. The broker’s Islamic accounts are really good; these accounts are developed after considering Islamic teaching to facilitate trading for Muslim clients. You need not pay any interest or swap charges for holding trades for more than 24 hours with these accounts.

We have also analyzed the Beirman Capital reviews on the different sites and platforms and found that the broker has overall good customer feedback. The broker’s platform uses cutting-edge technology and follows safety protocols to provide clients with a secure trading experience.

The regulatory license information is clearly stated on its website, along with other important details regarding its foundation.

Summary

Beirman Capital can be a suitable broker for beginner, intermediate, and advanced levels of traders. The platform has a good website and social media presence. You can find all the information regarding its products and services on its website. The currency spread, fees, and commission structure are also clearly stated on the platform.

In addition, the broker also provides demo account services, so if you have any questions regarding the services, you can go for demo accounts. Like any other platform, there are both advantages and disadvantages to being with this broker, but the pros outweigh the cons.

Based on our Beirman Capital Review, we found the platform good for starting your trading expedition. On a scale of one to five, we give the broker a rating of 4.8 and a trust score of 98 out of 100.

Pros

- One of the key qualities of Beirman Capital is this broker is suitable for all sorts of traders. Whether you use short-term trading strategies like day trading, and scalping or long-term trading styles like position trading, you can go for this platform.

- Another key advantage of Beirman Capital is the platform is best for your risk and investment portfolio diversification. You can access to a range of instruments like top forex pairs, all major cryptocurrencies, commodities like Crude oil, gold, silver, popular stocks, indices, NDF and bonds all at one platform. So you can spread your capital into different assets and eliminate the chances of big losses.

- The Forex broker platform uses cutting-edge technology to provide its clients with fast and quick trade execution. Delays or requotes are quite common in the trading world and can have a huge impact on profit or loss. Therefore, real-time order execution of a trade is a must, and at Beirman Capital, you will get it.

- Beirman Capital provides segregated fund accounts to its clients. Segregated funds account is a facility to keep clients’ funds separate from the broker, and it is a must to protect the clients’ capital. It is a kind of insurance for your hard-earned money, and only some brokers offer this facility.

- Beirman Capital offers a number of discounts, deposit bonuses, and offers. It can be a great feature, especially for new traders with low capital, to start their trading journey.

Cons

- You need to have a capital of minimum of 100 USD to open an account with the platform. Many traders may see as a disadvantage, however you can also go for a demo account facility in the beginning.

- The broker may ask you for KYC documents to open an account. However, almost all reputable ask for some documents to verify your identity, and it may be seen as a disadvantage in the beginning, but that is only to safeguard the client’s interest.