Subscribe to Market Updates

Enter your email below to get our weekly research reports and trading insights.

Weekly Forex News & Market Pulse

The new trading week begins with uncertainty in the US economy. Political risks, key economic data, and big tech news are creating mixed signals for markets. These events are shaping currency flows, commodities, and risk appetite worldwide.

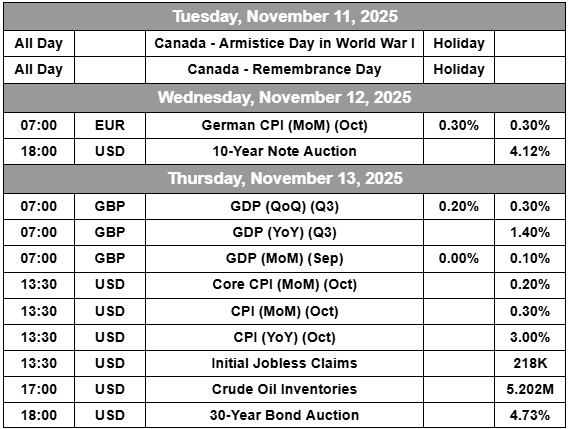

Weekly Economic Calendar

Summary of the key economic data releases, central bank events, and official speeches from major global economies for the week.

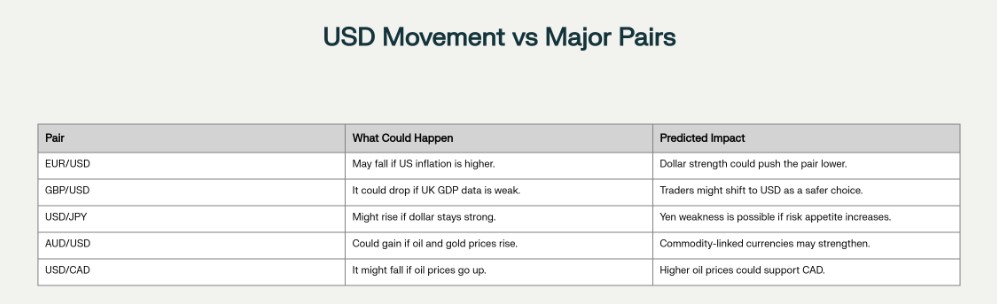

Possible USD Movement

US Government Funding Bill Passed?

The US Senate has approved a plan to keep the government open until January 2026. This means there will be no shutdown risk for now. It’s a positive sign for market stability and may help the US dollar stay steady. If market confidence improves, traders may return to riskier assets.

US Inflation Report – Main Focus This Thursday (Nov 13)

The United States will release its inflation (CPI) report for October. Experts think prices might rise by 3.0% (yearly) and 0.3% (monthly). If inflation is higher than expected, the US dollar might get stronger. If inflation cools down, the dollar could weaken, and gold might rise.

UK GDP Report – Also Coming on Thursday (Nov 13)

The UK will release its GDP data on Thursday. Analysts expect slow growth (~0.2%). If weaker, GBP/USD could drop; if stronger, it may climb.

Nvidia CEO to Meet President Trump

Nvidia’s CEO will meet President Trump to discuss AI chip sales and exports to China. Positive outcome could support US stocks; trade tension could reduce confidence.

Oil Inventory Report – Thursday (Nov 13, 12:00 PM ET)

US Crude Oil Inventory will show demand. Last week, inventories rose to +5.2M barrels, signaling replenishment. Strong demand may raise oil prices and benefit CAD/AUD; weak demand may lower them.

Forex Market View

- US CPI report is the most important event this week.

- US funding bill adds short-term stability.

- UK GDP may drive GBP movement.

- Oil data will affect CAD and AUD.

- Nvidia meeting could influence global sentiment and risk appetite.

Gold, Oil & Crypto Outlook

- Gold (XAU/USD): Might fall if USD strengthens after CPI.

- Oil (WTI): Might rise if supply is low or demand increases.

- Crypto (BTC): Could rise if USD weakens post-inflation.

Trader’s Edge: Week Ahead Tips

- Stay cautious before Thursday — volatility might increase sharply.

- Watch USD, XAU/USD, and DXY closely after the inflation release.

- Keep smaller trade sizes before key data.

- Oil and gold may offer short-term opportunities this week.

Remember: These are predictions, not guarantees. Markets can change anytime based on new information.