Trailing Stop Loss

The success of your trade highly depends on your exit plan. The more effective your trade exit is, the more favorable the result will be. Trailing stop loss is the tool that can make your trade exit smooth and profitable — whether you’re trading on Robinhood, TradingView, or platforms like Fidelity and Schwab.

Want to learn how? In this Market Investopedia blog, we will discuss trailing stop-loss orders, with their types, pros, and cons. So let’s get started.

What is a trailing stop loss order?

A trailing stop loss is a trading order to execute the buy or sell of a financial asset. It is an enhanced version of stop loss that adjusts automatically when the market moves in a favorable direction. This is also known as a trailing stop limit or trail stop order, and it’s available on many platforms like Interactive Brokers and Robinhood mobile.

The ultimate aim of a trailing stop loss is to lock and maximize the profit when the market turns in the trader’s favor. Here are the major types of trailing stops:

Buying Trailing Stop Loss:

When a trader opens a long trade using a trailing stop loss, the stop loss level automatically adjusts and moves upward when the prices of an asset rise and becomes fixed when the price reverses the direction. This is a common technique explained in trailing stop order YouTube tutorials, particularly useful for long trades.

Selling Trailing Stop Loss:

When a trader places sell orders using a trailing stop loss, the stop loss level automatically adjusts and moves downward when the price of an asset falls and becomes fixed when the price reverses the direction. This is how trailing stop orders provide flexibility compared to static stop losses.

A quick glance

A trailing stop level adjusts automatically when the market moves in a favorable direction and becomes fixed when the market reverses.

- Possibility of Premature Exit

- Requires Market Knowledge

- Limited Availability

A 7% stop loss level is a rule to close a trade at a loss of 7% to avoid significant losses.

Yes, the possibility of losing money exists even when trading with a trailing stop loss.

Trailing Stop Loss Example

Confused? Here is a trailing stop buy order example that helps you understand the concept of what is a trailing stop loss.

Suppose a trader is open to a buy position in the XAU/USD pair.

- Trade Entry Price: $3000

- Trailing Stop Loss: $50

In this case, if the gold price rises and moves to $3100, the stop loss level automatically rises to $3050 from the initial stop loss of $2950. If the trader chooses to close the trade, then the profit will be around $100.

In the same case, suppose the price reverses from $3100. Now the stop loss level becomes fixed at $3050, and the position will be closed at $3050.

In this way, traders can earn maximum profit with minimum losses by using the trailing stop loss feature

Key Benefits of Trailing Stop Loss

Solid Risk Management:

The risk of losing money exists when trading in any financial asset. You cannot eliminate the risk, but you can limit losses.

With trailing stop loss, the loss amount will be the same, but the profit can adjust according to market conditions. So if the market turns in your favor, you can earn more profit without taking more risk. That’s why understanding how to set a stop loss on Robinhood or how to set stop loss on Fidelity is vital.

Diverse Market Application:

Trailing stop loss orders have a broad scope and can be used for trading a range of assets. You can trade currency pairs, commodity products, metals, energies, stocks (including Schwab stock splits), indices, and many other financial products using it.

Flexibility:

The trading market is dynamic and changes due to different factors. To deal with flexible market conditions, you need a flexible order type. Trailing stop loss adjusts as per the conditions and allows you to take the maximum advantage of an opportunity. If you’ve ever compared trailing stop loss versus trailing stop limit, this flexibility stands out.

Effective Stop Loss Level:

Setting an ideal stop level is quite a complex task in trading. A conservative stop loss may close your position too soon, while a stop loss too far increases the loss amount. However, with trailing stops’ adjustable level features, setting an ideal and automatically adjustable stop price is easy.

Automation:

Manually adjusting stop loss levels can be complex. The best part of a trailing stop loss order is that you just need to set the execution criteria, and the trade level will adjust automatically. It saves your time and eliminates the possibility of delayed execution. That’s why traders look up interactive brokers stop loss by percentage and related features for more automation.

Cons of Trailing Stop Loss

Premature Exit:

It may be possible that due to a change in sudden market conditions, the price will see significant swings. In such a scenario, the chances of premature exits are present with trailing stop loss. This often comes up in stop quote limit Merrill Edge example cases.Requires Market Knowledge:

Trailing stop loss is undoubtedly a great feature. However, for effective utilization, you need to understand the market properly, such as knowing the difference between lead pip vs trailing pip or ideal trailing stop order best percentage.Limited Availability:

The trailing stop loss feature is not available at all trading broker platforms. So, to use the order type, you need to select an ideal broker accordingly — whether you’re on Robinhood, Fidelity, or other brokers offering stop loss tools.

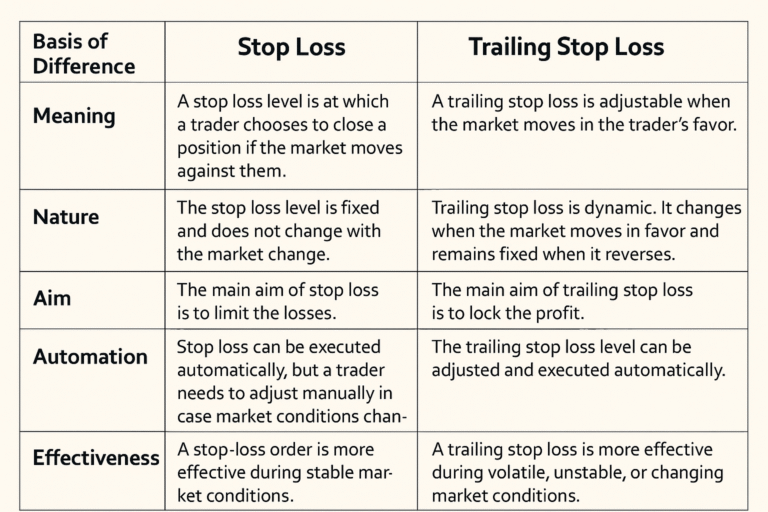

Stop Loss vs Trailing Stop Loss

Wrapping Up

Trailing stop loss is a must-know feature when you engage in buying and selling activities. It can lock your profit, limit losses, and assist you in dealing with changing market conditions.

However, you need to understand that using trailing stop loss every time when you place a trade is not always the ideal option. Also, even trailing stop loss has some limitations.

Understanding how to set stop loss on Robinhood, or how a trailing stop works, comes with knowledge. And Market Investopedia is the best place to gain that knowledge. Join us and get our valuable resources today.