Choosing a real forex broker to trade in the dynamic market is already a challenging task. And, the presence of scammers and fraudsters in the name of legitimate forex brokers makes it much more difficult for beginners. But worry not.

In this blog, we will help you select a legit forex broker and identify fraudsters in the market.

Introduction to the Forex Broker Platform

Forex Broker is the link between the large currency market and the trader. Such financial platforms provide traders with a range of trading facilities. It includes access to different financial assets, educational materials, leverage facilities, etc. For trading a dynamic currency market and enjoying good profit, having a broker is essential. And for the security of your fund, you should go for a well-regulated forex broker.

A QUICK GLANCE

Visit your broker’s website’s about us section and check the regulatory authority. A legit broker will have a license from a reputed financial jurisdiction.

Traders can seek the help of a FINRA Broker check to find the legitimacy of the broker. You can visit its website, email, or call to verify your broker.

Forex brokers registered under tier 1 and tier 2 financial jurisdictions are regarded as highly trusted.

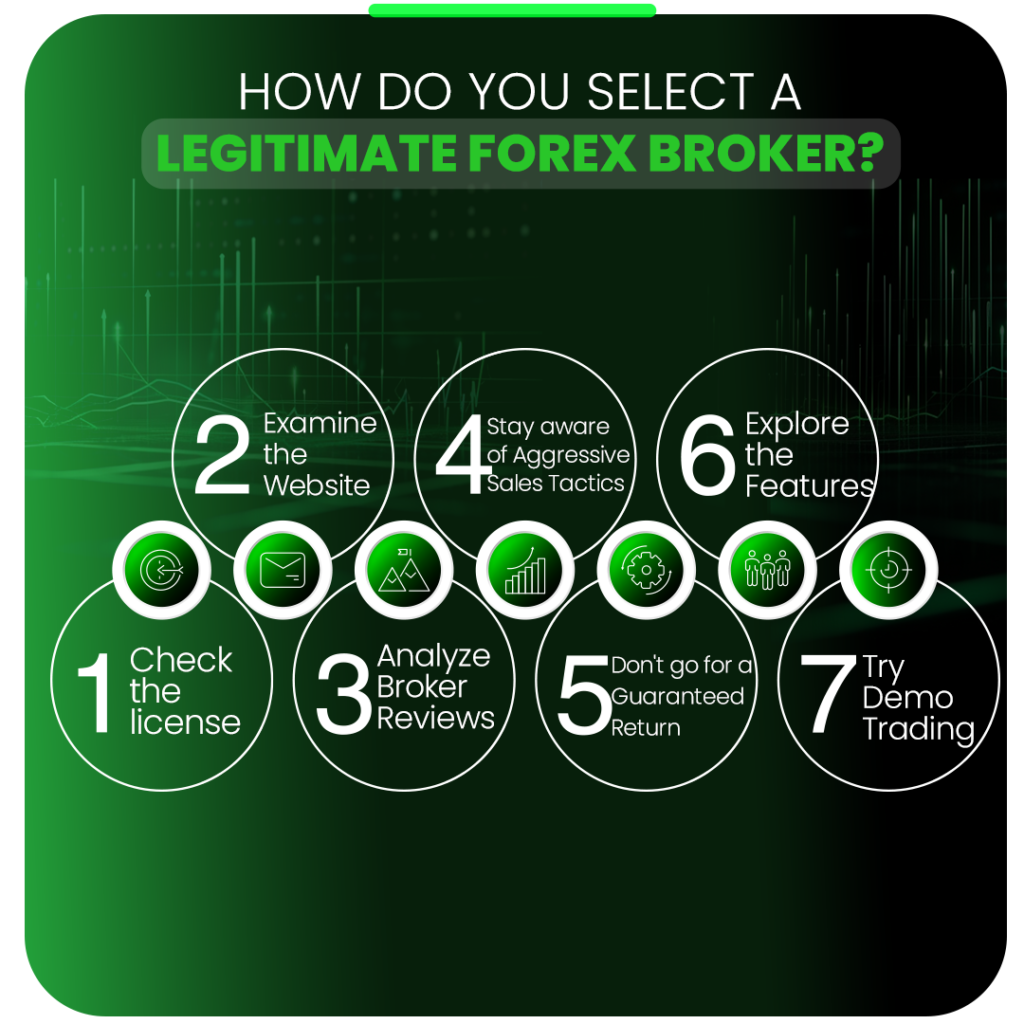

- Check the license

- Examine the Website

- Analyze Broker Reviews

- Stay aware of Aggressive Sales Tactics

- Don’t go for a Guaranteed Return

- Explore the Features

- Try Demo Trading

- Lack of License Information

- Low-Quality Websites

- Missing contact and Address details

- Aggressive Sales Tactics

- Lack of Client’s protection features

- High Return Offers

How to differentiate between a fake or real Forex broker

You can get in contact with numerous fake forex broker platforms that claim to be fully regulated. However, in the digital world, many forex trading scams run their businesses in the name of brokers. And a person with a lack of market knowledge struggles to differentiate between fake and real forex brokers.

In order to help you out, let me present you with our 7-step broker verification guide:

Give Priority to License Verification:

The first and most essential is to ensure you are trading with a licensed forex broker. A legitimate broker will provide all the regulatory information on the website.

However, you need to verify this information with the regulators. You can seek the help of a FINRA Broker check to verify your forex broker. Just visit their website and enter some details to check the authenticity of a broker. You can even mail them or call them to verify your broker.

With broker verification, considering the regulating authority’s trustworthiness is also essential. Forex is a global market with numerous financial Jurisdictions. The Tier 1 and Tier 2 institutions are highly trusted, while the Tier 4 and Tier 5 institutions involve significant risk. So here you need to make sure that your forex broker has a license from tier 1 or tier 2 financial Jurisdictions.

Examine the Website:

Making a website is not a big deal in today’s world. Many traders think having a website is a sign of a real forex broker. But that’s not true at all. These days, fraudulent platforms and scammers also have a website. However, the website’s quality and the information it provides can surely help you identify fake brokers. The best forex broker will provide clear contact information, including the address, phone number, email ID, and links to social media platforms on the website.

Also, the financial market is subject to risk, so you will see a risk warning or disclaimer with a real broker at the end of the page. Further, a fake broker cannot afford to maintain a high-quality website. So, if your broker has a vague website with limited and unclear information, it’s a sign of forex trading scams.

Analyze Forex Broker Reviews:

You may have seen a broker claiming high customer satisfaction and showing numerous positive reviews. Don’t trust them; do your own research and analysis. Go to different broker review sites and search about the respected broker to read the reviews. Also, many brokers write fake reviews on such sites. However, identifying them is quite easy; real customers have real stories and experiences.

Further, reputed platforms always reply to their clients. Even in the case of negative reviews, the broker will respond to the client’s complaints and try to solve their problems. With customer reviews, you can also refer to the broker review by a trusted financial education website. Such review websites provide in-depth reviews about brokers. You can get all the information on such sites, including licenses, features, services, and fees.

Stay aware of Aggressive Sales Tactics:

Forex trading is all about making money from money. And, when money gets involved, forex trading scams and fraudulent activities increase. Generally, real forex broker does not force their client to deposit more and more money. However, fake broker platforms reach different traders and follow aggressive sales tactics. No doubt a broker is making money from you, so they will ask you to open an account. But the problem starts when a broker pressurizes.

So, if you are feeling any pressure of depositing funds or restrictions on fund withdrawal, it’s time to unsubscribe from its services. In addition, when someone reaches out in the name of a broker, ask questions about its services.

Don't go for a Guaranteed Return:

A broker is a platform that connects you to the forex market. In return for the trading facilities, the broker charges trading fees in the form of currency spreads or commissions.

Your profit and loss will solely depend on your analysis and trade decision. The broker will have no relation to the trading outcome. It can only provide you with the top facilities so that you can execute trade smoothly. Therefore, if a broker platform claims to provide you with unrealistic or guaranteed high returns, It is just a way to fool you.

Explore the Features:

Whether a trading platform is legit or not can be determined from the services. Forex trading involves risk, and a broker takes some safety measures to protect traders from excessive risk. The best forex broker platform offers client protection features like segregated fund accounts, risk management tools, guaranteed stop-loss execution, and many others. In addition, brokers need to follow the guidelines of financial jurisdictions.

Many regulators restrict brokers from providing high leverage. Even after that, some brokers offer unrealistic leverage. However, unrealistically high leverage is not a good sign when choosing a broker.

Try Demo Trading:

Traders generally deposit real funds directly after selecting a broker. However, one should consider demo trading first before depositing your hard-earned money. Almost every legit trading platform provides demo account facilities. So, ensure you test the broker yourself and determine whether it is right for you. Once you are satisfied with demo account services, start trading with a small fund. Test the withdrawal and deposit services at the beginning. If you feel any kind of withdrawal restrictions, then it is better not to deal with that platform.

Bottom Line

Forex Trading can be an ideal way for generating income with low capital requirements and huge profit probability. Opening an account with a broker platform is essential to get access to the currency market. However, finding a real forex broker involves proper research, knowledge, and analysis. Not every trader can dedicate hours to choosing a broker. But worry not. Marketinvestopedia is there for you.

We help our clients in selecting the best forex broker by understanding their requirements. So, if you are also struggling with broker selection, you can give our platform a try.