What is swing trading?

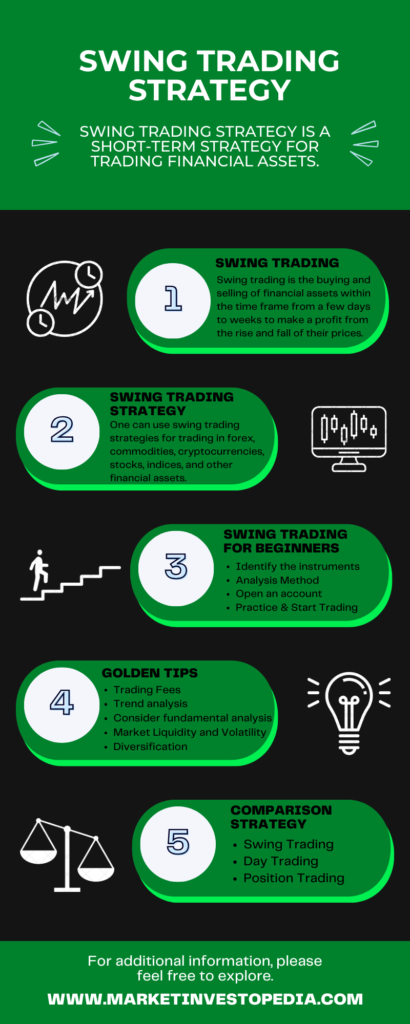

Swing trading is the buying and selling of financial assets within the time frame from a few days to weeks to make a profit from the rise and fall of their prices.

Like other trading strategies, swing trading also involves buying the asset when you think its price will rise and selling the asset when you think the price will fall.

However, the major difference is the time frame, which changes the whole game. Swing trading is a medium-term trading strategy where the trader opens the position from a few days to a week.

Swing traders usually place multiple trades of durations of 2 to 15 days with the aim to make a profit of 5 to 15 percent per trade, expecting a big overall profit from all trades.

Swing Trading Strategy Example

One can use swing trading strategies for trading in forex, commodities, cryptocurrencies, stocks, indices, and other financial assets. Let us have a look at an example of swing trading in forex for an effective understanding.

Suppose a trader is trading in a USD/GBP pair.

He came across an economic report which suggests that the pair is all set to rise in the upcoming month due to a positive US economic data release.

After this, for confirmation, he monitored the USD/GBP monthly chart and the price of the pair was moving in the downward direction, nd is currently hovering at 0.79.

The trader has spotted strong support at the 0.76 level, and according to the trader analysis, if the price touches this level, then the downtrend will stop, and it will start moving in the upward direction.

Based on his combined fundamental and technical analysis, he has decided to open a long position when the price of the pair reaches the key level of 0.76.

Now, suppose the price reaches the key level, and the trader has bought the mini lot that is 10,000 units of the pair. The trader’s analysis went true, and after 12 days, when the price reached 0.81, he decided to close the position.

In this case, the trader’s profit is {10,000(0.81-0.76)} is 500 dollars. So, the trader has made a profit of 5% on the trade within the time duration of 12 days.

How to start swing trading for beginners

In case you are new to the trading world and don’t know how to get started. Here is a step-by-step procedure for starting your journey as a swing trader:

A quick glance

Swing trading is the buying and selling of financial assets within the time frame from a few days to weeks to make a profit from the rise and fall of their prices.

Swing traders usually place multiple trades of durations of 2 to 15 days with the aim to make a profit of 5 to 15 percent per trade, expecting a big overall profit from all trades.

- Grab market knowledge

- Identify the instruments

- Select your analysis method

- Open an account

- Practice & Start Swing Trading

- Consider Trading Fees

- Trend analysis

- Consider Fundamental analysis

- Market Liquidity and Volatility

- Diversification

- Use Leverage Wisely

Grab market knowledge

The first and foremost step to start swing trading for beginners is to educate yourself about the financial markets and the factors affecting them.

In this step, swing traders need to get indept knowledge about the market they want to trade, like forex, stock or any other market. Once you have decided on the market, get well-versed with the basics like trading terminologies, risk management, market orders, analysis methods, trading strategies, etc.

Identify the instruments

Once you think that you have got sufficient knowledge about the specific trading market it’s time to select the asset in which you want to trade.

There are more than 180 currency pairs, over 22 000 cryptocurrencies and numerous stocks available to trade in. So, suppose if you want to trade in stocks in this stage you will decide few stocks in which you want to trade in based on your needs.

Also, you need to consider your strategy for selecting the right instrument. Generally, swing traders prefer assets with high market liquidity and volatility.

Select your analysis method

Analysis is the most important factor for swing traders to identify potential trading opportunities. Generally, short-term traders like scalpers and day traders prefer technical analysis.

Meanwhile, long-term traders like position traders and buy-and-hold traders prefer fundamental analysis. However, as swing trading strategies are medium-term, the best way to trade is to learn both the analysis and use them simultaneously.

Also, you need to choose technical analysis indicators which you will use to place the trade. There are a number of indicators, including Bollinger bands, Fibonacci retracements, oscillators, support and resistance, etc., which you can include to make the best swing trading strategy.

Open an account

For trading in financial instruments, you need a broker who will act as a bridge between the market and you. Your broker will provide you with a range of assets and facilities to trade in the market.

In this stage, you need to select a broker that suits your strategy and provides you facility that matches your requirements. For swing trading strategies leverage ratio, trading instruments availability, swap charges, and trading spreads are important elements to consider.

Practice & Start Swing Trading

In the above steps, you have gathered the knowledge and resources. But for starting swing trading for beginners, practice is essential.

However, before putting your hard-earned money in the market, it is better to practice swing trading with the help of demo accounts. These accounts allow traders to trade in real market conditions and learn to trade. It is a great way to test the effectiveness of your trading plan.

Once you have practised the swing trading strategy and you have faith in your plan, you can start trading with real money. Embrace technical and fundamental analysis to identify medium-term trading opportunities with the potential return and start placing a trade.

Golden tips for using swing trading strategies

Trading is a rewarding game, and you have to follow some set of golden rules to make potential returns. So let us quickly discuss some effective tips to develop the best swing trading strategy:

Consider Trading Fees

In swing trading, traders usually hold the position from 2 to 15 days; however, to hold the position overnight, you have to pay an amount called swap charges. These swap charges can really affect your overall profit, so always consider them.

Trend analysis

A trend is a swing trader’s friend, so you should consider the current market trend to make trading decisions accordingly. It will also help you identify crucial points like entry and exit points.

Consider fundamental analysis

One of the biggest mistakes swing traders make is they only trade using technical analysis. However, swing trading is not a short-term strategy; one crucial economic event or big announcement can change the whole market. So, one should also consider geopolitical, economic, social and overall fundamental conditions to trade efficiently.

Market Liquidity and Volatility

A swing trader should always keep an eye on the volatility and liquidity of the asset before placing a trade. Liquidity states the ability to quickly buy and sell assets, while volatility represents the degree of price fluctuation over a period. It is better to go with highly volatile and liquid assets.

Diversification

Swing traders place few trades as compared to day traders or scalpers. They cannot afford to invest in an asset with similar market conditions.

So, it is essential to spread their capital into different assets, including currency pairs, gold, oils, stocks, etc, to stay in a stable condition even in the opposite market condition.

Use Leverage Wisely

Swing traders generally use leverage facilities to place trade worth of large amounts with small capital to make a big amount of profit. However, Leverage magnifies your profit as well as losses, so use them wisely and consider your risk from the trade.

Comparison Between Swing Trading, Day Trading & Position Trading Strategy

Traders generally find difficulty in differentiating swing trading strategy from day trading and position trading. So, let us have a look at the comparison between these three strategies for a better understanding:

Wrapping Up

Many traders feel swing trading strategies are not worth it due to the slow trading process. However, for beginners, swing trading is a great option to start their trading journey.

Unlike short-term trading strategies, you don’t need to watch charts continuously, or long-term strategies, you don’t have to wait for profit for months in swing trading strategy.

The trading method keeps a balance where you can make a focused decision without dedicating all of your time to trading. So traders with jobs and businesses can surely go for this strategy.

However, like any other trading strategy, swing trading also requires commitment, time, discipline, analysis, proper execution, risk management, and the right psychology.