01 Key News Insights

Date: 20th February, Friyday, 2026

Daily Economic Outlook:

US Initial Jobless Claims Fall Sharply

- Initial jobless claims in the US fell by 23,000 from the previous week to 206,000 on the second week of February

- It remain well below market expectations of 225,000, to swing back to levels that are well below the average through the start of last year.

- In turn, continuing claims inched higher by 17,000 to 1,869,000 on the first week of February.

US Trade Gap Higher Than Expected

- The US trade deficit widened to $70.3 billion in December 2025 from $53 billion in November, above forecasts of a $55.5 billion gap.

- Exports were down 1.7% to $287.3 billion, led by a big fall in nonmonetary gold.

- Meanwhile, imports went up 3.6% to $357.6 billion, led by purchases of computer accessories.

Tensions Rise Between the USA & Iran after ongoing discussions remain inconclusive

- Washington said Tehran will suffer if it does not agree to a deal on its nuclear activity in a matter of days.

- Iran planned joint naval exercise with Russia after temporarily closing the Strait of Hormuz for military drills.

- Meanwhile, Trump is weighing an initial limited strike on Iran to force Tehran to meet his demands for a nuclear deal.

- The UK is blocking Trump from using RAF (British Royal Air Force) bases for strikes on Iran

The Dollar Index (DXY)

- The US Dollar shows strength during the early European trading session on Friday.

The index is trading below the monthly highs of 98.00, and failed to give a close higher. - Based on the rising Iran-US tensions, DXY might show bearish retracements.

EUR/USD

- After closing in the red on Thursday, EUR/USD stays on the back foot early Friday and trades at around 1.1750.

- PMI data from Germany and the Eurozone are both forecast to point to an ongoing expansion in the private sector’s business activity in February.

GBP/USD

- GBP/USD registered losses for the fourth consecutive on Thursday.

- The pair continues to push lower and trades at its weakest level since late January below 1.3450.

- The UK’s Office for National Statistics reported on Friday that Retail Sales increased by 1.8% on a monthly basis in January, surpassing the market expectation of 0.2% by a wide margin.

USD/CAD

- USD/JPY extends its weekly rally and trades comfortably above 155.00 early Friday.

- Japan’s PM said earlier in the day that necessary spending will be funded as much as possible through the initial budget.

- She plans to steadily lower the debt-to-GDP ratio and restore fiscal sustainability.

01 - Instructions/ Guidelines for Executing Suggested Trades

- Close your trades within 8-10 hours or before 6:30 PM UTC (midnight IST), regardless of profit/ loss.

2. By chance, if you face losses in your “Primary Trade”, the “Alternative Call” is designed to recover those losses.

3. That’s why, always place the “Alternative call” alongside the “Primary Call”.

4. In case the “Alternative or Recovery Call” doesn’t get triggered the same day, a new call (or signal) will be provided the following day.

5. Generally, the Global Market Outlook Report includes signals with a higher reward-to-risk ratio (from 2:1 and higher). Therefore, consider booking partial profits in steps as follows:

a. For example, if the reward is two times the risk (or 2:1), consider booking half (or 50%) of the profit when levels reach a 1:1 ratio, and maintain the remaining position.

b. Then, when prices reach twice the risk (2:1), book the remaining 50% position.

c. To make this process seamless and smooth, consider placing two calls simultaneously with the same Stop-Loss (SL) and Entry-Level but different Target-Levels.

Note: These guidelines aim to optimize your trading strategy while managing risks effectively.

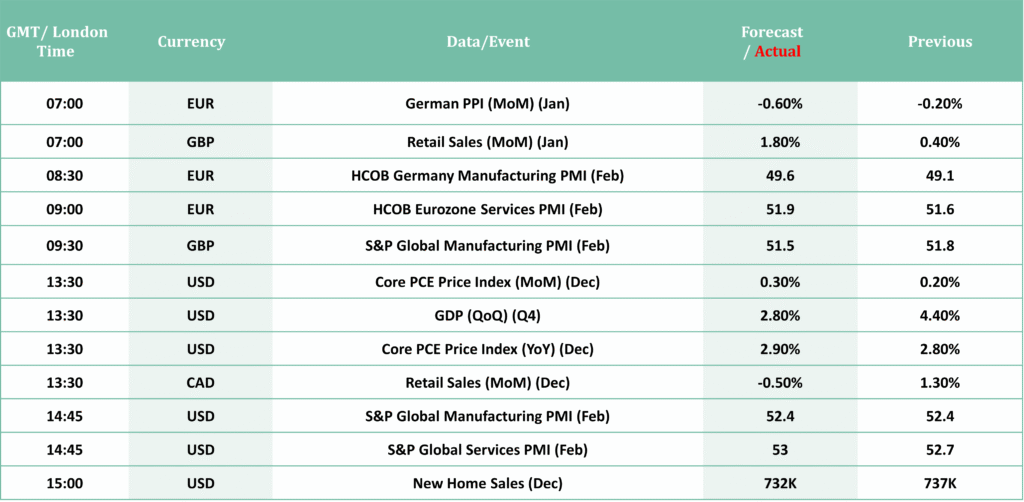

02 - Economic Calender

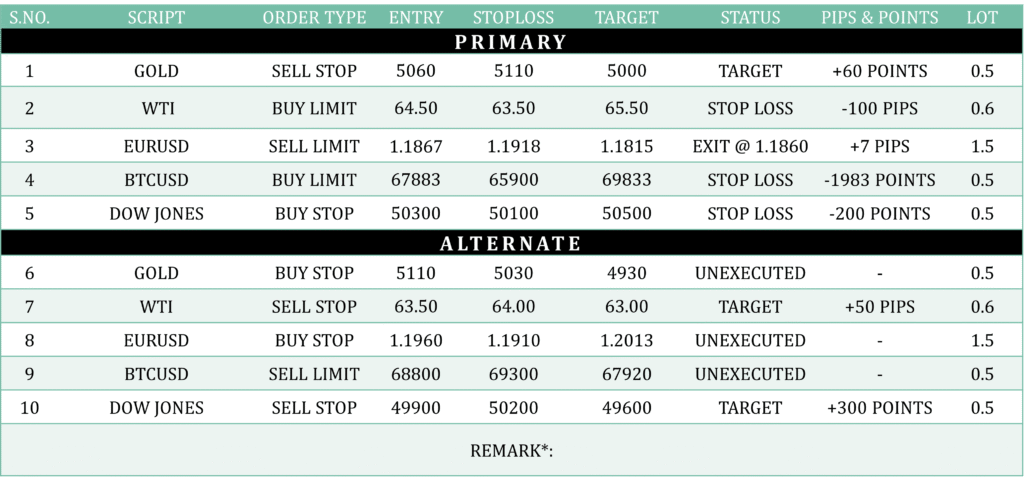

03 - Previous Day Performance

04 - Instructions/Guidelines for executing suggested trade

- Close your trades within 8-10 hours or before 6:30 PM UTC (midnight IST), regardless of profit/ loss.

2. By chance, if you face losses in your “Primary Trade”, the “Alternative Call” is designed to recover those losses.

3. That’s why, always place the “Alternative call” alongside the “Primary Call”.

4. In case the “Alternative or Recovery Call” doesn’t get triggered the same day, a new call (or signal) will be provided the following day.

5. Generally, the Global Market Outlook Report includes signals with a higher reward-to-risk ratio (from 2:1 and higher). Therefore, consider booking partial profits in steps as follows:

a.For example, if the reward is two times the risk (or 2:1), consider booking half (or 50%) of the profit when levels reach a 1:1 ratio, and maintain the remaining position.

b.Then, when prices reach twice the risk (2:1), book the remaining 50% position.

c.To make this process seamless and smooth, consider placing two calls simultaneously with the same Stop-Loss (SL) and Entry-Level but different Target-Levels.

Note: These guidelines aim to optimize your trading strategy while managing risks effectively.

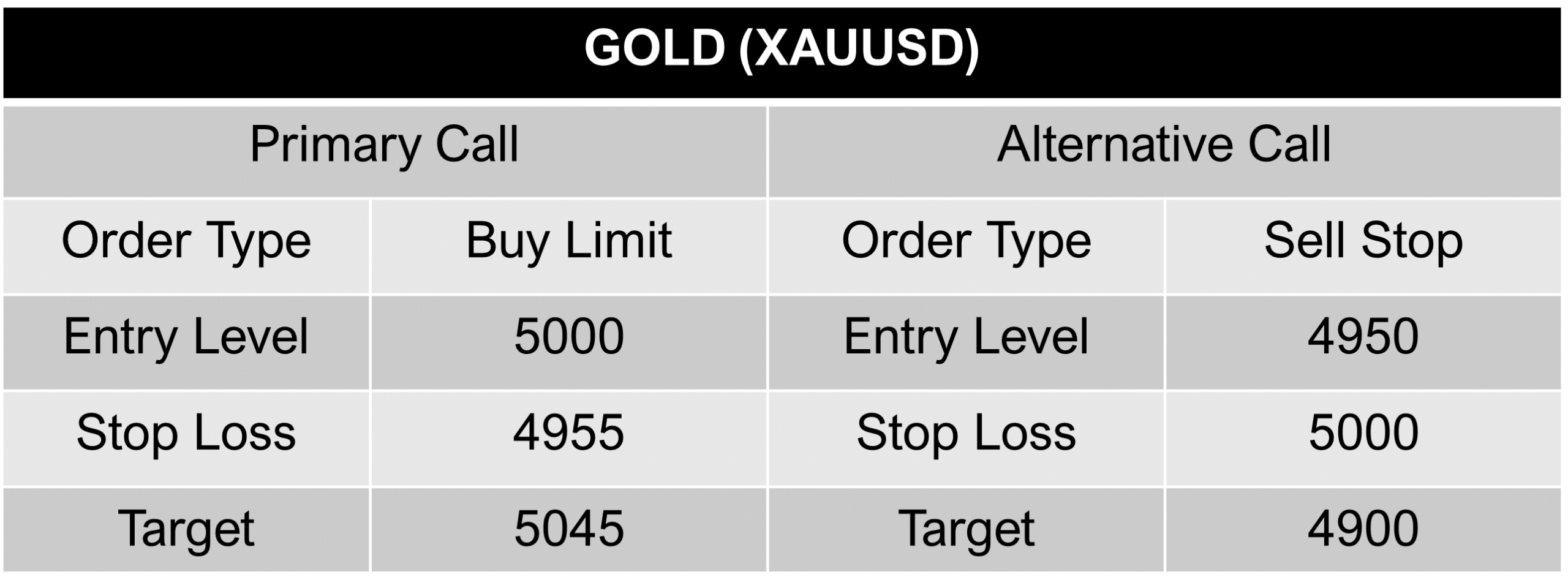

05 - Gold Analysis

Overview: Gold has been exhibiting strength over the past two sessions, with the bias remaining bullish as a constructive structure continues to form on the 1-hour timeframe. The 5,000 level stands out as a key zone for intraday long positions and 5045 could act as a breakout point from the current hourly consolidation range. However, a sustained close below 4,970 would signal potential weakness. Long opportunities will be considered around the London open.

Biasness: Gold prices ticked higher in Asian trade on Friday after two days of gains, but remained on track for weekly losses as investors navigated heightened U.S.-Iran tensions and awaited key U.S. inflation data.

Key Levels:

R1- 5119 R2- 5454

S1- 4657 S2- 4403

Data Releases: Today’s U.S. economic data—Advance GDP (q/q), Core PCE Price Index (m/m), and Flash Manufacturing & Services PMI—may fuel heightened volatility in gold prices during the New York session.

Technical Analysis: The price is holding above 100 EMA on the 4H timeframe, with the EMA slope trending upward, indicating a bullish bias.

Alternative Scenario: If prices starts to close below 100 EMA on 4H timeframe & closes below 4940 then we can plan short entries.

While writing the report, gold is trading at 5014.

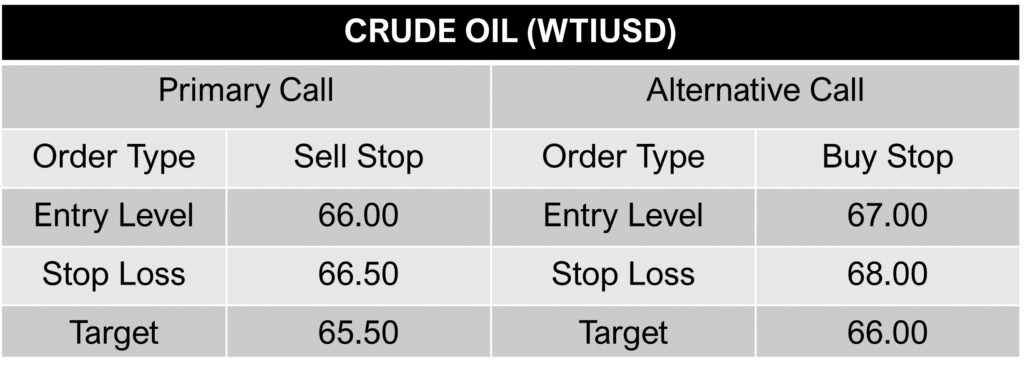

06 - Crude Oil

Overview: The primary trend in oil is bullish. On the 4H chart, the prices rose substantially in the previous 2 trading sessions and recently tested the resistance at R1 = 67.00. Now oil might retrace a little towards the mentioned support zones (S1: 66; S2: 65), before continuing its bullish trajectory.

Biasness: Crude Oil has reacted sharply to shifting US–Iran headlines, with prices rising to $67 per barrel, the highest since early August. Markets are focused on whether negotiations deteriorate into military confrontation, as US has moved significant military assets into the region.

Key Levels:

R1: 67.00 R2: 68.00

S1: 66.00 S2: 65.00

Data Releases: Today, several key U.S. releases are due, including the PCE Inflation Index, GDP, Home Sales, etc. which might creates volatility. Apart from that the oil rig count data is crucial for oil. A fall in rig count will signal lower demand in oil related products and thus prices may negatively react.

Technical Analysis: The prices are trending in the overbought zone of the indicators, hence minor retracements cannot be rejected.

Alternative Scenario: Only a sustainable breakout and closing of 4H candle above the immediate resistance R1 (67.00) might drive oil prices higher to far resistance zone.

While writing the report, the pair is trending at 66.25

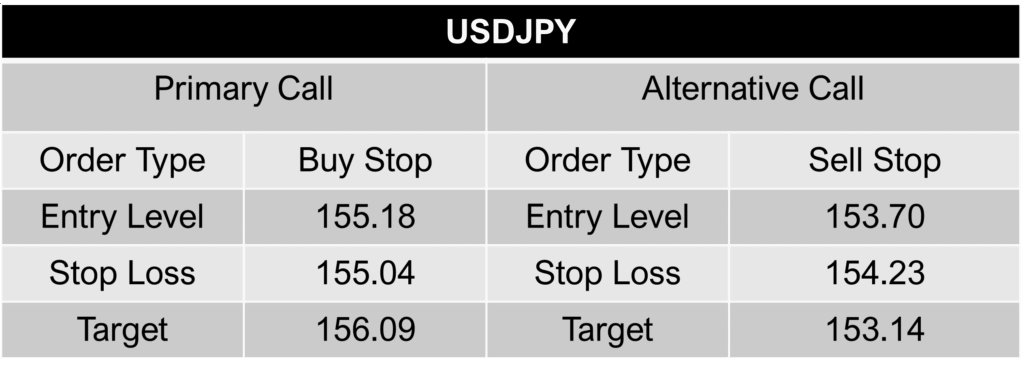

07 - USD/JPY

Overview: The broader trend remains bullish. Price has formed a higher low near 152.35 and is now trading within an ascending channel, showing steady upside momentum toward higher resistance levels.

Biasness USDJPY is supported as the dollar strengthened ahead of U.S. PCE data and hawkish Fed signals, keeping U.S. yields firm. At the same time, Japan’s CPI slowed to 1.5%, below the BOJ target, reducing rate hike expectations and favoring further upside in USDJPY.

Key Levels:

R1: 156.60 R2: 157.80

S1: 153.70 S2: 152.35

Data Release USDJPY is likely to stay supported as strong U.S. GDP (4.4%) and steady PCE inflation keep Fed policy expectations firm, supporting higher U.S. yields. Although Japan’s inflation remains above target, it is not strong enough to trigger aggressive BOJ tightening, maintaining upside bias in USDJPY.

Technical Analysis: Price is trading above short-term moving averages with RSI holding above mid-levels, indicating positive momentum. A continuation above 155.50 can accelerate the move toward 156.60–157.80.

Alternative Scenario: A sustained move above 156.6 would invalidate the bullish structure and shift momentum back toward the downside.

While writing the report, the pair is trending at 155.36.

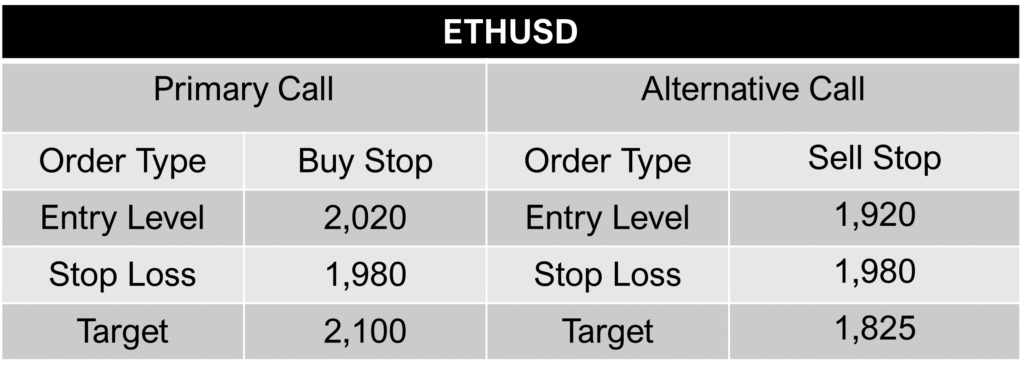

08 - ETH/USD

Overview : ETHUSD remains in a short-term consolidation phase after rejecting the descending trendline resistance near the $2,020–$2,030 zone (R1). Price is currently holding above immediate support at S1 forming a range-bound structure within a broader corrective trend below the 100 EMA. RSI showing slight upside momentum whereas price remaining in a box

Biasness: Sharplink, a leading advocate for Ethereum-focused digital asset treasuries, announced a series of major milestones on Thursday that signify its rapid ascent in the institutional finance space.

Key Levels:

R1 : 2,020 R2 : 2,100

S1 : 1,920 S2 : 1,825

Data Release: Today’s PCE Price Index m/m data from the US may introduce short-term volatility across crypto markets, potentially acting as the catalyst for the next directional move

Technical Analysis. ETHUSD is consolidating between $1,924 (S1) and $2,026 (R1) after rejecting the descending trendline resistance. Thereby RSI ascending above 50 slowly and price showing flat Price compression suggests a potential breakout setup. Holding above support keeps a mild bullish recovery toward $2,026, while a breakdown below $1,924 may open downside toward $1,823 (S2).

Alternative Scenario: A breakdown below $1,924 would weaken the structure and expose the next demand zone near $1,823 (S2), confirming continuation of the broader corrective trend.

While writing the report, the pair is trending at 1,981.

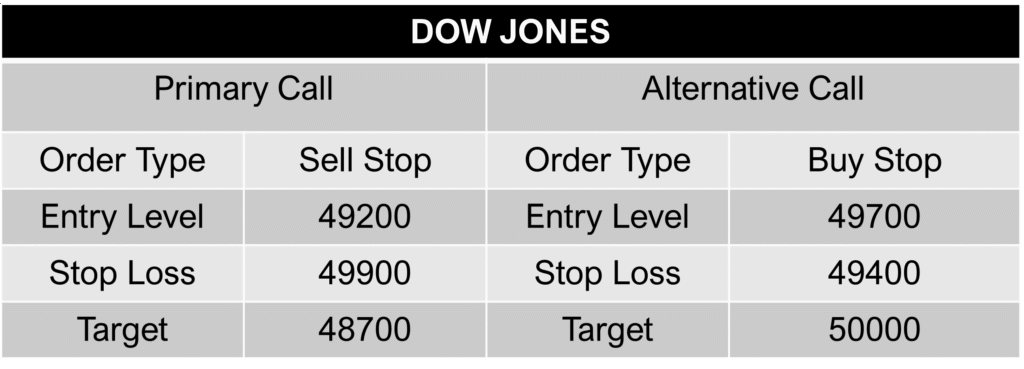

09 - DOW JONES

Overview: The primary trend of the Dow Jones remains bullish. On the 4H chart, prices tested the trendline yesterday and rebounded while correcting. However, failure to sustain above the pivot level could trigger renewed bearish pressure in Dow Jones prices.

Biasness: The Dow Jones slipped as losses in Salesforce and Goldman Sachs weighed on the index, continuing market pressure amid lingering geopolitical and economic concerns. Traders remain cautious ahead of upcoming key data and Fed speeches.

Key Levels:

R1: 49700 R2: 50500

S1: 49200 S2: 48600

Data Release Today, several key U.S. releases are due, including the Core PCE Price Index, PCE Price Index, GDP, new home sales, Michigan inflation expectations, and S&P Manufacturing and Services PMI. Stronger-than-expected data could support the dollar and pressure the Dow Jones lower.

Technical Analysis: 12 period EMA is currently below of 52 period EMA , indicating bearishness.

Alternative Scenario: If prices are able to breach the immediate resistance level and if 12 period EMA crosses above of 52 period then further bullishness can be seen.

While writing the report, the pair is trending at 49479.

10 - Disclaimer

- CFD trading involves substantial risk, and potential losses may exceed the initial investment.

- Signals and analysis are based on historical data, technical analysis, and market trends.

- Past performance does not guarantee future results; market conditions can change rapidly.

- Consider your risk tolerance and financial situation before engaging in CFD trading.

- Signals are for informational purposes only and not financial advice.

- Each trader is responsible for their decisions; trade at your own risk.

- The report does not consider individual financial situations or risk tolerances.

- Consult with financial professionals if uncertain about the risks involved.

- By accessing this report, you acknowledge and accept the terms of this disclaimer.

Safe trading,

Market Investopedia Ltd