Crude Oil Trading Strategies for Beginners

Crude oil is a commodity with a finite nature, global demand, limited supply and diverse usability. The commodity has become increasingly popular in the financial market, especially in the present time with the varied market dynamics.

The change in diplomatic relationships between countries, wars, and export and import conditions significantly affect the prices of crude oil. So naturally, black gold is attracting novice traders in current trading scenario.

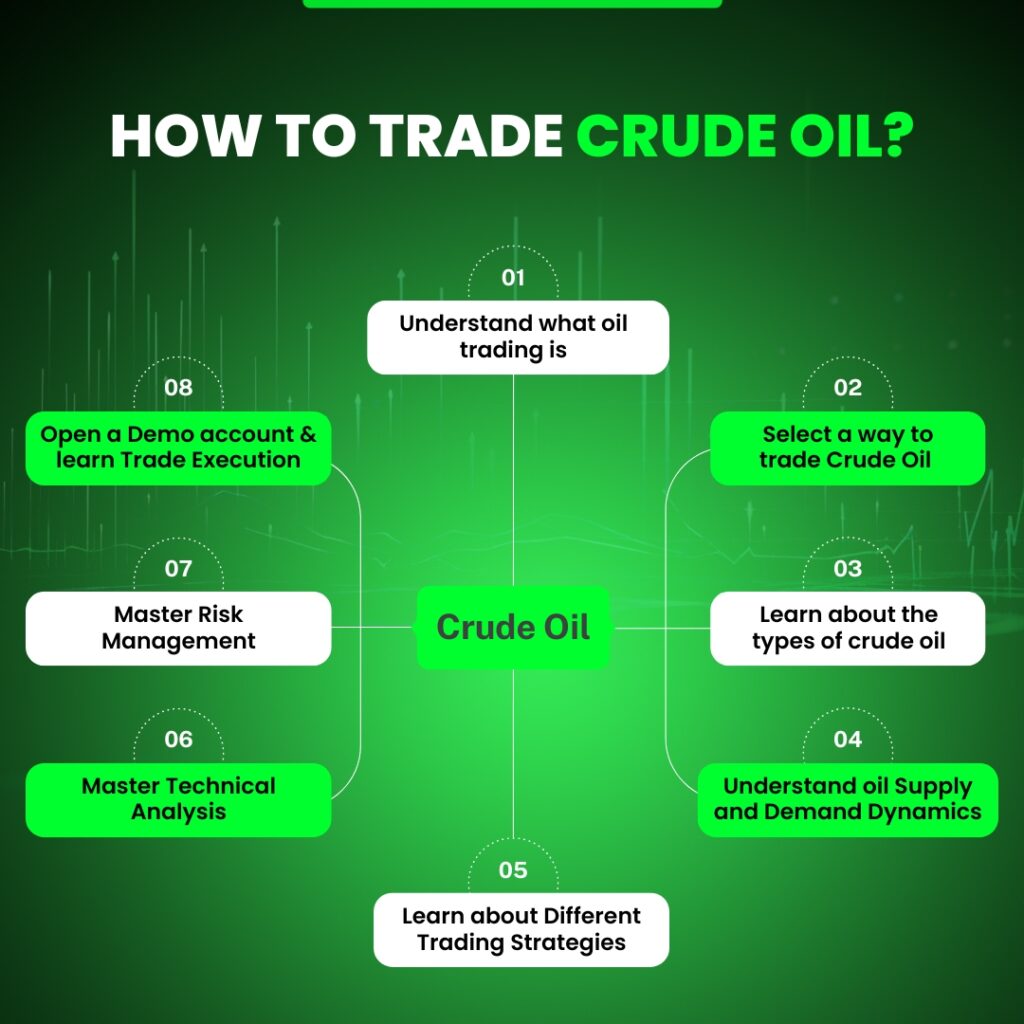

However, not many people know the right way to trade crude oil. But do not worry; Market Investopedia can help you learn crude oil trading. In this article, we will have a detailed study of how to trade oil forex in just eight steps. So, let’s get started on your journey to becoming a successful trader.

Understand what oil trading is

Crude oil is a fuel that is developed from the death and decay of animals and plants that were buried millions of years ago. The oil is used to make different products like gasoline, diesel, petroleum, jet fuel, lubricant, etc.

Crude oil is a commodity that is popular all around the world. The supply and demand of crude oil keep changing, which results in changes in crude oil prices. Many traders take advantage of these price changes and make money from the oil price movements.

The concept of crude oil trading is quite simple and old. Traders buy crude oil at low and sell it at high. Earlier traders used to store crude oil and then take advantage of its price fluctuation.

Now, with the advancement of technology, crude oil can be traded on the Internet. Traders can buy or sell the oil and take advantage of the product without owning the underlying asset.

Key Select a way to trade Crude Oil

Crude oil can be traded in many ways. Now that you know what crude oil trading it’s time to select an ideal way. Here are the popular ones:

Future Contracts:

A derivative contract is used to buy or sell crude oil futures at a specified date at a specified price. These are traded on regulated exchanges where traders can take advantage of rising and falling prices.

Options:

Option provides the right but not the obligation to buy or sell crude oil at a specified date in the future and at a predefined price. The only thing that makes the option different from the future contract is there is no obligation to continue with the trade. On the expiration date, the trader can let the contract expire or even use their right to do so.

Spot:

As the name suggests, the spot market deals with buying or selling crude oil at a current price or on the spot. Under this, buying and selling take place immediately, and traders can trade assets without owning them.

Learn about the types of crude oil:

Crude oil is basically classified into two types: West Texas Intermediate WTI and Brent crude oil. Now, traders need to select the crude oil type they want to buy or sell.

WTI crude originated from the fields of the United States. The oil is also known as light crude oil. The oil is soar and heavy in nature. It can be a more suitable option for US traders as it is a benchmark for the US oil market. So traders with knowledge of us commodities or the forex market can go for it.

Brent oil is more popular amongst traders than WTI. According to data, around 2/3rd of oil is traded in this category. It originated from the North Seas and is sweet and light in nature. It is a more suitable option for global traders.

Understand oil Supply and Demand Dynamics:

Crude oil trading is all about predicting the rise and fall of oil prices in order to make buy or sell decisions. Traders can identify trading opportunities only when they are aware of oil’s supply and demand dynamics.

The demand and supply phenomenon of crude oil results in rise and fall in the prices. When the demand is more and the supply is less, the price rises. Meanwhile, when the supply is more and demand is less, the price of crude oil falls. So traders need to look at these global supply and demand dynamics.

A trader needs to watch geopolitical factors, diplomatic relations, natural disasters, seasonal changes, commodity market dynamics, economic calendars, oil companies activities and other factors to track the supply and demand of crude oil.

A quick glance

Crude oil is a fuel that is developed from the death and decay of animals and plants that were buried millions of years ago.

Crude oil trading refers to buying and selling oil with the aim of making money from its price fluctuation over a period.

Crude oil can be traded in the future, as well as in the options and spot market.

Traders can organize sentimental, technical, and fundamental analyses to predict the rise and fall of crude oil prices.

Geopolitical factors, diplomatic relations, natural disasters, seasonal changes, commodity market dynamics, economic events, and many others affect crude oil prices.

Learn about Different Trading Strategies

Crude oil can be traded in different ways. Traders can trade crude oil for both the long term and the short term. They can even take advantage of daily price movements or even hold a trade for a considerable amount of time.

Short-term traders can select day trading or scalping. Long-term traders can go for swing trading, position trading, or price action. Traders can even use strategies like automated or copy trading. Also, technical analysis lovers can go for momentum or trend trading. So, learn crude oil trading by using different strategies.

Master Technical Analysis:

When buying or selling financial assets, technical analysis can actually help you. The analysis basically deals with examining the historical price movement of assets using chart patterns and indicators. Crude oil prices tend to react in the same manner in similar market conditions. Thus, technical analysis can help you predict the rise and fall of crude oil.

However, learning it can be difficult; it involves the study of different indicators, patterns and tools. You can even connect with us to get an in-depth and practical understanding of technical analysis. You can also connect with us to get our study and learn crude oil trading pdfs to study technical analysis.

Master Risk Management:

Like any other trading, crude oil also involves a significant amount of risk. If you think that you only earn profit while trading in crude oil, then it’s just a myth. Traders can even suffer loss with profit. Thus, risk management plays a crucial role when trading in dynamic financial assets like crude oil.

So, get well versed in risk-to-reward ratio, stop loss orders, manage money, and leverage usage to learn risk management. Diversification is also one thing a crude oil trader can do to manage the risk associated with crude oil trading. Traders can consider trading in gold, silver, natural gases, currency pairs, stocks and indices for portfolio diversification.

Open a Demo account and learn trade execution:

The above steps will only help you get a theoretical understanding of crude oil trading. However, a demo account shows you how buying and selling activities take place in crude oil.

Many crude oil trading platforms offer demo account facilities. Traders can practice strategy implementation, order execution, leverage usage, risk management, portfolio diversification and analysis methods using demo accounts. Demo accounts allow you to trade in real market conditions with fake money. So, the profit and loss are fictional; however, the learning is realistic.

Bottom Line

Like any other trading, crude oil trading also has advantages and disadvantages. It can give you both profit and loss. Many traders think that they can earn a good amount of money trading crude oil. But they failed to understand that the chances of losses are also there.

Undoubtedly, you can make a good amount by trading crude oil, but only when you have a knowledge of the market. So first, learn crude oil trading and then start the trading journey to efficiently manage its downside.