What is oil trading?

Oil trading is the buying and selling of oil for making profits with the increase or decrease in oil price.

Oil trading is quite similar to gold trading. Traditional traders used to store oil or gold in their homes to make profits by selling when the price increased in the future.

However, in the modern days, with the advent of internet trading, you can make a profit without taking the physical ownership of these commodities. In addition, you can make returns in both rising and falling markets.

Let us have a look at the oil trading example to understand the trading concept better. Suppose the price of one barrel is 75 dollars.

After analyzing the oil market, you feel that oil prices are all set to rise.

So you have bought 100 barrels of oil which means your buying price is 7500. Suppose you made the right prediction and the price of oil is increased by 1 Dollar per barrel.

In this case, your profit is 100 USD (7600-7500). However, it may be possible that the price of oil decreases against your prediction, and you may suffer a loss.

So basically, oil trading is a game of making the right predictions by effectively analyzing the market conditions. The more effective your prediction is, the more favorable the results.

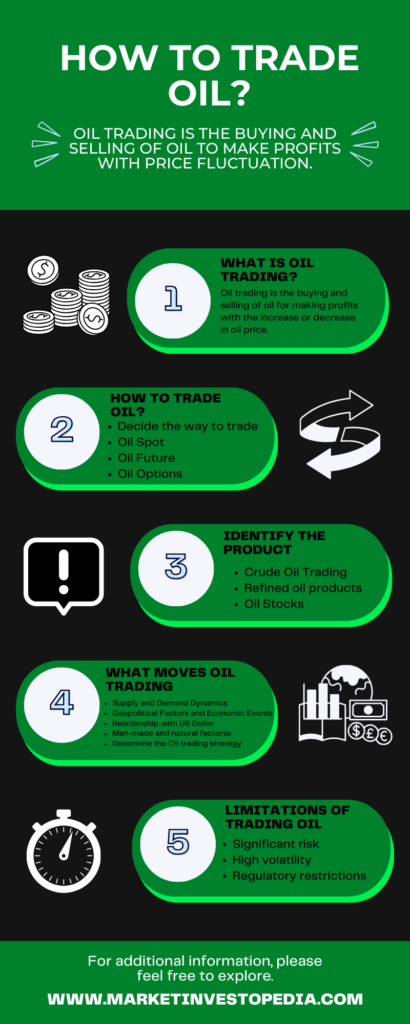

How to trade oil

Well, if you are wondering how to become an oil trader, let us simplify the process for you. We have covered every step and how to conduct it to help you start your oil trading journey.

Understand how oil trading works

The first and most crucial step that is usually skipped is learning. Trading without knowledge is no lesser than a person driving a car blindfolded.

Remember, trading requires capital, which means you are putting your hard-earned money, and when you do so without learning, it indicates that you don’t value your hard-earned money.

The oil market is amongst the most growing financial markets with different products, strategies, volatility, liquidity, economic, and geopolitical conditions. For identifying buying and selling opportunities, it is essential to get well-versed in the market conditions before starting your trading journey.

Decide the way to trade

Like any other financial instrument, trading oil can be done in different ways. So once you have grabbed the market knowledge, you should decide the way to trade oil in the following way:

A quick glance

Oil trading is the buying and selling of oil for making profits with the increase or decrease in oil price.

- Understand how oil trading works

- Decide the way to trade

- Identify what moves oil trading

- Decide your oil trading strategies

- Select a Broker and open an Account

- Start Trading

- Oil Spot

- Oil Future

- Oil Options

- Leverage Facility

- Wide range of products

- Round-the-clock trading

- Small capital requirement

- Risk

- High volatility

- Regulatory restrictions

Oil Spot

The oil spot is used to buy or sell the oil on the spot at the current price. Simply, it is a financial contract to exchange commodities at a prevailing price for immediate delivery.

Oil Future

An oil future is a derivative contract between two parties that agree to buy or sell oil at a predefined price at a specific date.

Oil Options

It is an agreement between two parties that gives the holder the right but not the obligation to buy or sell the underlying asset at a predefined price on a specific date.

A trader can select any of the above ways to trade in oil. However, it is essential to consider your needs, like expectations, risk, time frame, leverage ratio, etc, for choosing the right way.

Identify the product

Trading oil can be done in different ways with different products like crude oil or refined oil. Let us discuss the types of oil for a better understanding of how to trade oil.

Crude Oil Trading

Crude oil is amongst the most popular and widely traded commodity. It is generally classified into two types: Brent crude oil and WTI crude oil.

Brent oil is a sweet oil extracted from the North Sea, and two-thirds of the oil traders trade in Brent. It is a benchmark for the European, Asian, and African markets.

WTI is extracted from the fields of Northern America and represents the benchmark of the US market. It is lighter and sweeter as compared to the brents.

Refined oil products

Oil traders can also trade in refined forms of crude oil, including gasoline, kerosene, diesel, fuel, Liquid petroleum gas, etc.

Oil Stocks

One can also trade in oil by buying and selling stocks of companies that are directly or indirectly involved in the extraction, refinery, transportation, and distribution of oil.

The concept of oil stock trading is simple: traders generally buy the stock of oil companies when they feel that the price of oil is all set to rise and sell it in the opposite scenario.

What moves oil trading

One of the key steps of how to trade oil is to understand factors that cause rise and fall in oil prices for making buying and selling decisions accordingly.

There are numerous opportunities in the oil market; however, to identify them, you have to keep an eye on certain factors that cause changes in the price. Let us have a look at these factors:

Supply and Demand Dynamics

The first thing to look for is the supply and demand dynamics of oil. High supply and low demand result in a decline in the price of a commodity, while low supply and high demand result in a rise in the price.

Geopolitical Factors and Economic Events

Oil price is majorly affected by political factors like government decisions, elections, import and export policies, etc, and economic events like OPEC announcements, central bank speeches, reports, etc. One such event can change the entire market for trading oil, so one should watch these economic calendar events.

Relationship with US Dollars

The US Dollar is the most popular and globally acceptable currency in the world. As a result, oil is exchanged in USD Dollars between countries.

In addition, oil has a negative correlation with the USD; a rise in the USD results in a fall in oil prices and vice versa. Also, the market conditions of major oil suppliers, including the USA, Canada, Saudi Arabia, and Russia, have an impact on oil prices. So, an oil trader must keep an eye on the forex market, especially on US and Canadian Dollars.

Man-made and natural factors

Oil is a natural resource, which means its supply is affected by several factors like weather, season, disaster, erosion, and depletion have a significant impact on its price.

In addition, man-made factors like the advancement of technology, development of alternative and renewable energy resources, diplomatic relationships, wars, etc, also impact its price.

Determine the Oil trading strategy

For trading in oil, you will need a strategy defining when, where, and how to trade. In addition, you have to determine your trading style based on the time frame, number of trades, capital, risk management, and other aspects.

Day trading, swing trading, price action trading, scalping, position trading, copy trading, and automated trading, are among the popular trade method to choose from. A trading strategy is a framework of how you will execute a trade, so make it wisely.

Select a Broker & Open an Account

Another crucial step of how to trade oil is to select a broker. For trading in any financial instrument, you need a broker who will act as a bridge between the market and you.

In addition, the oil trading platform provides facilities, including financial assets, leverage, educational and training resources, etc. After analyzing the services and demo account testing, open an account with the broker.

Start Trading

A trader should begin trading with demo accounts, as these are neither risky nor profitable. The demo account is for practice trading before putting in the real money.

Once you are done with practice, fund your account and start placing trades using fundamental and technical analysis. Also, prepare a trading journal and analyze the strengths and weaknesses of your trade to make changes accordingly.

Suppose, according to a news report, the price of oil is all set to rise. So, based on this report, a trader decided to go long but suffered a loss. In this case, the trader will analyze the reason for your failure.

After analysis suppose he found out that he has only used fundamental analysis; in addition, he has placed the trade based on a news report without considering the authenticity of the platform. So, in the future, while placing the trade, he will take care of these aspects to eliminate losses.

Why choose oil trading

The scope of oil trading is increasing these days, so it can be a good option for traders to put their money in the market. However, before moving ahead first look at the advantages and disadvantages of oil trading to understand how oil trading works.

Leverage

One can get the benefit of a leverage facility in oil trading, which is essential for both professionals and traders with small capital. It can be defined as a borrowed loan that a broker provides to the trader to open a large position with a small amount.

Wide range of products

As we have discussed above, many products are there to invest your money in the oil market. In addition, if you are a forex trader or trade in any other market, you can diversify your capital by trading in oil products, as oil also correlates with another financial market.

Round-the-clock trading

Another benefit of trading oil is it allows the trader to trade 24 hours and five days. So, irrespective of your country, working hours, and trading way, you can trade anytime from anywhere.

Small capital requirement

One of the best parts about oil trading that is helpful for beginners or novice traders is you don’t require a big amount to trade in oil. One can start trading with a small capital to make small profits. In addition, you can increase your account size with the profit from trades.

Limitations of trading oil

Significant risk

You may have heard of the popular phrase, profit comes at a price, and that is true. Like any other financial asset, trading in oil requires traders to take significant risks. If your prediction or analysis goes wrong, you may suffer loss, so if you don’t want to take any risk, then the market is not suitable for you.

High volatility

Market Volatility is a crucial factor in the trading world. Volatility is the degree of price fluctuation of the asset during a period. While high volatility is not a disadvantage as big price swings increase opportunity and returns in the market. However, high volatility may result in unpredictable market conditions, and it may enlarge the losses.

Regulatory restrictions

The rules and regulations for oil trading may vary from country to country. Also, government policies and central bank announcements may affect your trading. So, one should be well versed with these regulatory rules and take all necessary precautions to deal with them.

Conclusion

We had an indept study of step-by-step procedures on how to trade oil with pros and cons. After this, I conclude that one can make a significant amount of money in the oil market.

However, a trader should get well versed in how oil trading works, its different ways, and strategies. In addition, the right trading broker, risk management, analytical skills, and continuous watch on factors that move the oil market is a must, one may suffer loss.

Also, before starting the trading expedition, a trader should know the possible positive and negative outcomes of a trade. The continuous rise in the demand and the limited supply of oil has surely made the asset the most popular.

The black gold may provide traders with huge returns. That’s the reason why it is the right time to trade in oils. However, one should know the right way to do it.

Oil Trading Facts:

Top oil producing countries

In 2023, approximately 80.75 million barrels of crude oil were produced by 98 countries, with the top five contributors making up around 52% of the total production. The leading crude oil producers and their respective shares of global crude oil production in 2022 were as follows:

1. United States: 14.7%

2. Saudi Arabia: 13.2%

3. Russia: 12.7%

4. Canada: 5.6%

5. Iraq: 5.5%

Top oil producing companies

1. Saudi Aramco is the world’s largest integrated oil and gas company, however, its stock is not traded in the United States.

2. The top oil company listed on NYSE are Exxon Mobil Corp. (XOM) followed by Shell PLC (SHEL), TotalEnergies SE (TTE), Chevron Corp. (CVX) in the top list.