option strangle vs straddle

In trading, some days you feel the asset price will rise, some days you feel it will fall, and some days you feel that it remains sideways. And based on your prediction, you make the trading decision.

However, what if you expect a huge movement in an asset price but are unable to determine the direction? Many traders will not place a trade in such cases. But with option strangle and straddle, you can enter a trade even without knowing the direction.

Want to know how? In this Market Investopedia blog, we will discuss option strangle vs straddle with meaning, examples, pros, and cons. So, let’s get started.

What is the straddle trading strategy?

Straddle is an option trading strategy that you can use when you are unclear about the asset price direction, but think that it will see a significant move in either an upward or downward direction.

Straddle allows traders or investors to take advantage of opportunities without correctly predicting the price direction. Under this, a trader buys a call option and sells a put option at the same strike price with the same expiry date.

A quick glance

The better strategy depends entirely on the trade conditions. If you are unclear about the price direction, you can go for the Straddle strategy, and if you have an idea of the price direction but are confused, you can go for the Strangle strategy.

Strangle and straddle option trading strategy can give you unlimited profit.

Both the strangle and straddle strategies can give you unlimited profit.

Straddling may not be the best trading strategy, but undoubtedly a good one.

Straddle Trading Strategy Example

For a proper understanding of the straddle vs strangle options, let us first see the straddle strategy example in the stock market:

Suppose a company is all set to release its financial report in a month. However, you don’t know what impact the report will have on the stock price. In this case, you can use the straddle trading strategy.

Stock is trending a $50, the price of a call option is $8, and put option is $7. So the trader decided to use a straddle strategy by buying both call and put options for $1500= ($8+$7)*100 shares.

In this case, the straddle contract rises in both cases, whether the stock price rises or falls, because you bought both call and put options. In this case, the profit will rise as long as the price moves by more than $15 in any direction.

Pros of Straddle Trading Strategy

The best part of the strategy is that you don’t need to be accurate about the price direction; you just need to predict a potential for movement that is not possible with any other strategy.

Straddle is a versatile trading style. You can use it for trading stocks, indices, forex pairs, and other assets.

The risk is significant when you enter a position in one direction; however, with the straddle strategy, the risk is limited.

With the straddle strategy, the premium paid is the total loss of a trader. So you have the knowledge of the amount of loss before even placing the trade.

Cons of the Straddle Trading Strategy

Traders can only use the straddle strategy in a highly volatile market where there is a potential for huge price movement in either direction.

Straddle strategy involves a significant amount of fees, and that is even greater than the usual option contracts.

When trading with a straddle, traders need to monitor the market properly to deal with unexpected changes.

In our strangle vs straddle option strategy guide, we have discussed the straddle. Now, let us move forward with the strangle style for a better understanding:

What is the Strangle trading Strategy?

A strangle trading strategy is quite similar to the straddle one, but there are some minor changes that make the whole difference.

The Strangle option strategy is the buying of a call and a put option with the same expiration but with different strike prices. Traders generally use a straddle when they are unclear about the price direction.

Meanwhile, the strangle trading is for that scenario when you believe that the price will move in a particular direction, however, you still want to protect your position if the market moves against your prediction.

Strangle Trading Strategy Example

Confused between strangle vs straddle option strategy? Let us have a look at an example for clarity:

Suppose a company is all set to release its financial report in a month. And you are confident that the data comes in positive and believe that the stock price will rise. However, you don’t want to take a big risk, thus you decide to go with the strangle trading strategy.

Stock is trending a $50, the price of a call option is $8, and put option is $7. As you believe that the price has more potential to move upward, you will keep the strike price of the call option more and put option less.

So, you have taken the buy call option strike price as $55, and the put option with strike price = $45. In this case, your maximum loss will be $15 if the price stays near $50. And you will make a profit if the price rises or declines by $15 in the stock price.

Pros of Strangle Trading Strategy

The best part about the strangle strategy is that the maximum loss you can suffer is the premium price. However, profit can be unlimited, depending on how big the moment was.

When you compare the cost of an option strangle vs a straddle strategy, the premium or trading cost is lower with the strangle strategy.

Risk is limited with the strangle trading strategy. Although you are confident about the market move direction, you can still protect your position if the chance of a negative outcome.

Cons of the Strangle Trading Strategy

With a strangle trading strategy, you will earn profit only when the asset price sees a significant move. The strategy does not work well in stable market conditions.

Strangle is a complex strategy quite different from the others. So novice traders may struggle in using the option contract effectively.

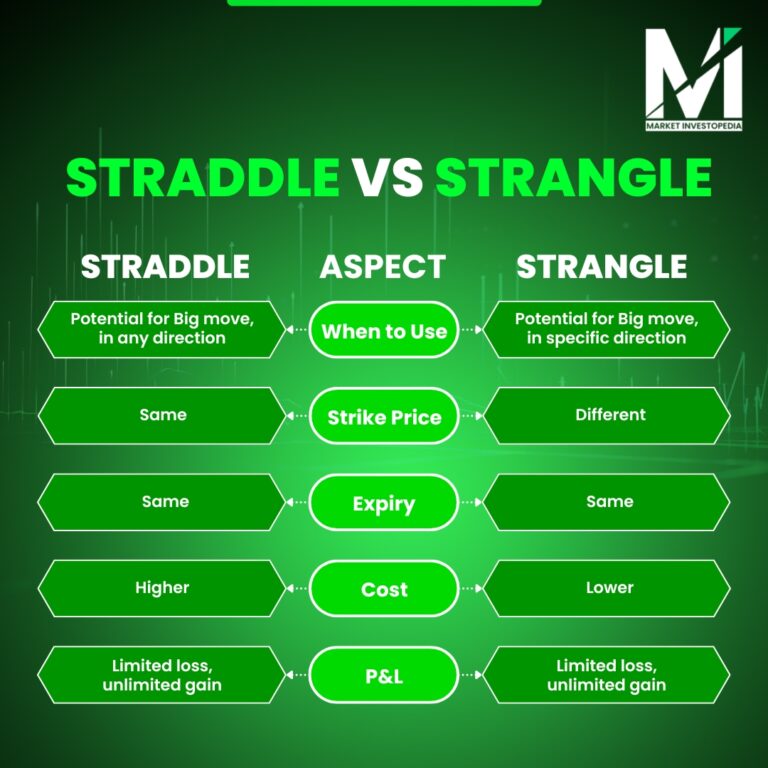

Option Straddle vs Strangle Strategy

Option Strangle vs Straddle: Which is Better

Strangle vs Straddle: Which strategy is better depends entirely on the trade conditions. If you are unclear about the price direction movement, you can go for the Straddle strategy. And if you can have an idea of the price direction movement but are confused, you can go for the Strangle strategy.

For a detailed knowledge of option trading, you can read option trading books, or you can even reach out to attend our exclusive webinar to get exclusive insights.