Reverse Cup and Handle Pattern

Candlesticks form different patterns on the chart to visualize the price movement. The reverse cup and handle pattern is one such popular and useful pattern.

Traders can identify potential bearish opportunities by watching the chat pattern. Want to know how? In this Market Investopedia blog, we will explore the inverted cup and handle pattern, meaning, its key components, and how to trade it with pros and cons.

What is a reverse cup and handle pattern?

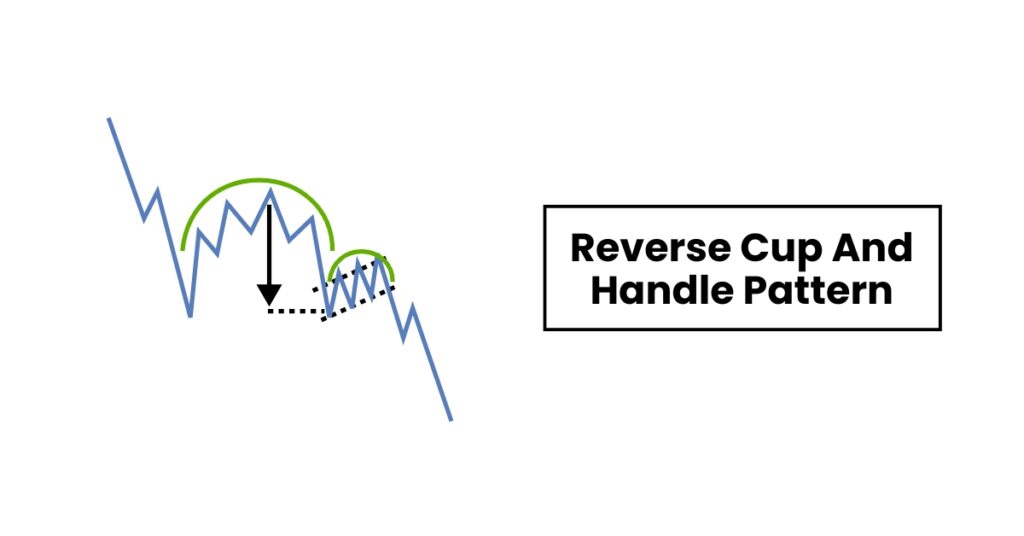

A reverse or inverted cup and handle pattern occurs when the asset price rises and falls in a way that it makes a reverse U on a chart, followed by a handle in an upward direction. It is a bearish pattern completed with a support breakout.

A quick glance

No, the reverse cup and handle is a bearish continuation pattern.

An inverted cup and handle is the opposite of the cup and handle pattern.

The success rate depends on how effectively you have interpreted and confirmed the pattern. Generally, its success rate lies between 50% to 60%.

An inverted cup and handle fail during a false breakout that occurs due to choppy or highly volatile conditions.

Identifying the Inverted Cup and Handle Pattern

Trend: An inverted cup and handle usually forms during a temporary pause in a bearish trend.

Cup: The pattern starts with an inverted cup structure formation on a chart. The cup reflects a transition in sentiment from bullish to bearish.

Handle: Small upward direction handle consists of two trend lines that act as support and resistance. A handle represents a period of consolidation in an upward reaction that is for a short period. Also, the uptrend should not exceed the height of the cup’s peak.

Round Top: An ideal inverted cup and handle pattern should have a round top. A V shape or improper circle is not good for trading.

Volume: At the beginning of the pattern, the volume is less and is increases during the breakout phase.

Breakout: The inverted cup handle pattern completes with a break of the handle’s lower trend line that acts as a support. It is also known as the neckline.

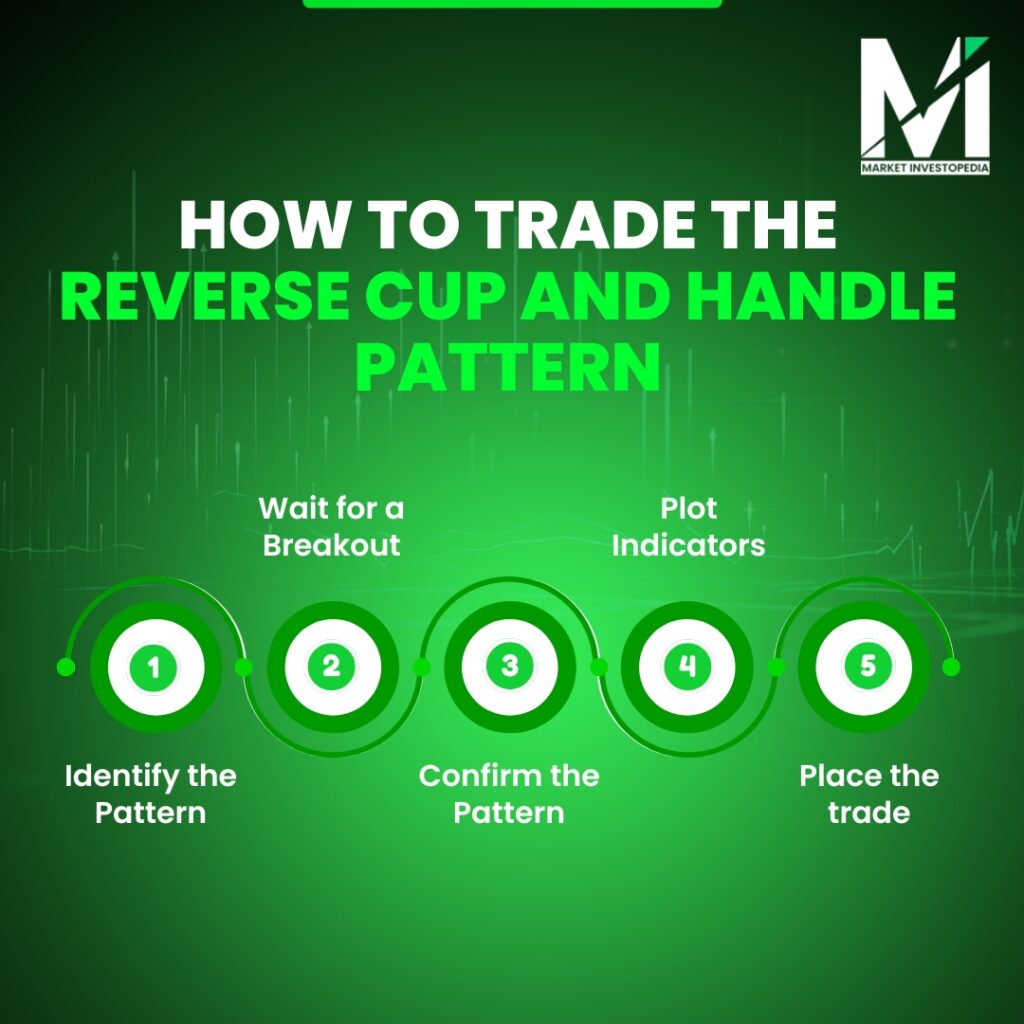

How to Trade the Reverse Cup and Handle Pattern

Identify the Pattern:

The first step is to spot a reverse cup and handle on the chart. Look for the key components we have discussed above to efficiently spot it.

Wait for a Breakout:

An inverted cup and handle completes with a breakout at the neckline. So wait till the price breaks the neckline or support line of the handle

Confirm the Pattern:

Once you have spotted a bearish cup and handle, confirm the pattern. Check the volume to confirm the pattern, and also to confirm the breakout. Do not hurry to take a position. Wait till the price falls to a significant level to avoid the potential for a fakeout.

Plot Indicators:

Do not place trades solely relying on the findings of the inverted cup and handle pattern. Use indicators such as moving averages, relative strength index, or oscillators.

Place the trade:

Once you are satisfied with the breakout confirmation and the indicator interpretation, you can go ahead with placing a trade. A neckline break of an inverted cup handle suggests a trader open a short position.

Traders can place stop losses and take profits according to their risk-to-reward ratio. Also, you can set the stop loss at the handle’s high and the reverse cup and handle pattern target price based on the cup’s height from the breakout.

Pros of the Inverted Cup and Handle Pattern

Exact Points: An inverted cup and handle is a comprehensive pattern. It not only tells the direction of the price movement but also helps you in setting the trade entry and exit points.

Diversity: An inverted cup and handle forms during both short-term and long-term periods. You can use the charting pattern to trade forex, stocks, indices, commodities, cryptocurrencies, and other assets.

Multiple ways to confirm: You can use multiple tools and indicators to confirm the pattern. Popular options include volume indicators, oscillators, moving averages, and support and resistance tools.

Easy to Spot: The structure forms when the cup and handle pattern reverse. So basically, you just need to imagine an inverted cup and handle structure and spot it on the chart.

Cons of the Inverted Cup and Handle Pattern

Early Entry: Many traders enter the trade as soon as the handle forms. However, early entry without a pattern confirmation can lead to significant losses in case of false breakouts.

Misinterpretations: A trader should be very specific while spotting chart patterns. A V-shaped cup or a cup with a very short handle leads to misinterpretations.

Rare: You cannot make your strategy solely based on this pattern. As it rarely appears on the chart. So the opportunities are limited when trading this pattern.

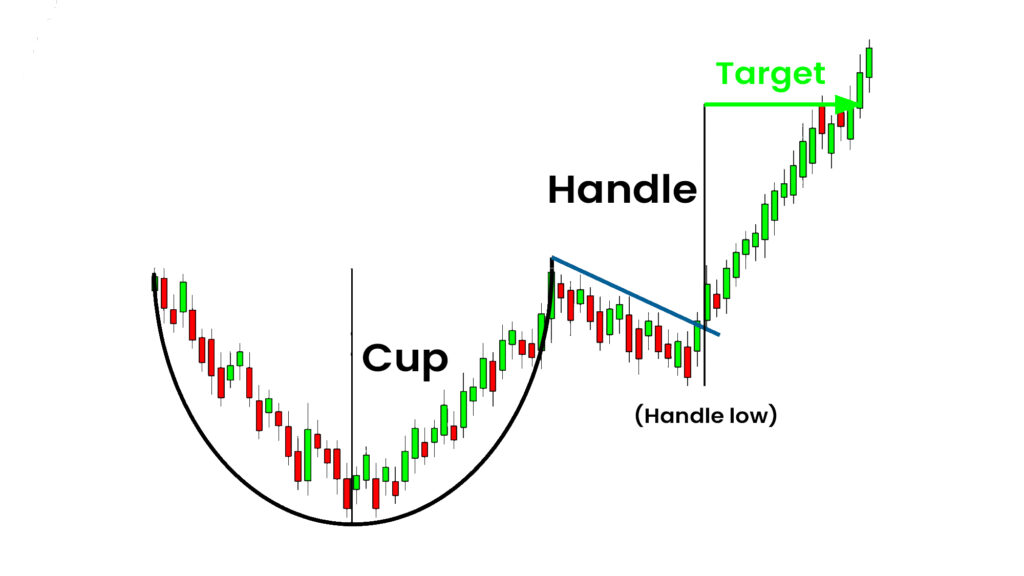

Inverted Cup and Handle Vs Cup and Handle

A bullish cup and handle pattern begins with a U shape, followed by a handle in a downward direction. It forms during the change in sentiments from bearish to bullish, indicating a potential for opening a buy position.

A bearish cup and handle pattern begins with an inverted U shape, followed by a handle in an upward direction. It forms during the change in sentiments from bullish to bearish, indicating a potential for opening a short position.

Bottom Line

An inverted cup and handle pattern is a widely used pattern by forex, crypto, stock, and other traders. The structure provides comprehensive and valuable information to plan the entry or exit of your trades.

It does have some limitations, such as false signals and the probability of misinterpretations. However, every charting pattern has limitations, and proper knowledge will help you in dealing with these limitations.

If you want to learn similar patterns like the inverted cup and handle, explore our blog section, and for practical studies, reach out to attend our exclusive webinars.