Top 6 Forex Managed Account Platforms for 2026 Beginners

Forex trading remains an attraction to traders all over the world due to its liquidity and profitability, making it a trust forex market for global participants. Nevertheless, trading in the currency markets takes time, market knowledge, and patience in decision-making, and not all traders or investors would invest or allocate such time and dedication to the markets. Consequently, this has led to a large number of market players considering forex account management services, including dot trading solutions, as an alternative option.

This report discusses the nature of the forex managed account, the benefits and limitations of such set-ups, and some of the variables that would be relevant when comparing the account management services offered by forex brokers and forex broker affiliate programs. This is not aimed at marketing platforms or promoting incentives such as an etoro bonus, but to guide the reader to evaluate whether managed forex trading fits in his/her capital objectives, risk attitude and expectations.

Introduction to Forex Managed Account

A forex managed account is a trading kind in which a professional in the market handles the trading account on behalf of the investor. The model is usually viewed by people who are new to forex trading or have low knowledge in the market, or like a more organised process of forex trading account management commonly supported by platforms using MT5 affiliate program structures.

Numerous investors wish to increase capital by means of the currency market, yet lack technical expertise, risk management structure or psychological discipline to trade actively. In this event, they can also invest their money in an expert account manager who adheres to a specific trade and capital management approach commonly found in regulated environments such as avafx services.

A managed forex account enables investors to be involved in the market b, but they do not take part in the running of daily trade. The account manager, on the other hand, is usually paid in terms of performance-based charges or management fees or both, depending on the agreement and structure of the account.

A quick glance

Identify regulated sites which have transparent managed account structures. Before investing, examine the strategy, history of losses, charges and performance of a particular company by independent measurement.

Good forex managers demonstrate actual performance history, straightforward risk strategies, transparent charges and achievable targets. Do not believe managers who offer not fixed or very high returns.

Yes, PAMM, MAM or other systems whereby a pro trades using a set of rules can run forex accounts, but market risk remains with the investor.

In forex, you can not get daily gains. The outcome will be determined by the level of money at hand, the amount of risk taken, market factors and strategy. Claims of daily fixed income: beware.

6 Best Forex Account Managers

The services of dealing with forex accounts are provided by some brokers and institutions across different parts of the world, including those operating under forex broker affiliate programs. Although such structures enable investors to outsource the execution of trades, it also entails giving access to a third party to make trading decisions. This renders the selection of platform, visibility and risk awareness as key elements of the evaluation process.

Managed forex accounts fail to eradicate market risk. There is a risk of capital drawdown, strategy underperformance and execution risks. Because of this reason, investors normally evaluate platforms in terms of account setup, strategy disclosure, risk controls, and history of operation rather than projected returns or promotional offerings like an etoro bonus.

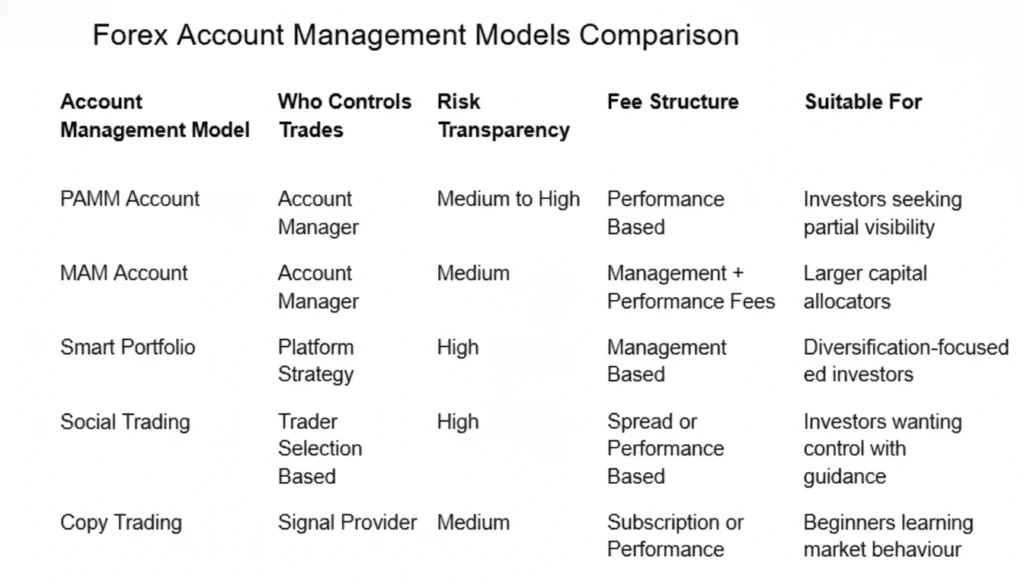

The following are some of the popular platforms that host various models of managed forex accounts, such as smart portfolios, PAMM, MAM, and social trading platforms.

Etoro:

eToro offers portfolio-style products through its Smart Portfolio platform. Internal research teams construct these portfolios, which are based on preset market themes or investing methods rather than bonus-driven incentives such as etoro bonus schemes.

Investors do not select the trades manually but instead invest in portfolios where they have a set of rules to follow in the allocation of capital. This model is also attractive to users who want to diversify and have an account manager for the forex trading account manager with the use of rules without getting directly involved in the execution of the trade.

Avatrade:

AvaTrade, also widely referenced as avafx, has managed account structures in PAMM and multi-account management systems. In such an arrangement, investors will invest with professional managers who will trade as per the set parameters.

Profits and losses can be proportional under the PAMM model in the distribution of gains and losses, depending on the amount invested. The structure is frequently employed by traders who would like to have strategy-related exposure but have access to performance measures and risk characteristics.

IG:

IG is a multi-asset investment company that offers managed portfolio solutions that aim at diversification and not direct exposure to forex. Its offences that are under management enable investors to invest capital in various asset classes by using standardised portfolio strategies.

The focus is on the transparency, visibility of costs and long-term capital distribution, but not on short-term trading results. This structure suits investors who require a wider capital management view and prefer a trust forex operating environment.

FXTM:

FXTM, widely recognised as the FXTM company, has managed account solutions that enable investors to select the strategy providers depending on the past performance, the risk involved, and the duration of holding. The service allows one to access strategy measures, history of drawdown, and portfolio composition prior to making an investment.

This strategy helps to conduct informed decision-making and correlate with investors who place emphasis on analytical review as an element of a professional forex trading framework analysis.

FX Pro:

FXpro offers accessibility to PAMM-type managed accounts into which investors can join professionally run trading programs. The platform also focuses on regulatory supervision and transparency of operations as a component of an account management package and trust forex standards.

Besides the involvement of the investors, FXPro also enables professional traders to act as strategy managers, making it applicable to the capital allocators as well as professional traders seeking account management opportunities through MT5 affiliate program integrations.

Beirman Capital:

Social trading Beirman Capital has a model of account management that uses social trading. Strategy leaders are chosen by investors on a historical basis, performance behaviour, and risk traits, and the capital allocation decisions are made by them.

This structure is attractive to users who do not wish to completely delegate account control but only to copy the established trading behaviour, which is to take part but have the final decision-making authority while still choosing whether to invest or exit positions.

The benefits of Forex Account Management Services

The traders and investors tend to use forex accounts management services when they are interested in systematic and professionally oriented market participation, including structured dot trading environments. Although these services do not eliminate market risk, they may provide operational and decision-making benefits to their use with realistic expectations.

Expert Trade Performance

Managed forex accounts are based on professional traders who trade within set strategies and risk models. Through rules-oriented implementation, position sizing, and risk management controls, the managers were to mitigate emotionally driven choices that were pegged on fear and greed.

Diversification With Structure

Most managed account models can be used to allocate capital amongst a variety of strategies or instruments. This is a well-organised diversification strategy to minimise dependence on a single trade or market situation and, as well as, to manage forex trading accounts more balanced within a trust forex framework.

Time Efficiency

Trading actively involves discipline in the execution and monitoring of the market. Managed accounts enable investors to engage in the market without having to make daily trade choices and are thus suitable for persons who have limited time at their disposal.

Incentive Alignment

Performance-based fee arrangements tend to harmonise the interests of the trader and the account manager. Although it does not warrant profits, this brings about accountability and discipline in capital management.

Drawbacks of Forex Account Management Services

The services of forex account management may provide convenience and structure, but at the same time, there is a limitation that investors must consider before committing capital. A fair assessment is necessary, particularly in leveraged markets such as forex supported by forex broker affiliate programs.

Market Risk Remains

Managed forex is not a risk-free trading account. Markets in the currency world are unstable, and no plan or fund manager can be sure to make steady profits. Trading is characterized by losses and drawdowns irrespective of the trades being placed by whom.

Manager Dependency

The skills, discipline, and risk framework of the account manager are very critical to performance. Investors are usually not much involved in the day-to-day operation, and this implies that the quality of execution and the process of decision-making by the manager play a major role in determining the outcomes.

Lack of Control over Capital

Most account structures are managed to cater to the trading decision-making being made by the manager. Although this will decrease operational involvement, it will also decrease direct control over the timing of trade, the size of position, and the standards of strategy.

Victimization to Fraud and Abuse

Misleading or unverified offerings have also been increasing due to the popularity of managed forex accounts. New traders might struggle to differentiate the right account management structure from the marketing schemes. Transparency checks and independent verification are needed.

Cost and Fee Structure

Managed forex accounts usually have management fees or commission-based fees. These expenses could decrease net returns and might not be appropriate to small size of accounts. Fee structures are important in the examination of long-term capital efficiency.

Practical Guidelines for Using Forex Account Management Models

Selecting a forex account management model is not just making a choice of a popular platform. The evaluation process will avoid unnecessary risks and assist you in making improved capital allocation decisions.

Platform Due Diligence

The platform that you select is your service provider as well as the operating base of your account. Establish its regulatory position, history of operation, transparency, and reporting of risk. It is a good idea to compare some of the platforms before committing to any of them.

Manager Profile Assessment

Good platforms provide the account managers with detailed performance and risk information. Examine such measures as the percentage decrease in the account, the rationale of the strategy, risk to reward ratio, and how the strategy has performed over the years. Look at the way the returns were made and not merely the size of those returns.

Do Not Be a Full Delegation Mind

Managed accounts reduce the number of daily tasks, yet you have to monitor them. Check reports, frequency of trade, and risk level regularly to be able to intervene early, in case the performance is not met.

Fee Structure Awareness

The net returns are directly affected by fees and commissions. Not only on the advertised price, but also assess costs according to the size of the account and the kind of strategy.

Ongoing Performance Review

Compare the performance with the capital utilised with the risk undertaken rather than the overall profit. Drops, volatility and time tracking can better explain whether the model remains fitting or not.

Professional Forex Trading Framework Guidelines

The professional management of forex accounts is based on systematic decisions and not the frequency of trading or the short-term performance. Some important principles are discussed below.

Allocation Discipline of Capital

Investing in trades is done in accordance with preset exposure limits, rather than due to opportunity. This will assist in reducing downside risk in volatile markets.

Risk Per Trade Structure

Pro traders limit the risk in each trade with fixed percentage regulations. This ensures that your whole capital is not ruined by just one trade.

Drawdown Tolerance Planning

There is a reasonable loss limit in each strategy. Anything beyond that tends to initiate a review or risk reduction.

Behavioral Control

Trading invariably involves dealing with such emotions as fear and greed. A framework ensures that you do not make hasty decisions during stressful periods in the market

Performance Review Cycle

Checking of the results is done over the set periods by using the risk-adjusted figures as opposed to one win or one loss.

How We Evaluate Forex Account Management Structures

None of the forex account management models meet professional standards. It is not about the marketing, but it is about the structure.

At Market Investopedia, the management structures of forex accounts are evaluated based on the following:

- Strategy logic and consistency

- Drawdown behaviour over time

- Transparency of risk and fees

- Capital protection approach

- Alignment between manager incentives and investor outcomes

This framework helps separate professionally managed models from promotional offerings.

Conclusion

The Forex account management allows you to speculate on the currency market and not to make trades. Managed forex accounts are more of a capital allocation device than a trading device for traders and investors who tend to make risk-averse, open, and disciplined decisions.

However, market risk will always exist. It is a matter of the design of the strategy, whether you are able to deal with drawdowns, the charges, and your discipline. By that, I say that you have to consider and analyse frequently and then invest.

We are committed to making forex account management, professional trading systems, and risk models easy and accessible in such a manner that individuals can make knowledgeable and well-thought-out decisions at Market Investopedia.

In order to stay updated with the information on forex account management, risk frameworks, and professional trading, explore our resources and subscribe to our updates.