01 Key News Insights

Date: 30th Friday, 2026

Daily Economic Outlook:

US Initial Jobless Claims Hold at Tame Level

- Initial jobless claims in the US inched lower by 1,000 to 209,000 from the upwardly revised value in the previous week, ahead of the market consensus of 205,000. In the meantime, continuing claims fell by 38,000 to 1,827,000 on the earlier week, firmly below market expectations of 1,860,000, to reflect the softest level of outstanding unemployment since September of 2024.

US Trade Gap Widens in November

- The trade deficit in the US widened sharply to $56.8 billion in November 2025, the highest in four months, compared to a $29.2 billion gap in October which was the lowest since 2009, and much higher than forecasts of a $40.5 billion shortfall.

France Q4 GDP Growth Hits 3-Quarter Low

- France’s economy expanded 0.2% qoq in Q4 2025, easing from a 0.5% rise in Q3 and matching market expectations, flash data showed. It marked the weakest quarterly growth in three quarters, reflecting a softer contribution from domestic demand.

President Trump will announce the name of New Fed Chair next week.

- Although he said to announce the name next week

- But market strongly expects that Trump will announce Kevin Warsh as Fed’s new chairman

The Dollar Index (DXY)

- The USD is experiencing mixed trading, regaining some ground against core majors after earlier losses, while ranging close to 96.50 on Friday’s early Euro session.

- The undertone remains bearish, with concerns about Fed policy autonomy impacting investor sentiment.

- The DXY index is close to key support levels, and minor gains may attract sellers.

USD/ JPY

- USD/JPY flirts with 154.00 as the Japanese Yen (JPY) holds softer Tokyo CPI-inspired losses amid reduced bets for an early interest rate hike by the Bank of Japan (BoJ).

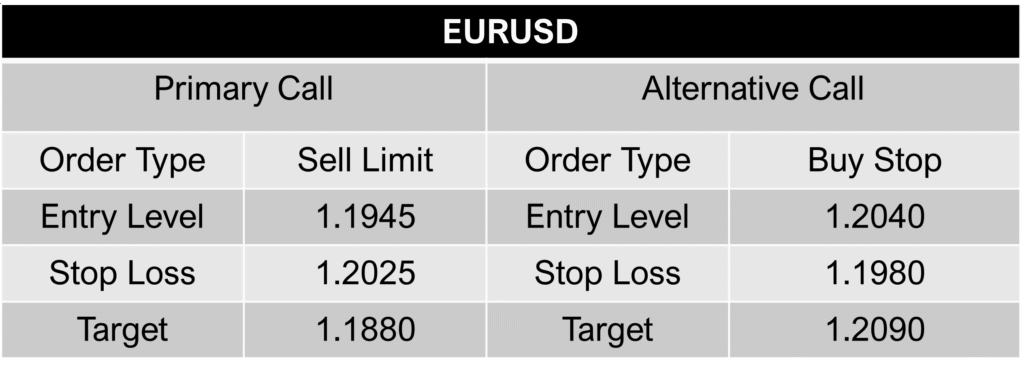

EUR/USD

- EUR/USD trims losses to regain 1.1900, but sellers remain in control ahead of key German/ Eurozone GDP data.

GBP/USD

- GBP/USD holds correction at around 1.3750, pressured by the ongoing USD recovery.

AUD/ USD

- AUD/USD depreciates after three days of gains, trading around 0.7000 during the early European hours on Friday.

- The likelihood of AUD closing above 0.7100 is not high but it will remain intact as long as 0.6960 is not breached.

01 - Instructions/ Guidelines for Executing Suggested Trades

- Close your trades within 8-10 hours or before 6:30 PM UTC (midnight IST), regardless of profit/ loss.

2. By chance, if you face losses in your “Primary Trade”, the “Alternative Call” is designed to recover those losses.

3. That’s why, always place the “Alternative call” alongside the “Primary Call”.

4. In case the “Alternative or Recovery Call” doesn’t get triggered the same day, a new call (or signal) will be provided the following day.

5. Generally, the Global Market Outlook Report includes signals with a higher reward-to-risk ratio (from 2:1 and higher). Therefore, consider booking partial profits in steps as follows:

a. For example, if the reward is two times the risk (or 2:1), consider booking half (or 50%) of the profit when levels reach a 1:1 ratio, and maintain the remaining position.

b. Then, when prices reach twice the risk (2:1), book the remaining 50% position.

c. To make this process seamless and smooth, consider placing two calls simultaneously with the same Stop-Loss (SL) and Entry-Level but different Target-Levels.

Note: These guidelines aim to optimize your trading strategy while managing risks effectively.

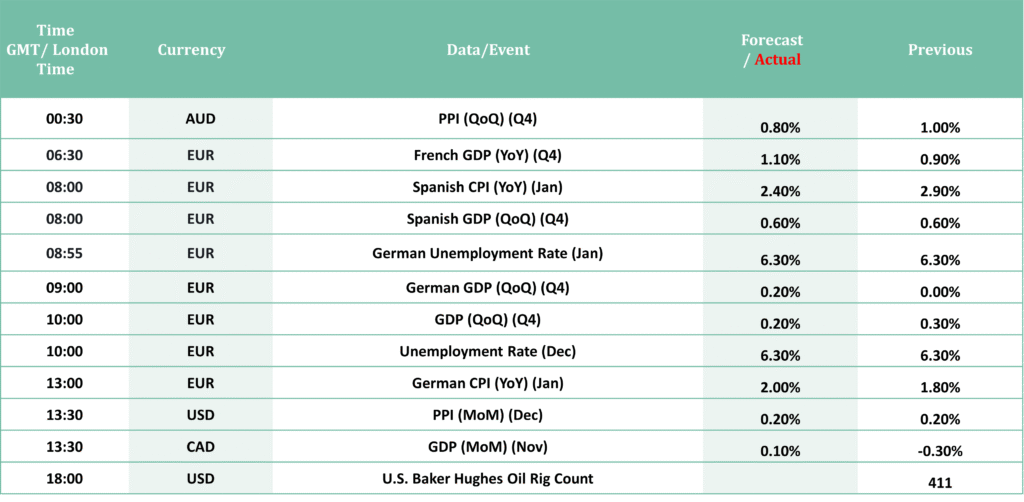

02 - Economic Calender

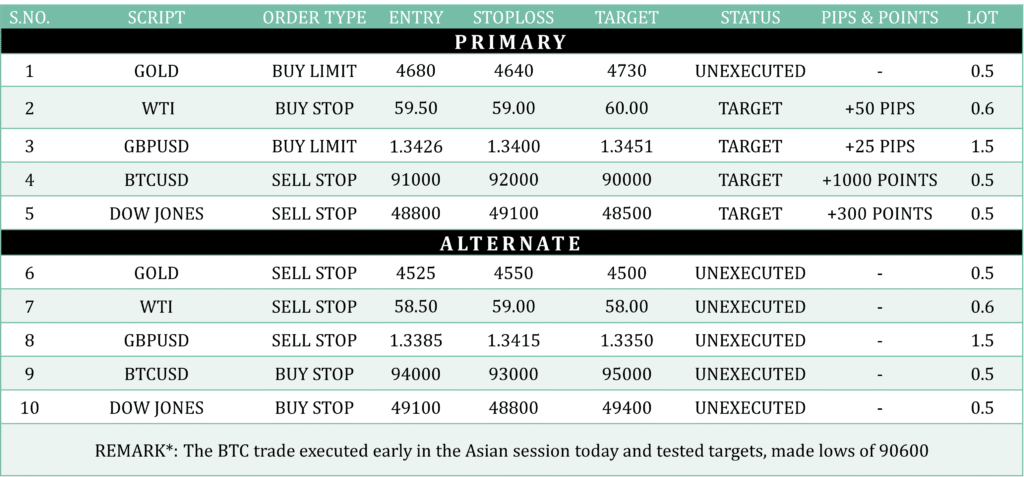

03 - Previous Day Performance

04 - Instructions/Guidelines for executing suggested trade

- Close your trades within 8-10 hours or before 6:30 PM UTC (midnight IST), regardless of profit/ loss.

2. By chance, if you face losses in your “Primary Trade”, the “Alternative Call” is designed to recover those losses.

3. That’s why, always place the “Alternative call” alongside the “Primary Call”.

4. In case the “Alternative or Recovery Call” doesn’t get triggered the same day, a new call (or signal) will be provided the following day.

5. Generally, the Global Market Outlook Report includes signals with a higher reward-to-risk ratio (from 2:1 and higher). Therefore, consider booking partial profits in steps as follows:

a.For example, if the reward is two times the risk (or 2:1), consider booking half (or 50%) of the profit when levels reach a 1:1 ratio, and maintain the remaining position.

b.Then, when prices reach twice the risk (2:1), book the remaining 50% position.

c.To make this process seamless and smooth, consider placing two calls simultaneously with the same Stop-Loss (SL) and Entry-Level but different Target-Levels.

Note: These guidelines aim to optimize your trading strategy while managing risks effectively.

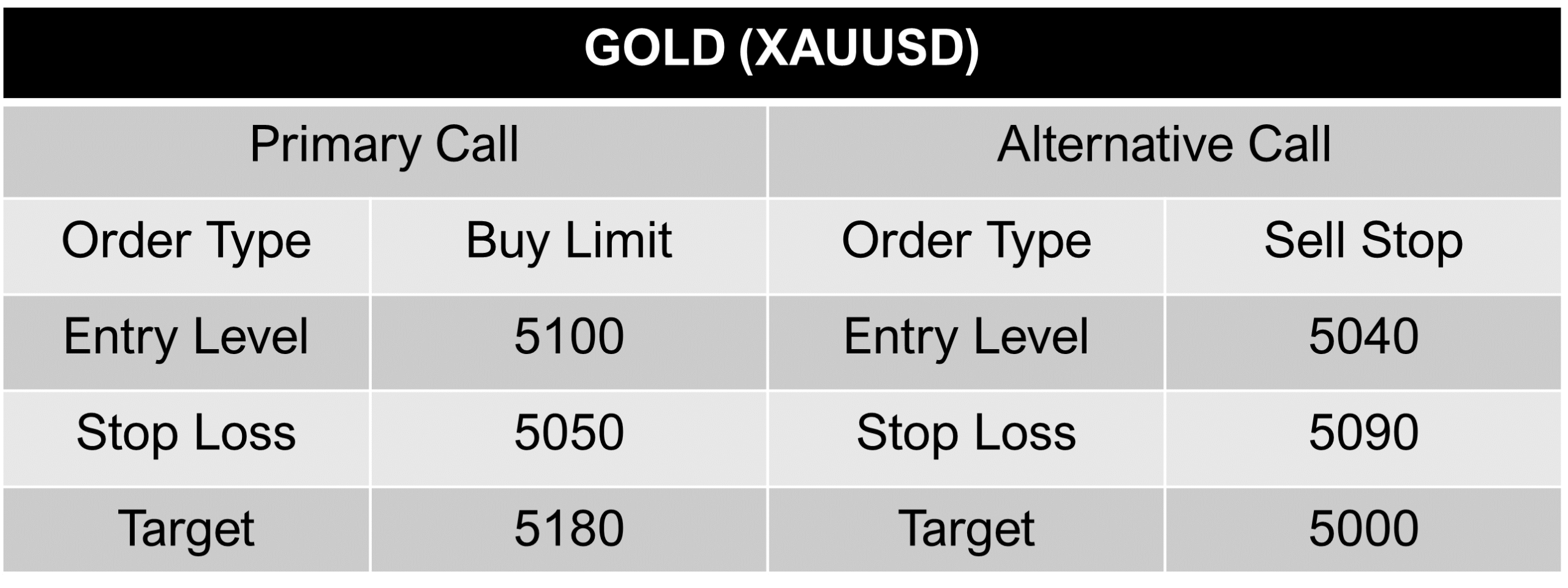

05 - Gold Analysis

Overview: Gold hit fresh record highs near 5,597 yesterday before pulling back meaningfully. As highlighted earlier, the daily RSI at 91.5 signaled an overstretched, overbought condition, making a correction likely. A move toward the 5,100 liquidity zone appears possible, and if price sustains below that level, further downside toward the 4,900 area may unfold.

Biasness: Gold retreated as expectations grew for a more hawkish Federal Reserve leadership. President Donald Trump signaled he will announce his choice to replace Chair Jerome Powell on Friday, with increasing speculation that former Fed Governor Kevin Warsh may be the preferred candidate.

Key Levels:

R1- 5452 R2- 5601

S1- 5098 S2- 4991

Data Releases: Today’s U.S. releases—Core PPI m/m, PPI m/m, and remarks from FOMC Member Musalem—are likely to inject volatility into gold prices during the New York session.

Technical Analysis: The price is holding above All key EMA on the 4H timeframe, with the EMA slope trending upward, indicating a bullish bias.

Alternative Scenario: If prices starts to close below 50 EMA on 4H timeframe & closes below 5045 then we can plan short entries.

While writing the report, gold is trading at 5190.

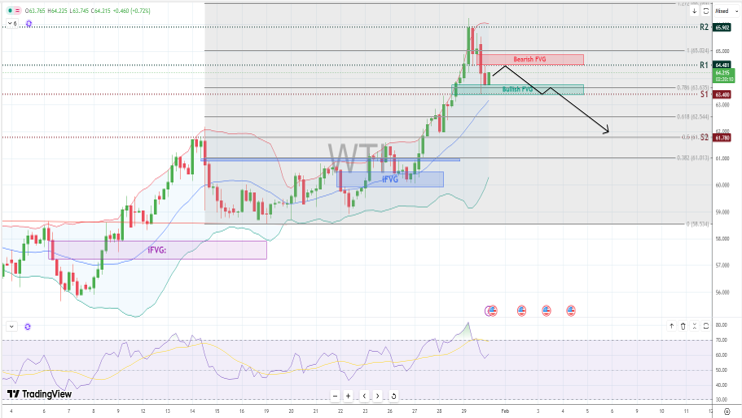

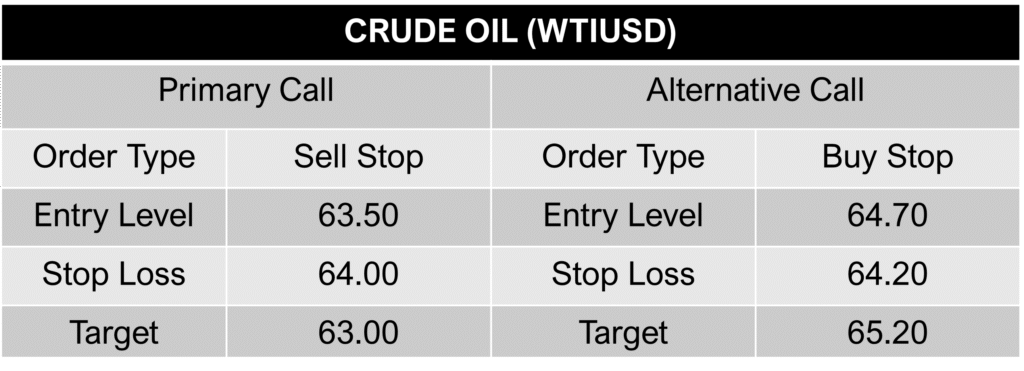

06 - Crude Oil

Overview: – The primary in oil trend turned bullish with a break of structure during the previous 3 trading sessions. WTI is trading around 64.00 during the early European session, after testing September highs of 66.25, after which moderate corrections could be witnessed. The prices are expected to re-initiate a bearish trajectory, given bullish FVG (S1 = 63.40) is breached and prices sustain lower.

Biasness: Crude oil global production exceeded consumption throughout 2025, leading to significant stockpile builds. This, in turn, weighs on the black gold price. EIA estimated a substantial surplus will continue through 2026, with an average oversupply of more than 3.7 mil bpd for the year.

Key Levels:

R1: 64.50 R2: 66.00

S1: 63.40 S2: 61.75

Data Releases: Today, U.S. PPI, Core PPI, and Chicago PMI data are scheduled for release. But US Rig count data will provide more cues about the demand in oil products, a fall in rig count will diminish demand projections and weaken oil prices

Technical Analysis: If the prices falls below the middle Bollinger band and RSI also slides lower, then bearish trend could continue.

Alternative Scenario: Only a sustainable breakout and closing of 4H candle above the R1 (64.50) might drive oil prices higher to far resistance zone.

While writing the report, the pair is trending at 64.20

07 - USD/JPY

Overview: The primary trend in EUR/USD remains bearish. In 4H chart price failed near the 1.2040–1.2050 resistance zone and is now moving lower, indicating profit booking and weakening bullish momentum. Unless price moves back above the key resistance zone, higher chances of further downside or sideways-to-lower movement in the near term.

Biasness Despite some short-term technical strength, the news flow leans bearish for EUR/USD. Soft Eurozone data and ECB comments about cutting rates if the euro strengthens limit upside, while a potentially hawkish Fed pick supports a stronger U.S. dollar. This fundamental imbalance favors renewed downside pressure on EUR/USD.

Key Levels:

R1: 1.2040 R2: 1.2130

S1: 1.1686 S2: 1.1580

Data Release: The key movers today are Eurozone/German GDP, CPI, and unemployment data, along with US PPI and Jobless Claims. If Eurozone growth or inflation comes in weak, it pressures the euro, while firm US inflation data supports the dollar. This combination keeps downside pressure on EUR/USD in simple terms.

Technical Analysis: Technically, Price has slipped below the trendline and key averages, showing weakness. RSI is cooling, and price is moving away from the upper Bollinger Band, which signals fading buying strength and further downside risk.

Alternative Scenario: If price fails to hold above the 1.2040 resistance and move higher with momentum, the bearish view would weaken and a bullish setup can be planned from there.

While writing the report, the pair is trending at 1.1932.

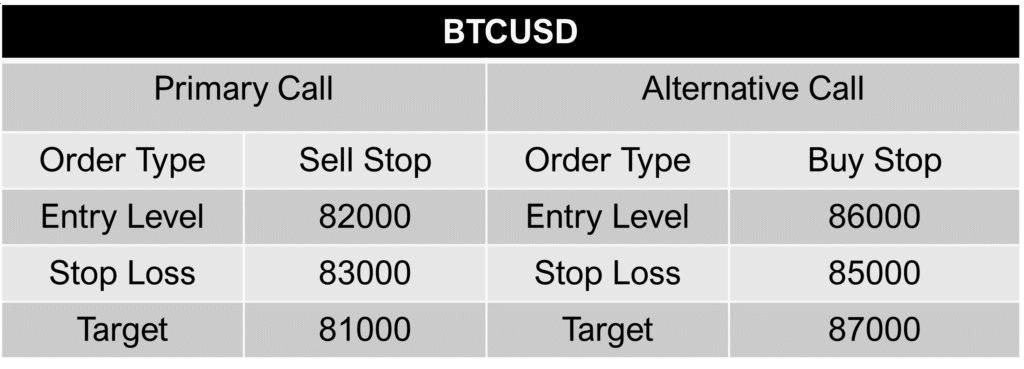

08 - BTC/USD

Overview: Bitcoin’s primary trend is bearish. On the 4H chart, price broke the bullish trendline, failed to hold above it on the retest, and is now trading below the pivot, heading toward immediate support.

Biasness: Bitcoin slipped to a two-month low as speculation over a tighter-money Fed chair weighed on risk assets, dragging BTC down about 2.5%.

Key Levels:

R1: 86000 R2: 90500

S1: 82000 S2:80500

Data Release: Today, U.S. PPI, Core PPI, and Chicago PMI data are scheduled for release. If PPI comes in higher than expected, it could strengthen the dollar, increase rate-hike expectations, and create downside pressure on Bitcoin as risk sentiment weakens.

Technical Analysis The 12-period EMA is below of 52-period EMA , indicating bearishness in prices.

Alternative Scenario: If prices are able to breach the immediate resistance level and 12 period EMA crosses above 52 period EMA then further bullishness can be seen.

While writing the report, the pair is trending at 82998.

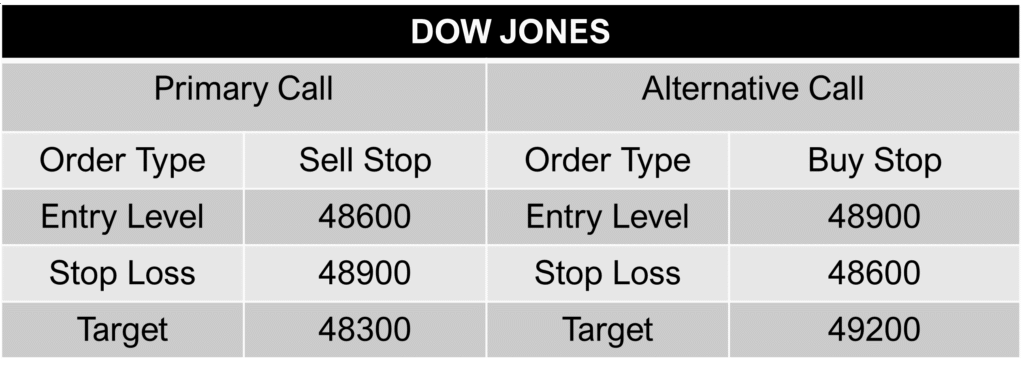

09 - DOW JONES

Overview: The Dow Jones primary trend remains bullish; however, prices are turning lower, forming lower highs and lower lows. Currently, price is holding below the pivot level and moving toward immediate support. A break below this level could trigger further bearish momentum.

Biasness: Dow Jones showed mixed action, pulled lower by tech sector weakness and investor caution ahead of data and earnings, while markets also reacted to broader stock declines and muted sentiment across major U.S. indices.

Key Levels:

R1: 49200 R2: 49600

S1: 48600 S2: 48300

Data Release Today, U.S. PPI, Core PPI, and Chicago PMI data are set for release. If PPI comes in higher than expected, rising rate-hike fears could weigh on market sentiment and put downward pressure on Dow prices.

Technical Analysis: 12 period EMA is below of 52 period EMA , indicating bearishness in prices.

Alternative Scenario: If prices are able to breach the immediate resistance level and if 12 period EMA crosses above 52 period then further bullishness can be seen.

While writing the report, the pair is trending at 48724.

10 - Disclaimer

- CFD trading involves substantial risk, and potential losses may exceed the initial investment.

- Signals and analysis are based on historical data, technical analysis, and market trends.

- Past performance does not guarantee future results; market conditions can change rapidly.

- Consider your risk tolerance and financial situation before engaging in CFD trading.

- Signals are for informational purposes only and not financial advice.

- Each trader is responsible for their decisions; trade at your own risk.

- The report does not consider individual financial situations or risk tolerances.

- Consult with financial professionals if uncertain about the risks involved.

- By accessing this report, you acknowledge and accept the terms of this disclaimer.

Safe trading,

Market Investopedia Ltd