Risk Averse Meaning & Examples

When there is a probability of earning more money, the chances of losing some are there. Risk is the inevitable part of the financial market, but how much risk you take decides your trading journey. Some traders love taking risks, while some are risk-averse, and some even look for the opposite of risk-averse approaches such as risk-takers or neutral risk behaviour.

Being a leading education provider, Market Investopedia wants our clients to have a clear understanding of risk management trading, trading risk control, and portfolio optimization with risk aversion.

In this blog, we will discuss a risk-averse strategy, how it differs from others, the top risk-averse assets to invest in, and whether you should go for this approach or not.

What Is Risk Averse?

Risk-averse is when an investor fears losses and invests in safe-haven assets. Such traders give priority to stable and consistent returns over quick and high returns. This mindset is the opposite of what you see in risk takers, often counted as the risk antonym or risk averse opposite personalities.

The financial market is a great place to double your income. However, instead of doubling, you may lose what you have if you make the wrong decisions.

Risk-averse traders are those who don’t want to lose their hard earned capital. Thus, they allocate the capital to low-risk assets that grow slowly over time. This is often explained using a risk averse utility function, risk averse graph, or utility function and risk aversion models.

Risk averse vs risk adverse is also a common confusion, but both refer to different meanings risk averse is correct in trading.

Example

A trader has $1000 in the savings account. The trader wants to earn a profit but cannot afford to take large risks. The trader comes to Market Investopedia, and our mentor suggests US Bonds. Bonds are low risk assets, so this way the trader will have low yet steady income. This is ideal for someone with risk averse utility function behaviour.

A quick glance

Risk-averse is when an investor fears losses and invests in safe-haven assets.

Risk-aversion is the process of allocating money to low-risk assets to avoid significant losses.

Too little risk helps you survive in for long term in the market, have a stable mindset, and gives you overall consistency.

The more the risk, the more the profit or losses. Less risk means stable and consistent returns.

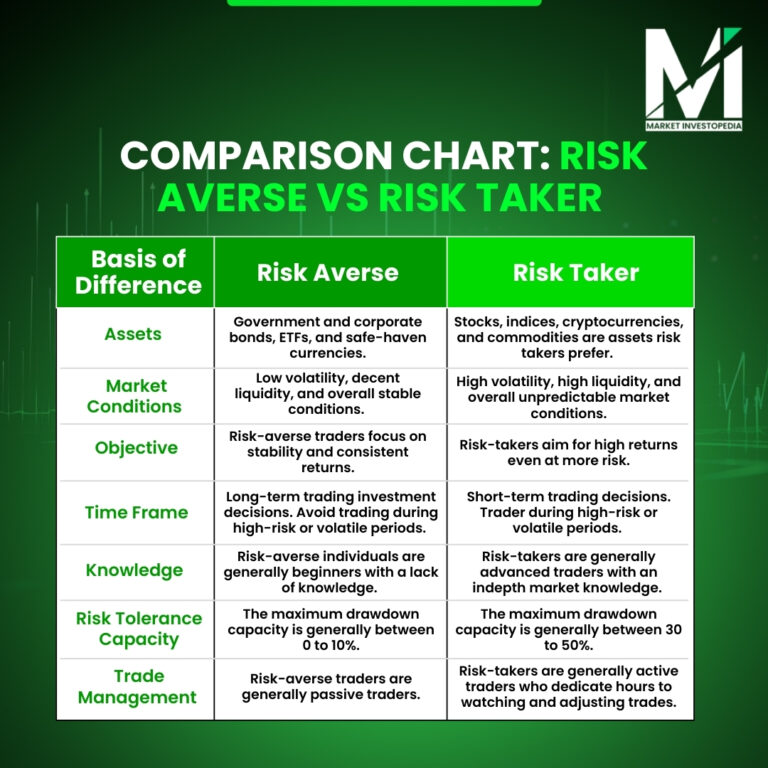

Types of Traders Based on Market Risk

Aggressive Traders

Aggressive traders are the opposite of risk-averse, popularly known as risk takers. Another word for risk taker in the thesaurus is “adventurer” or “speculator.” They want to make more, and for that, they are willing to risk more. Such traders trade highly volatile assets such as cryptocurrencies with aggressive strategies.

Risk Neutral

There are traders who lie somewhere in between. They neither want to risk too much nor want to be too conservative. Such traders follow a neutral risk profile and maintain a balanced portfolio.

Risk Averse

We have already learned of the third type the risk averse or conservative traders. They take minimum risk to avoid any kind of losses. Sometimes beginners confuse this with risk adverse, but “risk-averse” is the correct term.

Top Risk Averse Financial Assets

Looking for options to invest or trade in for risk-averse assets? Here are the top choices you can consider:

Bonds:

Bonds are debt instruments issued by governments or corporations to raise funds. Investors receive fixed interest payments over time on their investment and get their principal at the maturity date. These are the safest investments with steady and timely returns.

Treasury Securities:

Treasury bills, notes, and bonds issued by the government are also great when investing in risk-averse assets. You will surely get the repayments and returns as per the policy.

Investment-Grade Corporate Bonds:

You can even invest in bonds issued by financially stable corporations with a high credit rating. With reputed companies, chances of default are rare, and you will get timely returns.

Exchange-Traded Funds (ETFs)

ETFs are generally a collection of diversified securities that contain stocks, commodities, or currencies. Bond ETFs or index based ETFs can give you a good and comparatively higher return with limited risk.

Factors Affecting Your Trading Risk

Overall Experience: Beginners are more risk-averse, while pros lean toward the opposite of risk behaviour.

Market Conditions: Crises increase risk levels.

Emotional State: Your mindset decides whether you are risk averse or adverse (commonly misused).

Trading Capital: More capital = more risk-taking flexibility.

Loss Capacity: Some traders tolerate high losses; others follow strict risk averse utility function guidelines.

Conclusion

There is no problem in becoming a risk-averse trader if you fear losses. However, being risk-averse is not the only solution. You can diversify, spread your capital across bonds, ETFs, forex, crypto, and commodities.

At Market Investopedia, we believe smart trading begins with education and disciplined strategy. Whether you’re conservative, neutral, or the opposite of risk-averse, learning risk control is essential. Join us and expand your market knowledge.