AI Penny Stocks

Artificial Intelligence (AI) is transforming the world of work – how we drive, how we trade. The world invested more than 50 billion dollars in AI startups in 2023 alone, and the figure continues to grow. Meanwhile, numerous small firms operating in the field of AI are selling their stocks at extremely low prices, sometimes less than $5 or even $1. These are called AI penny stocks, often searched today as artificial intelligence penny stocks by new market participants.

These cheap AI stocks may seem very exciting to new traders or those with a limited budget, especially those exploring artificial intelligence stocks under $1. They provide an opportunity to invest in the rapidly developing AI sector without having to spend much money. However, as with any cheap stock, they are risky as well, and not every AI penny stock succeeds.

This blog will discuss what AI penny stocks are, why they are popular in 2026, and how a novice can select the right ones. We will also provide a penny AI stocks list to keep an eye on, and some easy tips for new traders.

We make the market more understandable to beginners at Market Investopedia. This guide is meant to help you in case you are just beginning your trading career.

What Are AI Penny Stocks?

AI penny stocks are the stocks of small firms that operate with artificial intelligence (AI) and are traded at a very low price, often below $5, and even below $1 dollar. These are commonly referred to in the market as artificial intelligence penny stocks.

Let’s break it down simply:

- Artificial intelligence is abbreviated as AI. It involves intelligent technologies such as robots, machine learning, speech recognition, and data automation.

- Penny stocks are cheap stocks of small firms. These are stocks that tend to be of low market value and are listed in smaller exchanges or even over the counter (OTC).

When the two are combined, AI penny stocks (also referred to as penny AI stock or penny stocks AI) are cheap stocks of small firms that are developing or utilising AI technologies in one form or another.

These companies are not as large or well-known as Google or Microsoft, but they may be developing intelligent AI tools, software, or systems that can expand in the future. In case of success, the stock price may increase, and the initial investors can get high returns. However, when it does not work, the price may fall rapidly as well.

The reason why AI penny stocks and AI companies are of interest to many beginner traders is:

The price of entry is low

Artificial intelligence is a rapidly developing sector

They desire to be early investors in future technology players

It is, however, worth noting that these stocks are risky and can fluctuate in value. Therefore, it is highly important to conduct proper research prior to investing. Platforms like TradingView for AI penny stocks have made it easier to track price movements and research performance.

A quick glance

No one AI penny stock is the best, but some of the most popular ones are SoundHound AI and BigBear.ai. Always do your homework and make decisions depending on your objectives and risk tolerance.

Nvidia or Microsoft may be a good AI stock to purchase because they are powerful companies that apply AI in practice. Before investing, always look at their latest news and performance.

Guardforce AI, Rekor Systems, and C3.ai (when it goes down) are some of the AI stocks under $10. These are small-cap stocks that have AI-based services. Investigate the company before investing.

Advanced machine learning models such as neural networks and deep learning are the best AI to predict stock prices. Such tools as TensorFlow and IBM Watson are commonly used to analyse market data.

There is no single best AI stock under $5, as prices and performance change often. Traders usually focus on small AI companies with real products, steady revenue growth, and clear long-term use cases.

There isn’t one universally “most promising” AI stock because opportunities vary by strategy and risk tolerance. Investors often look for companies with strong technology adoption, solid financials, and real-world AI use cases rather than hype alone.

Yes, AI penny stocks are risky. They are highly volatile, often have limited financial history, low liquidity, and depend on early stage technology, which means prices can change quickly based on news or market sentiment.

There isn’t a definitive list of the best AI penny stocks, as their performance and risk profiles change over time. Many traders watch small AI-focused companies with real products, growth potential, and clear long-term use cases rather than hype.

AI stocks trading around $3 change frequently. Prices depend on market conditions and news. Traders usually check live stock screeners or brokerage platforms to find current AI-related stocks near this price level.

Why Are Traders Looking for AI Penny Stocks in 2026?

2026 is going to be a big year for artificial intelligence. Following the success of such tools as ChatGPT, self-driving cars, and AI-based apps, an increasing number of companies, both large and small, are entering the AI game.

A McKinsey report shows that AI has the potential to contribute $4.4 trillion annually to the global economy. With such growth, most traders are of the opinion that small AI companies can also become big. This is why best penny AI stocks are attracting the interest of new and experienced investors looking for penny stocks for 2026.

Here are a few reasons why more traders are interested in these stocks now:

1. AI Is Growing Fast

AI is being used in everything from healthcare to cybersecurity. Even small firms are developing AI tools. This leaves room for best AI penny stock opportunities with long-term growth potential.

2. Low Entry Cost

AI penny stocks under $1 or $5 allow budget-conscious investors to participate in the AI boom without needing large capital. It’s a chance to start small but think big.

3. Big Potential, Small Companies

Some of the largest tech companies now began as small companies. Investors are hoping that the next big AI winner might be one of the penny stocks today. When you get the right one early, the payoffs can be great.

4. Retail Trader Interest

With the help of such platforms as Robinhood and Webull, more individual traders are joining the market. They are all on the hunt to find the best AI penny stocks to buy now, before the big institutions get involved.

However, keep in mind that high reward is accompanied by high risk. These stocks tend to be volatile (they rise and fall rapidly), and a lot of small firms fail. This is why you should know what you are purchasing.

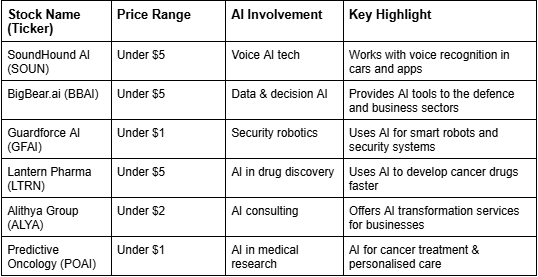

AI Penny Stocks List for 2026: Top Picks

These are small AI-oriented firms that are generating a stir among novice and cost-conscious traders. Some of them are developing real and interesting AI technology, even though their stock prices are low. Because of this, traders often track them as part of the best ai penny stocks list research and informally refer to such selections as the penny list. Let’s take a look at what each one does:

1. SoundHound AI (SOUN)

SoundHound has a reputation for creating sophisticated voice recognition and conversational AI. Its technology is applied in smart cars, customer support and mobile apps. The company has collaborated with large brands such as Mercedes-Benz and Hyundai to introduce voice commands in cars, which gives it a bright future in the voice-AI market.

- Listed on NASDAQ

- One of the most popular AI penny stocks under $5

- Rapid revenue growth reported in recent quarters

2. BigBear.ai (BBAI)

BigBear.ai specialises in data analytics and artificial intelligence-based decision systems, primarily in the U.S. defence industry. It assists government and military organisations in making quicker and smarter decisions with the help of AI. At the beginning of 2023, the company entered into million-dollar contracts, demonstrating its increased activity in the field of national security.

- Works with the U.S. Army and other agencies

- Offers predictive modelling, machine learning, and data visualisation

- Volatile stock but attracts momentum traders

3. Guardforce AI (GFAI)

Guardforce AI is an international security corporation that applies AI-driven robotics in surveillance, cleaning, and hospitality. It has robots in Asian malls, hotels, and airports. With the rise of automation, GFAI wants to be at the forefront of AI-based workforce solutions.

- Trades under $1, ultra-low entry

- Expanding robotic services in smart cities

- Often shows sudden price spikes on news

4. Lantern Pharma (LTRN)

Lantern Pharma is combining AI with biotech to speed up drug discovery. Its AI system, RADR®, analyses data to find new treatments for cancers. This approach could make drug research cheaper and faster, especially in personalised medicine.

- Uses AI to repurpose existing cancer drugs

- Strong IP portfolio in oncology

Frequently covered in AI-healthcare investor circles

5. Alithya Group (ALYA)

Alithya is a digital strategy and IT consulting company that assists businesses in embracing AI, cloud, and data technologies. It is headquartered in Canada, and it serves customers in such industries as energy, healthcare, and manufacturing. It is not a pure AI play, but it is appealing because of its exposure to enterprise AI.

- Provides AI and Machine learning services

- Trades between $1-$2

- Steady revenue, low hype- suited for cautious investors

6. Predictive Oncology (POAI)

Predictive Oncology applies AI to cancer research and treatment prediction. Its technology aims to forecast how different types of tumours respond to therapies, helping doctors personalise treatment plans. While still in early stages, its mission has drawn attention from biotech-focused penny stock investors.

- Develops AI platforms for drug testing

- Focuses on rare and hard-to-treat cancers

- Low float stock moves fast on news

Top AI Penny Stocks to Watch in 2026

How We Picked These Stocks

When looking for the best AI penny stock, follow these steps:

Confirm the company is truly AI-focused

- Selling at less than 5 or 1, which often places them in artificial intelligence stocks under $1 discussions

Study its real-world applications

Track updates via AI for penny stocks TradingView or news aggregators

Check if it’s on NASDAQ (preferable over OTC)

Start small, especially with AI penny stocks under $1

Diversify across industries (e.g., biotech, defense, SaaS)

How to Choose the Right AI Penny Stocks

Purchasing AI penny stocks is thrilling, yet it is also dangerous, particularly to novice traders exploring artificial intelligence penny stocks. Prices may rise or decline rapidly. This is why one should take several easy steps before deciding what stocks to purchase, especially when planning for penny stocks for 2026.

This is a simple guide to smarter picking:

1. Understand the Company’s Core Business

Ensure that the company is engaged in artificial intelligence before purchasing any stock. There are a lot of small businesses that have AI in their name or marketing, but they may not be developing or utilising the technology in a significant manner. Determine whether their core business is dependent on AI, e.g. machine learning, automation tools, robotics, or data-driven software.

2. Look for Real-World Growth Potential

Pay attention to the companies that provide solutions in the industries where AI is developing rapidly, e.g., healthcare, defence, or logistics. The company may have a higher likelihood of long-term success in case the product it offers solves a real-world problem and can be scaled in the future. Attempt to find out whether their technology is in demand and how competitive their space is.

3. Monitor News and Trading Activity

Penny stocks are very sensitive to market news. The prices can be driven up or down in a short period of time because of a new partnership, the launch of a new product, or an update on funding. Also, note the trading volume. The more individuals are trading the stock regularly, the more it indicates interest and liquidity, which makes it easier to buy or sell.

4. Review the Financial Basics

It is useful to verify some of the main financial information even when you are not an expert. Check whether the company has been increasing its revenue, reducing losses, or becoming profitable. Also, be wary of a company that often raises capital through the issue of new shares, which may dilute the value of the old ones.

5. Preferred Stocks Listed on Major Exchanges

Attempt to concentrate on AI penny stocks that are traded on reputable exchanges such as NASDAQ. The reporting rules in these companies are more stringent, and they provide better transparency. Over-the-Counter (OTC) stocks are usually riskier and can be more difficult to study or sell in a short period of time.

6. Start Small and Diversify

Never put a lot of money in one penny stock. These stocks are very volatile, and it is advisable to start with a small amount. When you intend to purchase more than one, you should select different kinds of companies to minimise your risk. Diversification will ensure that you do not lose a lot of money when a single stock fails to perform.

Things to Keep in Mind Before Investing in AI Penny Stocks

AI penny stocks can be exciting, especially for traders searching for artificial intelligence penny stocks, but you should know these risks before investing:

- It is possible to issue more shares: This may reduce the value of your shares. which is common among undervalued AI stocks trying to raise capital.

- Difficult to sell occasionally: Selling can be slow or hard when the trading is low, a frequent issue with many ai penny stocks.

- Excessive chatter on the internet: There is excessive chatter on the internet about some stocks that are only hyped.

- New businesses: Most of them lack good track records and consistent revenues.

- Prices are dynamic: The stock may increase or decrease rapidly.

Conclusion

AI penny stocks provide a low-cost opportunity to enter the growing world of artificial intelligence in the stock market and start small especially for those researching penny stocks for 2026. However, they come with substantial risk. Whether you’re tracking penny AI stocks on TradingView or hunting the next big thing in AI penny stocks under $1, research is key. At MarketInvestopedia, we guide beginners through these markets with simplified, educational content.